On Saturday, Ethereum transaction fees tapped a low not seen since November 2020 as the average network fee dropped to 0.0016 ether or $1.67 per transfer. Average fees on Saturday have been as low as 32 gwei or $0.69 per transfer as Ethereum gas fees have been steadily dropping since May 11, 2022.

Ethereum Fees Drop to the Lowest Range Since November 2020

Ethereum’s average gas fees tapped a low on July 2, 2022, not seen in 19 months or November 12, 2020. Essentially, the gas or network fee is a quantity of ethereum (ETH) that is required to push a transaction on the blockchain network.

Like the Bitcoin (BTC) network, ETH gas fees compensate the network’s mining participants in order to reward them for verifying transfers. In the early days, ETH transfers were negligible and from August 2015 to July 2016, the average gas fee was less than a U.S. penny per ETH transfer.

Between July 2016 to May 2017, Ethereum network fees were between $0.01 to $0.10 a transfer. Nowadays Ethereum fees are a bit more pricey and on May 12, 2021, average fees reached $69 per transaction.

Between August 2021 to February 2022, fees did not drop lower than $20 per transfer. At times throughout that period, fees hit $30, $40, and $50 increments for every transaction made depending on the day. On May 1, 2022, the average network fee jumped to $196 per transfer, thanks to a popular non-fungible token (NFT) sale that day.

The aforementioned fees only apply to sending ether as well, and an Opensea contract, decentralized exchange (dex) swap, or an ERC20 transfer can cost even more.

Median-Sized Fees Tap $0.69 per transaction, L2 Fees Slip Lower

On July 2, 2022, average fees tapped a low of 0.0016 ether or $1.67 per transfer. The last time fees on the Ethereum network were this low was in mid-November 2020. On November 12, 2020, the average ETH fee was 0.0034 ether per transfer or $1.55.

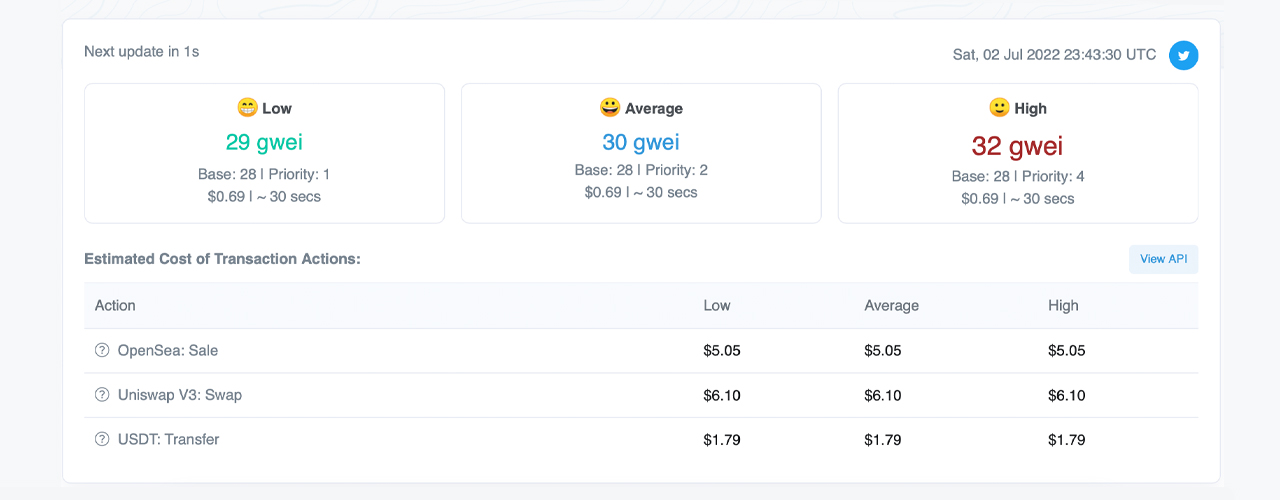

Moreover, on Saturday, the web portal etherscan.io’s gas tracker shows the highest Ethereum network fee slipped as low as 32 gwei or $0.69 per high priority transfer. Etherscan.io’s data indicates an Opensea sale will cost $5.05 for the transaction, a Uniswap trade is $6.10, and to forward an ERC20 like tether (USDT) it’s $1.79 per transaction at the time of writing.

Metrics from bitinfocharts.com indicate that a median-sized transaction fee is 0.00065 ether or $0.695 per transaction. Given the fact that average and median-sized network fees on Ethereum are much lower than they have been in 596 days, layer-two (L2) transaction fees are less expensive as well.

L2fees.info data shows that a Loopring transaction is less than a U.S. penny, Zksync transfers cost $0.01, and Metis Network is also $0.01 to send a transaction. Optimism costs $0.03 on Saturday, Boba Network is around $0.06, and Arbitrum fees are $0.10 per transaction. Polygon Hermez costs $0.25 per transfer and Aztec Network costs $0.35 for transactions this weekend.

What do you think about the low Ethereum network transfer fees on July 2, 2022? Let us know what you think about this subject in the comments section below.