The Ethiopian government has instructed banks to reject requests for foreign currency to buy so-called non-priority products. The Ethiopian Minister of Industry Melaku Alebel Addis has defended the move, saying this will allow local manufacturers to grow and become competitive. The restrictions are set to remain in force for an indefinite period.

Eliminating Pressure From Foreign Products

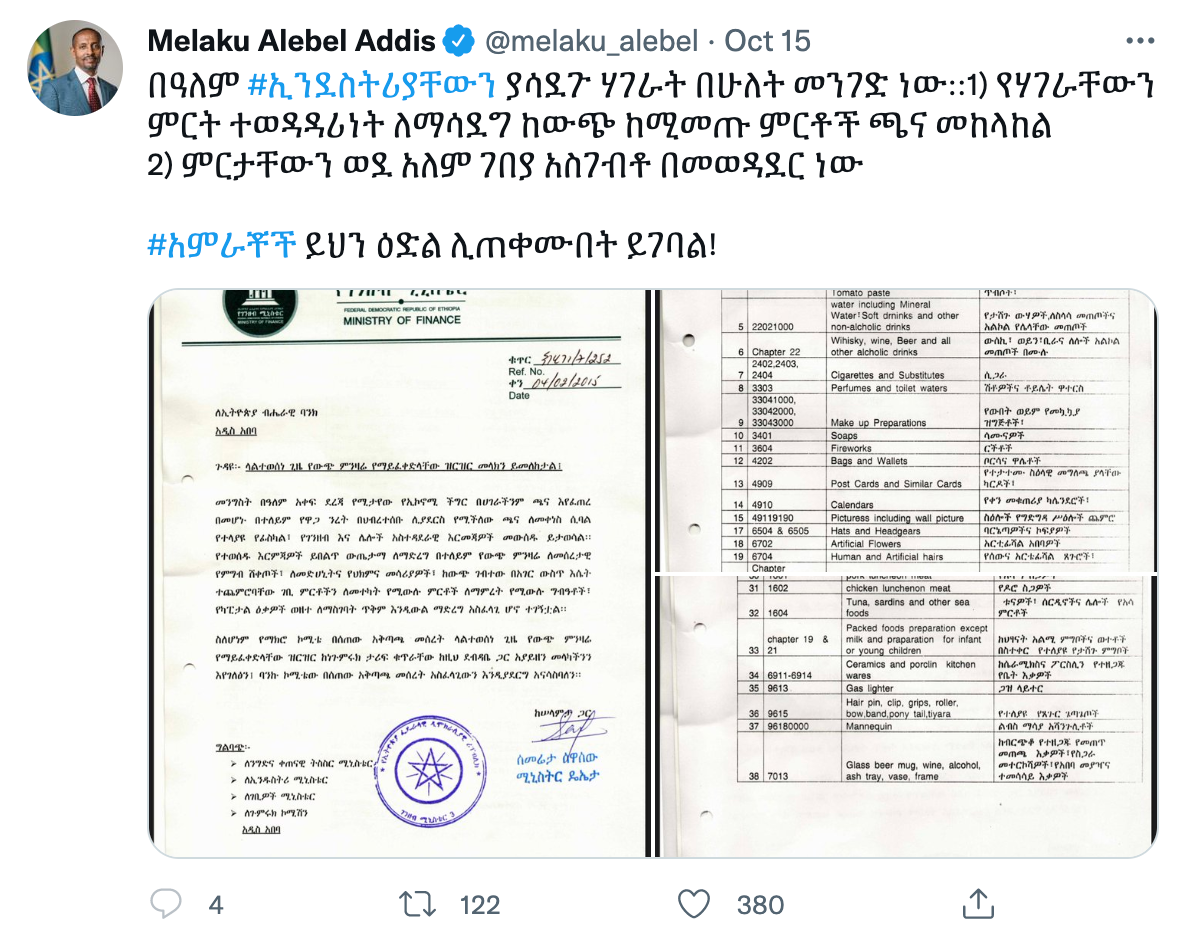

The Ethiopian government has reportedly instructed banks to reject requests for foreign currency to buy what the Ministry of Finance calls non-priority goods. In a letter to the country’s central bank, the ministry reportedly stated that banks must only approve requests for foreign exchange if the customer’s objective is to import food, medicines, or medical equipment. Foreign exchange should also be availed to importers of raw materials, the ministry reportedly said.

Justifying the seemingly protectionist policy, the Ethiopian Minister of Industry, Melaku Alebel Addis, suggested in a tweet that the latest forex restrictions are necessary because they give local products a chance. Addis insisted that countries with well-developed industries were only able to achieve this feat firstly by limiting or eliminating the pressure from foreign products.

Ethiopians’ Worsening Forex Woes

The second step, according to the minister, was the introduction of “their products to the world market and competing.” Addis ends the tweet by urging local manufacturers to take advantage of the policy change. He said:

You must take advantage of this opportunity.

According to an AFP report, some of the products and imports affected by the latest government foreign exchange conservation measures include motor vehicles, alcoholic drinks like wine and whiskey, artificial jewelery, perfumes, and cigarettes.

The Ethiopian government, which has waged a bloody war against rebels in the country’s Tigray province, faces ongoing shortages of foreign exchange. At the same time, the gap between the local currency’s official and black market exchange rates has widened to a record high.

To counter the foreign exchange shortages as well as the Ethiopian birr’s depreciation, the country’s central bank — National Bank of Ethiopia — announced in September that it had revised downwards the amount of foreign exchange and local currencies Ethiopian travelers can take outside the country. Before that, the central bank had also advised against trading cryptocurrencies.

Meanwhile, according to Addis, his government’s latest forex restrictions are set to remain in force for an indefinite period.

Register your email here to get a weekly update on African news sent to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.