Crypto trading volumes rose over 500% in 2021 compared to 2020, which sparked a massive increase in cryptocurrency adoption worldwide.

The rise in adoption also brought record cryptocurrency gains for the average crypto investor. According to research from TradingPedia, 2021 was when a significant amount of crypto investors started to earn enough to secure the necessities of life.

The research, shared with CryptoSlate, offers a unique insight into the dynamics of crypto profits, debunking the myth that only professional traders can earn a living from buying and selling cryptocurrencies.

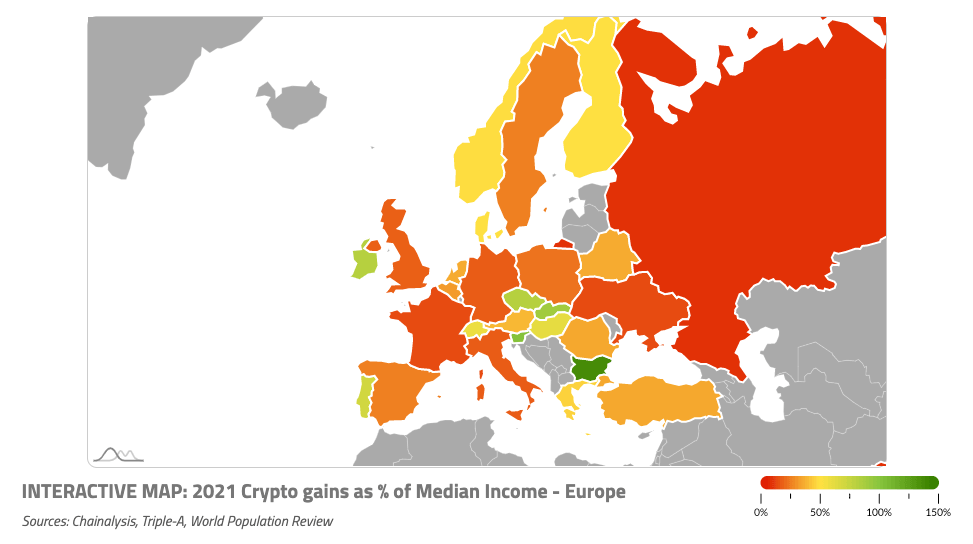

European crypto owners managed to earn a living by trading cryptocurrencies in 2021

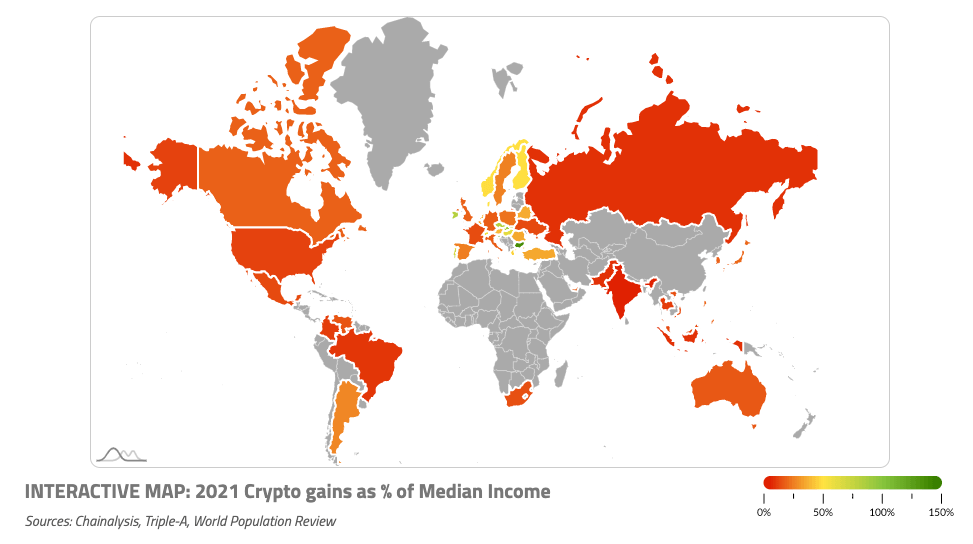

Estimating how much an average crypto trader makes requires deep insight into the market. TradingPedia mapped Chainalysis’ recently-released data for estimated crypto gains by country with a dataset to show the world’s crypto adoption rate. This game them the estimated profit an average crypto holder made last year, grouped by country.

The researchers then went further, comparing that data to the median income per country.

“The results vary substantially and give us a glimpse at how well different crypto investors did across the world,” it said in the report.

The data came as a surprise — Europe was taking the lead in crypto gains as a percentage of the median income.

Europe was the only region where crypto investors earned more than 30% of their country’s median income in 2021. The average rate across the continent stands at 46% — Canada, Australia, and the U.S. saw 17%, 14%, and 9%, respectively.

Brian McColl, a crypto and market analyst at TradingPedia, said that this is the first time in the crypto industry’s history that we’ve seen half a dozen nations where the average crypto owner made a profit of over 67% of their respective country’s median income.

“This would imply that in these countries most regular cryptocurrency traders were able to make ends meet just by trading digital assets, predominantly as a part-time hobby. Up untill late 2020, this was a privilege exclusive only to professional full-time traders. This is very exciting news, pertaining to the practicality of crypto as an alternative or a main income stream for ordinary people.”

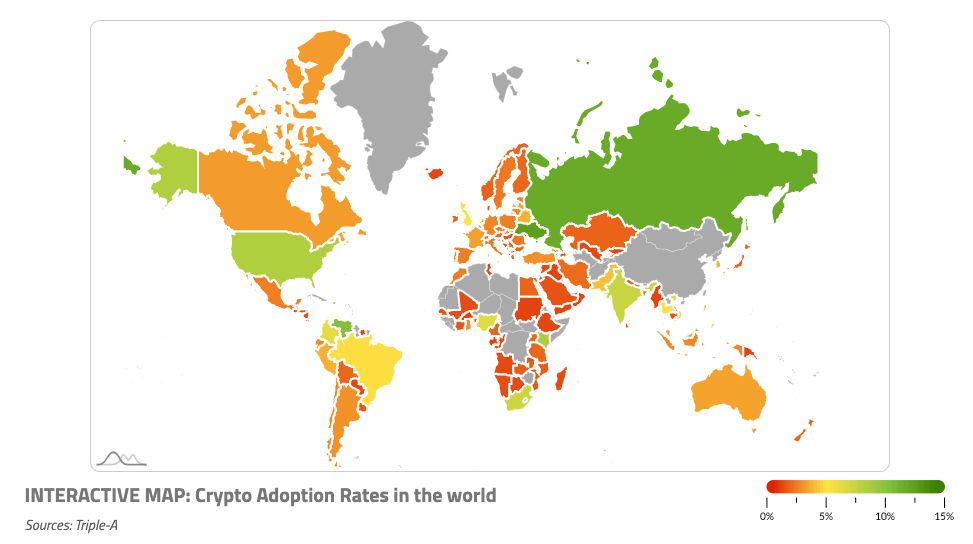

The inverse relationship between adoption and trading gains

Diving deeper into the makeup of the cryptocurrency market in Europe reveals an interesting contrast. Namely, Europe lags behind other countries when it comes to cryptocurrency adoption. Russia, the U.S., Ukraine, India, South Africa, and Brazil all rank higher in crypto adoption, despite its citizens ranking low when it comes to gains from crypto trading.

McColl says that this inverse relationship between the adoption rate of cryptocurrencies and the percentage of median income its crypto owners gained in 2021 was “expected and easily explained.”

“Europe is traditionally lagging behind the U.S., where cryptocurrencies initially found early adoption with the first bitcoin transaction for physical goods taking place in Florida on May 22, 2010.”

On the other hand, Europeans who entered the crypto market in 2020 and 2021 could be considered “early adopters” by the region’s standards.

McColl says that because these “early adopters” are almost always tech-savvy, highly educated IT professionals and enthusiasts, they are more likely to have better performance when trading cryptocurrencies.

The trend is in line with a Chainalysis report from September 2021, which revealed that Europe had overtaken Eastern Asia as the largest crypto economy in the world.

According to the report, the continent has witnessed impressive growth since July 2020, receiving over $1 trillion worth of cryptocurrencies — a figure equivalent to 25% of activities in the industry globally.

The report identified Europe as the “international hub in the world crypto economy” and found that it was the biggest crypto trading partner for every other region it studied, sending at least a quarter of all value received by other regions.

And while an influx of institutional investors certainly added to the growth, retail activity jumped significantly, leading to a significant increase in transaction volume across virtually all cryptocurrencies and service types, especially DeFi products.

However, the increase in trading volume across Europe wasn’t followed by an equal rise in the number of crypto companies operating in the region. The European Parliament proposed Markets in Crypto Assets (MiCA), a new framework under the European Commission’s Digital Finance package that would make it easier for crypto companies to comply with European regulations.

If implemented, MiCA could open the doors of Europe for dozens of new crypto services, both centralized and decentralized, further expanding the market.

The post Europeans profited the most from crypto trading in 2021 appeared first on CryptoSlate.