In crypto, wild price swings are normal when policies and new regulations are announced. This market observation became evident this week, immediately after US President Donald Trump announced plans for a strategic crypto reserve that includes Ethereum, Solana, ADA, Ripple’s XRP, and of course, Bitcoin.

Cryptos’ reaction was immediate, with Ethereum as one of the top assets that surged and fell massively within days. On March 2nd, ETH was trading at $2,191, then climbed to as high as $2,542 on March 3rd, before dropping below $2,300 at the day’s close and settling at the $2,050 level again the next day.

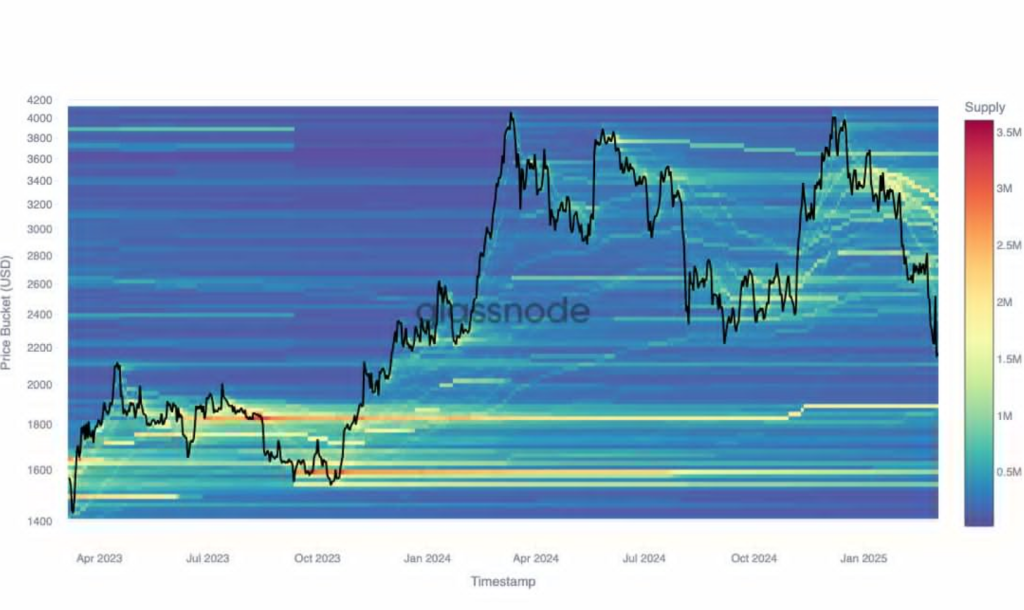

According to Glassnode, the recent crypto price movements unraveled some of the key strategies of ETH holders.

A Flurry Of Activities Among ETH Holders

Glassnode data shows ETH holders and investors moved and adjusted their holdings during the recent crypto price swings. Based on its three-month analysis, Ether holders who acquired their tokens at $3,500 adjusted their holdings in February.

#Ethereum investors actively managed their exposure through this volatile period. After a rally to $2.5K, $ETH retraced to $2.05K – levels last seen in Nov 2023. Cost Basis Distribution (CBD) shows how capital rotated across price levels and who took advantage of the dip.

pic.twitter.com/vl6AdghfRO

— glassnode (@glassnode) March 5, 2025

These investors started their positions at a peak price of $2,500, and remained on their positions when ETH revisited $2,050. Based on Glassnode figures, these investors own 1.75 million ETH with an average acquisition price of $3,200. This means that their holdings are now down 10% from their entry.

Glassnode also shares that on March 1st, investors bought 500k ETH at an average price of $2,200. However, this group quickly redistributed their holdings when ETH’s price hit $2,500.

Ethereum’s recent price action has revealed a new major price resistance at $2,800, where market traders accumulated 800k tokens. As such, crypto holders and investors are now looking at this level if ETH rebounds soon.

Growing Accumulation Among ETH Whales

Market analysts also highlight the growing trading activity and accumulation among crypto wallets. Crypto commentator Ted shared that a crypto whale investor recently bought 17,855 ETH worth roughly $36 million, with an average price of $2,054.

The whale’s ETH holdings are now valued at $2.5 billion. This transaction validates the current accumulation trend, suggesting that today’s price is a “buy opportunity”.

Is It Time To Buy ETH?

Currently, ETH is trading between $2,100 and $2,300, which is still below its Monday price of $3,500. According to a CryptoQuant analyst, Ethereum is most likely in favorable condition after its recent price swings. The analyst added that Ethereum’s MVRV ratio drops below 1, meaning the asset is undervalued.

This level often sets the tone for a price surge in previous bull markets. He also noted that an increasing number of ETH addresses are buying more tokens. These wallets hold ETH without selling, suggesting that institutional players are building their holdings.

Still, the CryptoQuant analyst remains cautious on ETH, pointing out that macroeconomic conditions can still sway crypto prices. He then noted the possible impact of tariff measures and monetary strategies on ETH and altcoin prices.

Featured image from Reuters, chart from TradingView