Quick Take

Bitcoin recently experienced the fifth-largest realized loss since the FTX collapse, sending Bitcoin below 54k. While some commentators attribute this decline to the German government’s sale of their Bitcoin reserves or the Mt. Gox redemption narrative, it seems more plausible that a significant correction was overdue following an 18-month period of consistent price increases.

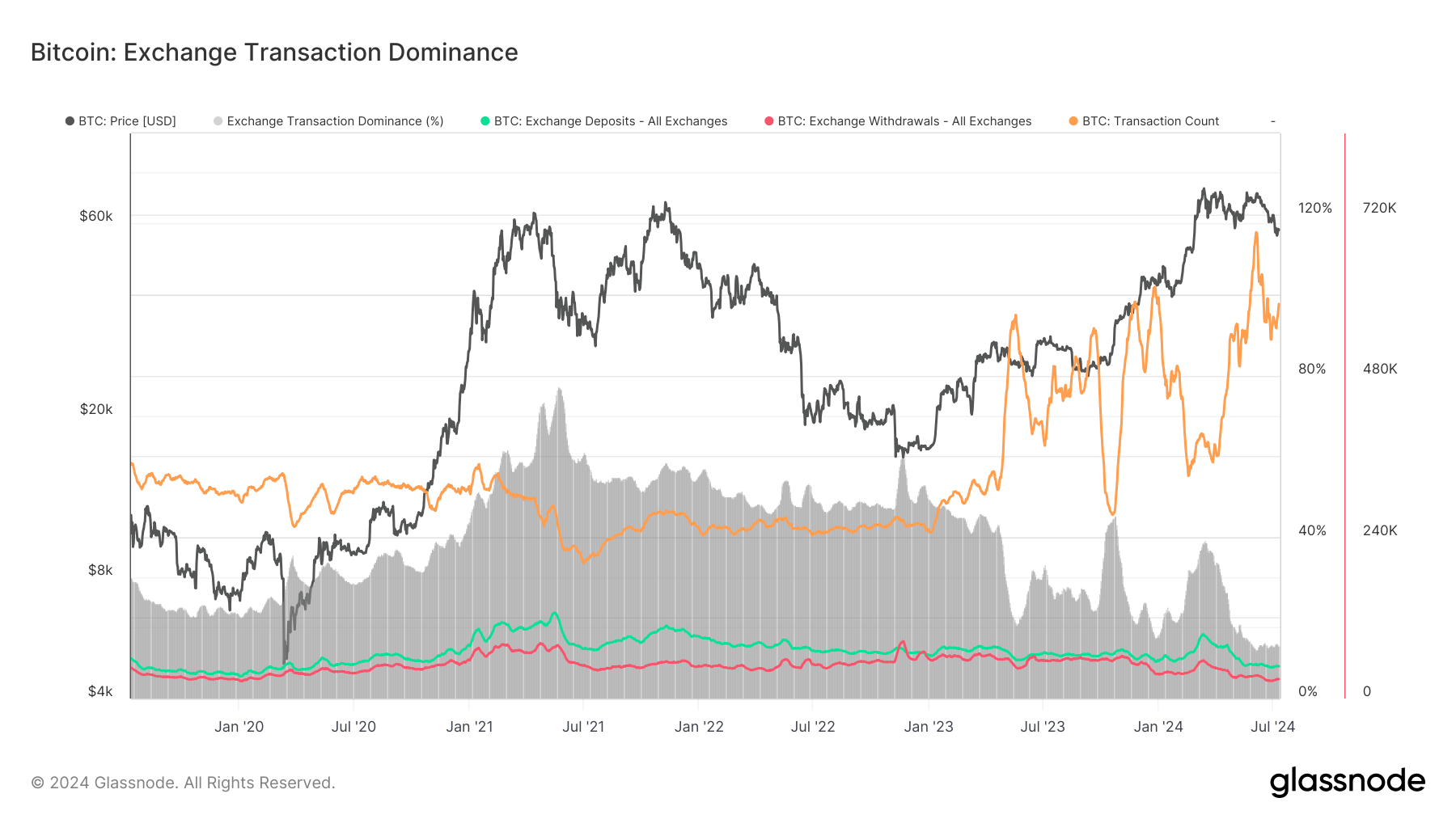

Analyzing the recent Glassnode data on exchange-related deposits and withdrawals reveals several key insights. Notably, exchange withdrawals have decreased to 28,500 BTC, down from a mid-March peak of approximately 50,000 BTC, indicating fewer coins being withdrawn from exchanges.

Currently, exchange deposits are around 47,000 BTC, consistently outpacing withdrawals. This divergence has grown, contrasting with 2023, when deposits and withdrawals were closely matched, contributing to Bitcoin’s price rise that year. Historically, instances in early 2021 and early 2024 showed price increases accompanied by substantially higher deposits than withdrawals, suggesting that savvy investors were selling into the bull run peaks.

For a healthier market, it would be preferable to see withdrawals start to tighten with deposits, indicating more balanced and potentially sustainable price increases.

The post Exchange withdrawals at 5-year low of 28.5k BTC appeared first on CryptoSlate.