Shanghai, Capella, Shapella, 0x01, execution layer, consensus layer – while the web3 community undoubtedly boasts impressive technical competence, Ethereum’s latest update had even the best of us confused at times.

A Nansen report on Ethereum withdrawals reviewed by CryptoSlate shone a light on everything that’s going on, using data derived from Nansen’s Shapella dashboard.

Sha-nghai Ca-pella

The Shapella Upgrade, successfully executed on April 13, marked a significant milestone in Ethereum’s multi-stage roadmap by enabling the withdrawal of staked Ethereum (ETH) on the Beacon chain. This highly anticipated upgrade reduces the liquidity risk associated with staking, encouraging increased participation.

The name comes from combining the two simultaneous upgrades, Shanghai and Capella. Shanghai upgraded the execution layer, and Capella upgraded the consensus layer. The upgrades differed only in terms of the part of the network they targeted, as the goal of both upgrades was to open withdrawals.

Ethereum staking

Unlike other Proof-of-Stake (PoS) systems, Ethereum requires validators to stake a fixed amount of 32 ETH, with rewards based on this amount. Validators may have more than 32 ETH due to accrued rewards or less if slashed or penalized. To enable withdrawals, validators must set their withdrawal credential prefixes from 0x00 to 0x01.

Since the Shapella upgrade, the number of validators with the 0x01 credential has increased from 40% to 83.3%, according to Nansen’s data.

Furthermore, Ethereum’s staking system involves two types of withdrawals: partial and full.

Partial withdrawals include withdrawing accrued rewards while keeping the minimum 32 ETH required for validator operation, processed periodically through an automated process in approximately 2-5 days.

Moreover, full withdrawals involve withdrawing a validator’s entire balance voluntarily or following a slashing event. Full withdrawals take longer than partial withdrawals, involving multiple steps: the exit queue, a “minimum validator withdrawability” delay of 256 epochs (27.3 hours), and the automatic withdrawal process (2-5 days).

Why do stakers have to wait in a queue?

The exit queue serves as a protective measure to maintain the security of the Ethereum network. Its primary function is to control the rate at which validators can exit the network, preventing a large number of them from leaving simultaneously. If too many validators exited quickly, the network could become vulnerable to attacks due to a reduced number of active validators securing it.

The 27.3-hour delay (equivalent to 256 epochs) imposed on the exit process is an additional security measure designed to provide the network with sufficient time to detect and respond to any harmful activities. This delay acts as a safeguard, ensuring that bad actors cannot negatively impact the network and then exit without consequence. Essentially, the exit queue and the associated withdrawal delay work together to maintain the stability and security of the Ethereum network during the validator exit process.

Liquid staking

Liquid Staking Derivative protocols (LSDs), such as Lido, deliver capital efficiency by leveraging liquidity and, thus, may influence validator decisions. There has been a slight increase in the amount of ETH staked in LSDs since the Shanghai upgrade. Although no dashboard currently tracks if this increase is primarily driven by restaking, a correlation is likely due to the benefits of LSDs. Nansen is reportedly working on a dashboard to track this metric.

Understanding upcoming withdrawals is essential for assessing Ethereum’s staking ecosystem. Kraken, one of the top withdrawers, is often misconceived as one of the top sellers. However, according to the report, their “full exits have not materially impacted total withdrawal numbers,” as most withdrawals have been rewards and validators are still in the exit queue or pending the automatic withdrawal process. Furthermore, validators may have other reasons to request withdrawals, such as switching validator setups or moving to LSD protocols.

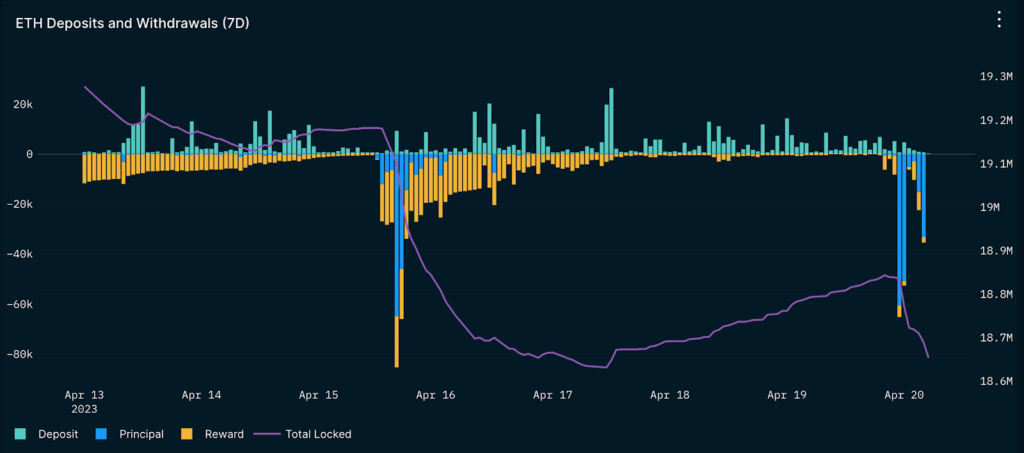

Nansen’s data on deposits vs. withdrawals offers valuable insights into the flow of ETH between locked and unlocked states, with the cumulative sum used to estimate changes in the liquid supply of ETH.

Nansen data analyst Martin Lee commented,

“While the chart gives a good overview of the change in liquid supply, it lacks nuance when making inferences on the implications of the withdrawals. In order to gain proper insights into the withdrawal data, knowing the split between partial and full withdrawals is vital.”

Insights on Shapella

Lee’s hypothesis on Shapella suggests there will be an increase in participation and the overall amount of ETH staked in the network now that Ethereum withdrawals are live. If so, it could bring Ethereum’s staking ratio closer in line with other major L1s.

The hypothesis is based on the observation that Ethereum had one of the lowest staking ratios among major L1s and was the only chain without withdrawals enabled until the Shanghai upgrade. As the upgrade approached, there was a rapid increase in the amount of ETH staked, indicating a strong interest in staking ETH.

However, Lee also highlighted Ethereum’s staking ratio might not reach as high as some other chains, mainly due to the large NFT ecosystem and the growing DeFi ecosystem. The various use cases for ETH set it apart from other major L1 tokens, which could impact its staking ratio. Lee believes it is important to consider that the introduction of withdrawals may not necessarily lead to mass selling pressure, as many factors can influence the decisions of validators and users

Lee ultimately argued that the following events have had people “jumping to conclusions too early.’

- Kraken unlocks = mass selling pressure

- The overall trend in the amount of staked ETH based on current withdrawal data

- Kraken being forced to unwind their staking service in the US doesn’t necessarily mean they (or their customers) are selling. It just means they have to exit as validators. What users do with the ETH is yet to be seen.

- The amount withdrawn now will be highly volatile, with spikes here and there based on partial and full exits. It’s only been 4 days, and a baseline has not yet been established.

In conclusion, the Shapella upgrade has unlocked new possibilities for Ethereum staking and brought more flexibility to validators. Understanding the nuances between partial and full withdrawals, the impact of LSDs, and key metrics like deposits vs. withdrawals will help crypto enthusiasts navigate this new landscape.

The post Everything you need to know about ETH Shapella withdrawals appeared first on CryptoSlate.