Ethereum has largely mirrored Bitcoin in terms of price action and has yet to break out on its own accord in the past few months. According to price data, Ethereum is up by 13% in the past seven days, outpacing Bitcoin’s increase of 5.8% in the same time frame. Behind this interesting increase in Ethereum are some large Ethereum holders who seem to be increasing their holdings.

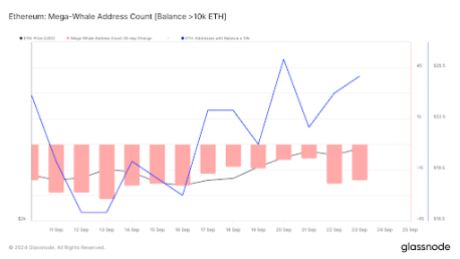

Notably, on-chain data from multiple analytics platform points to an uptick in activity from Ethereum whales in the past few days. Particularly, Glassnode data suggests large holders of Ethereum have added at least 70,000 ETH into their wallets since the beginning of last week.

Ethereum Whales Spend Big On ETH

The interesting Ethereum whale activity noted above is revealed through on-chain analytics platform Glassnode. As shown in the chart below, the number of Ethereum wallets holding 10,000 ETH or more has experienced a rise in the last 24 hours, increasing to 925 wallets. This marks a gain of about seven new whale wallets that have accumulated a huge number of ETH tokens, up from the 918 wallets recorded on September 18.

Supporting this trend, additional data from IntoTheBlock (ITB) indicates a surge in activity from addresses holding substantial amounts of Ethereum. ITB tracks these movements through a specific metric that monitors the number and value of transactions exceeding $100,000. According to this metric, Ethereum whale activity has reached over $29 billion in the past seven days. While this figure accounts for both inflows and outflows from whale wallets, the sheer scale of these transactions is notable. Historically, such high levels of activity from large holders tend to be a bullish indicator for cryptocurrencies.

This heightened activity is further reflected in the inflows of ETH into large holder wallets. On September 23, these inflows soared to 515,520 ETH, representing an impressive 440% spike compared to the 95,820 ETH recorded during the previous 24-hour period.

Time To Buy ETH?

At the time of writing, Ethereum is trading at $2,626. As noted earlier, this is on the back of a 13% increase in the past seven days, prompting Ethereum’s overperformance over Bitcoin for the first time since the beginning of the year. The leading altcoin has mirrored Bitcoin’s movements so consistently that some analysts have questioned its potential for decoupling anytime soon.

Ethereum’s importance in the crypto industry means there’s never a bad time to accumulate more ETH. Ethereum just broke over $2,600 for the first time in September, which is the first step in a sustained move to the upside. The next key target is to break above $2,700 before the end of the month, which could pave the way for a push towards $3,000 in October.