Ethereum (ETH) is gaining prominence as Bitcoin maintains its recent highs. Despite the fact that ETH is currently 36% below its all-time high of $4,878 from 2021, analysts anticipate that the second-largest cryptocurrency by market capitalization may be preparing for a significant shift.

Ethereum’s ecosystem is a hive of activity, with a surge in institutional investments, rising ETF interest, and increasing transaction volumes.

From the 1.1 million recorded three months ago, the daily transaction volumes on Ethereum have climbed to 1.22 million, a notable rise according to the most current statistics from IntoTheBlock.

Bitcoin has been the star of this rally, but what about Ethereum?

Historically, Ethereum has been one of the first assets to benefit from profit rotations after Bitcoin’s move.

Currently, Ethereum’s on-chain activity shows evenly spaced potential resistance levels, but in… pic.twitter.com/amkbZmtEyo

— IntoTheBlock (@intotheblock) November 21, 2024

Despite the fact that the increase is not substantial, it indicates that network usage is consistent. This consistent activity serves as the foundation for Ethereum’s long-term value and underscores its ongoing significance in the crypto sector.

Institutional Investors Place Bets

In the past week, institutional buyers bought more than $1.4 billion worth of Ethereum (ETH), which caused a stir in the crypto community. During the same time frame, $147 million has been put into Spot Ethereum ETFs. This shows that people are becoming more optimistic about the future of ETH.

#Ethereum whales have bought over 430,000 $ETH in the last two weeks, worth over $1.40 billion! pic.twitter.com/n7iTTADuax

— Ali (@ali_charts) November 14, 2024

The activity surge continues; trading volumes for Ethereum ETFs reached a record $1.63 billion last week, representing a 44% weekly increase.

According to analysts, this increase is consistent with the patterns observed in Bitcoin ETFs, which experienced an initial period of stagnation, followed by a period of sustained growth.

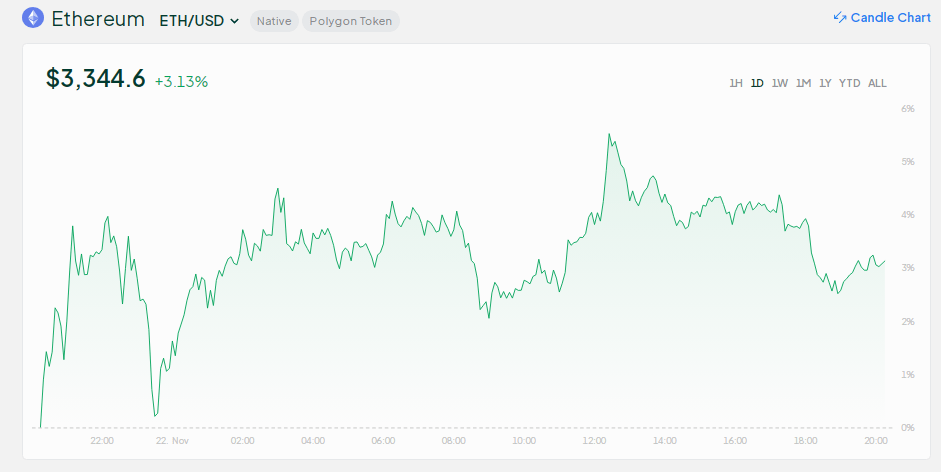

In response, Ethereum’s price went through the roof, rising by 25%, which was the biggest weekly gain in six months. Many people see these changes as signs that Ethereum is gaining speed, which could possibly lead to more benefits.

Shifting Landscape: Layer 2 Solutions

While there are positives, growth in Ethereum’s network sends out a mixed signal. New ETH addresses created are lower than those seen in previous bull markets.

The reason for this is seen by experts as Layer 2 options such as Base. Because these technologies are built on top of Ethereum’s infrastructure, transfers can happen more quickly and for less money. This makes it less important to directly connect to the main Ethereum chain.

Nevertheless, Ethereum’s significance has not been eclipsed by Layer 2 growth. Tokens continue to be indispensable in the decentralized finance (DeFi) and NFT ecosystems. In reality, this expansion strengthens Ethereum’s fundamental function while simultaneously increasing its scalability and accessibility.

ETH is becoming less correlated with BTC.

The 180-day BTC-ETH Pearson correlation is at a three-year low. A 10% rise in #Bitcoin could result in only a 3% gain for #Ethereum.

Just because BTC is strong doesn’t mean you should buy ETH. Each asset is now following its own path. pic.twitter.com/4Dn4QoInXo

— Ki Young Ju (@ki_young_ju) November 19, 2024

Ethereum Dissociates From Bitcoin

Ethereum’s autonomy from Bitcoin is becoming increasingly apparent. The 180-day correlation between the two cryptocurrencies has plummeted to a three-year low, falling below 0.5. This change, according to analysts, indicates that Ethereum is now more influenced by its distinctive market dynamics than by the price fluctuations of Bitcoin.

The necessity of independently assessing Ether’s potential is increasing as it continues to pursue its own course. Ethereum is demonstrating that it is more than just Bitcoin’s counterpart — it is forging its own path in the crypto world, whether through the adoption of Layer 2 solutions, institutional interest, or increasing ETF activity.

Featured image from DALL-E, chart from TradingView