The analytics firm Glassnode has revealed that exchanges haven’t been bleeding Bitcoin, at least not to the degree many previously thought.

Bitcoin Exchange Reserve Has Only Seen A Minimal Decrease In Recent Years

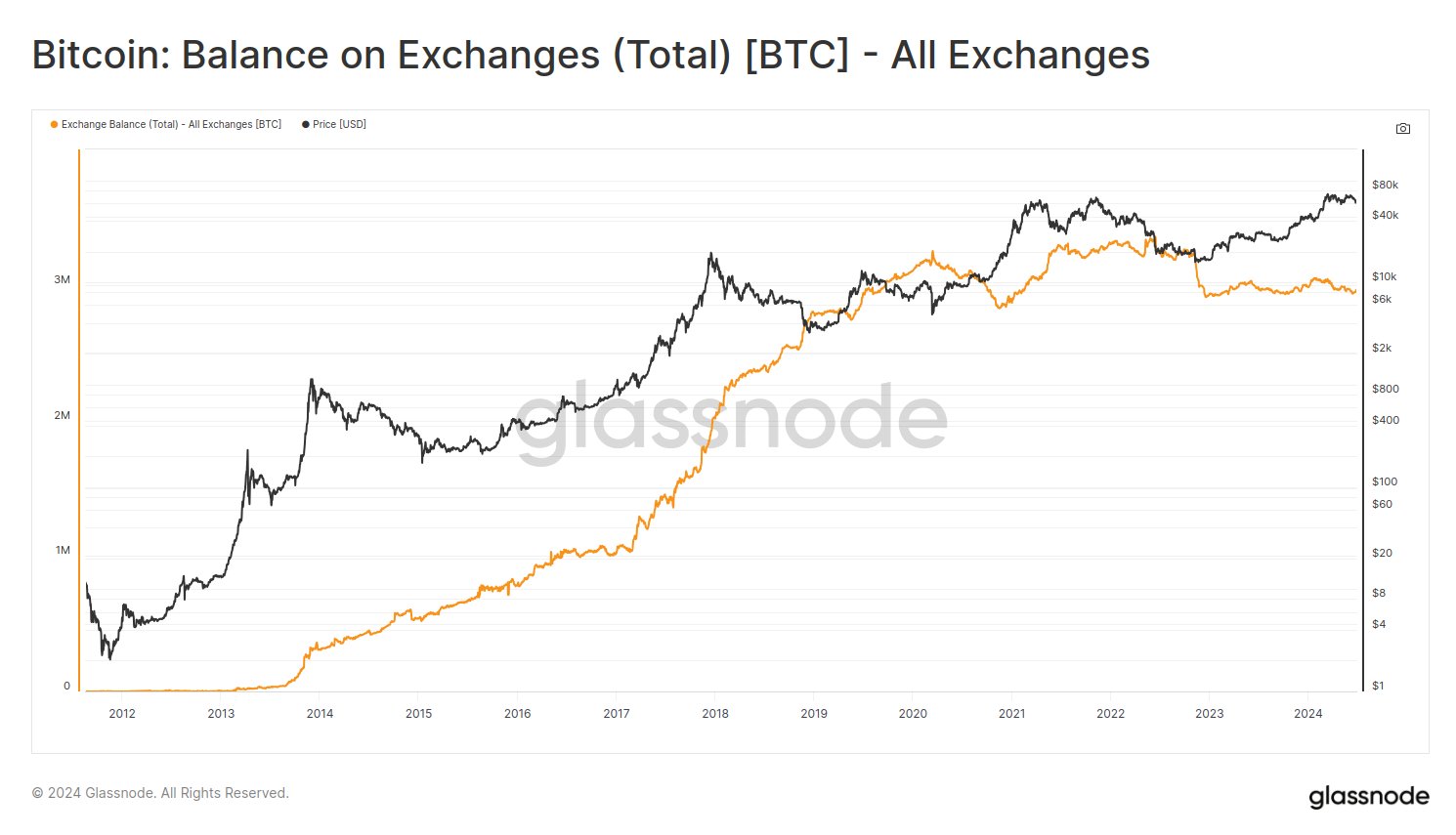

The exchange balance, a measure of the total amount of Bitcoin sitting in the wallets of centralized exchanges, has often been a hot topic in the on-chain analysis community.

Investors use these platforms for selling-related purposes, so many look at the exchange balance as a sort of reflection of the “available” trade supply of the cryptocurrency.

In recent years, an interesting pattern has emerged in this supply sitting on the exchanges, with its value observing a constant decline. This suggested that investors were continuously taking coins out, thus decreasing the asset’s potential sell supply.

The trend made some community members think Bitcoin was heading towards a supply shock. There was, however, also opposition to the idea, with questions around whether the outflows were simply a result of changing dynamics in the market rather than an apparent shift towards widespread HODLing.

Glassnode’s modification for one of its indicators may have just put the supply shock theory to bed. As the analytics firm has explained in its changelog, the Coinbase balance has been updated to include new entities.

Previously, these labels were associated with Coinbase Custody in our database. However, we have decided to discontinue this distinction as differentiation from an on-chain perspective is not always clear-cut.

The Coinbase Custody includes coins from large entities such as spot exchange-traded funds (ETFs). Thus, the result of this change is that the Coinbase balance has now seen a notable increase.

As is visible in the chart, while the exchange balance appeared to be shooting down earlier, the modification has meant that its value has moved more or less sideways over the last few years.

In an X post, on-chain analyst Checkmate also mentioned the topic. “Exchange balances are notoriously hard to parse and monitor,” says the analyst. “They are an advanced metric valuable, only if you know what you’re doing.”

As Checkmate pointed out, the wider exchange balance chart has also looked flat in recent years.

“Many folks who have been talking about endless outflows did not appreciate the Bitcoin balance held in Coinbase custody,” notes Checkmate. In March 2020, the total exchange balance was 3.146 million BTC; today, it’s 2.968 million.

There have still been net outflows since then, but the decrease is just 178,000 BTC, which isn’t much in the grand scheme.

BTC Price

At the time of writing, Bitcoin is trading at around $62,700, up more than 2% over the past week.