Crypto expert “The Great Mattsby” has found something interesting on the XRP monthly chart: the Bollinger Bands are the smallest they have ever been. This trend has shown huge price changes in the past, which has led to rumours that XRP is about to make a big rise.

Historical Patterns: Previous Explosions And Current Expectations

Mattsby looked at patterns before XRP’s price shot up after its Bollinger Bands found themselves in a tight range. One pattern was from September 2016 and March 2017, when its price went up by a huge 60,000%.

In comparison, a similar trend in April 2021 resulted in a relatively modest 1,000% increase. According to Mattsby, the current situation is different; the bands are even tighter than previously, implying an oncoming and maybe bigger price movement.

A $250 $XRP by 2028??

So a ±60000% $XRP does line up with the math of that green angle, which was also a very important support and resistance angle in the past (highlighted). Proof that its not impossiblehttps://t.co/LDzEiKjz5Z pic.twitter.com/v0qHTg9MFv

— The Great Mattsby (@matthughes13) July 11, 2024

“It’s like a coiled spring ready to unleash,” Mattsby explained in his most recent video. “The breakout force increases as the bands tighten.” This observation is consistent with the technical notion that low volatility is frequently followed by periods of high volatility.

XRP’s All-Time High: The Long Road To Recovery

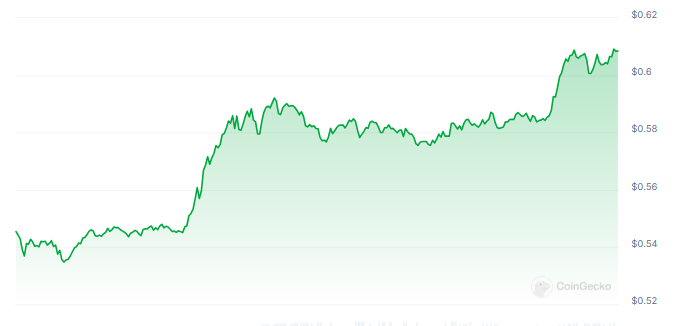

It’s been more than 2,000 days since XRP hit a high point of $3.31. The altcoin is worth $0.5345 right now, which is 84% less than its all-time high. Mattsby is still hopeful, though. The long time of stabilisation, along with the extremely tight Bollinger Bands, makes him think that a big price move is coming.

Mattsby saw that the Bollinger Bands for Bitcoin and Ethereum are not as tight as those for XRP. This unique thing about XRP’s data makes it stand out. Even though Bitcoin and Ethereum are strong competitors in the cryptocurrency market, their Bollinger Bands don’t show that they are about to break out, he said.

The $250 Prediction

Mattsby is so optimistic that he even dares to say that XRP will hit $250 by 2028. Using Gann’s theory, he found that the 45° angle was a key level of support and barrier for XRP’s price history. He thinks XRP will go in this direction, maybe to test it as support before bursting into the $250 level of resistance.

Mattsby supported his projection by using Fibonacci retracement from XRP’s 2013 high to its 2014 low, finding important levels that XRP may hit. He points out that the 3.618 extension level is quite near to his $250 goal price. “If Bitcoin and Tesla can reach comparable Fibonacci extensions, there’s no reason XRP can’t,” he said.

Featured image from SpaceRef, chart from TradingView