The crypto industry is on the verge of a potentially significant development as key figures in the sector hint at the imminent approval of a spot Ethereum ETF in the United States, possibly triggering a notable price rally for ETH.

Nate Geraci, president of The ETF Store, shared insights into the expected timeline for the launch of the first spot Ethereum ETF.

According to Geraci, current forecasts by Bloomberg predict a mid-July launch. He detailed the procedural timeline via X, stating, “Wen spot eth ETF? BBG sticking w/ mid-July. Amended S-1s due July 8th. Potential final S-1s by July 12th. Would theoretically mean launch week of July 15th.”

In parallel, Steve Kurz, head of asset management at Galaxy Digital, confirmed to Bloomberg on July 2 that the U.S. Securities and Exchange Commission (SEC) might greenlight a spot Ethereum ETF before the month’s end.

Kurz emphasized the extensive groundwork laid in collaboration with the SEC, drawing parallels between the proposed Ethereum ETF and Galaxy’s existing spot Bitcoin ETF (BTCO), created with Invesco. Kurz expressed confidence in their preparedness, remarking, “We know the plumbing, we know the process… The SEC is engaged.”

Bloomberg ETF analyst Eric Balchunas also chimed in, aligning with the mid-July expectations. He highlighted the SEC’s recent instructions to Ethereum ETF issuers for amending their S-1 registration forms by July 8, suggesting possible further amendments. Notably, the SEC approved rule changes under 19-b4 in May, facilitating the listing and trading of such funds, though the issuance of funds remained pending final approvals.

Ethereum Price Holds Above Key Support

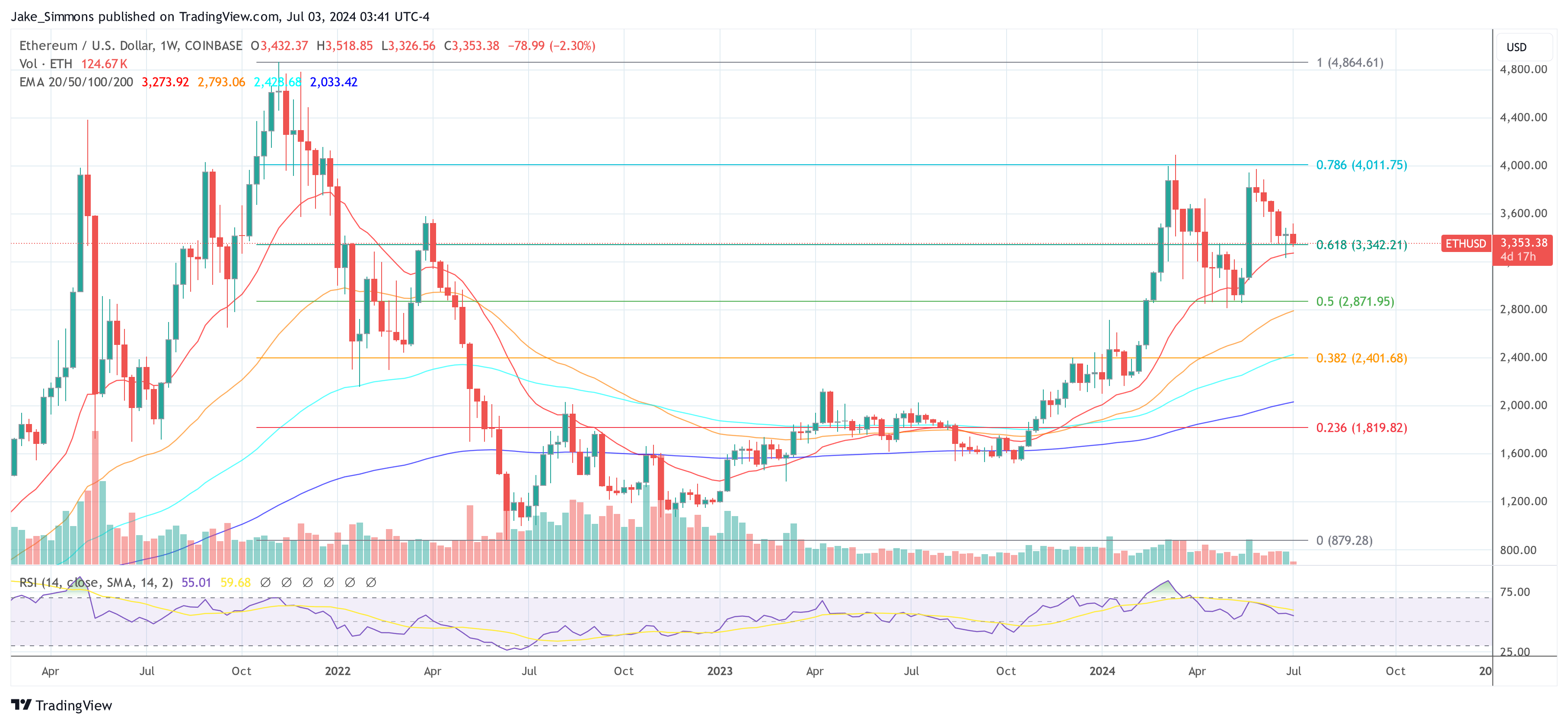

The anticipation of these approvals appears to be having a stabilizing effect on Ethereum prices. Crypto analyst IncomeSharks, commenting on Ethereum’s current price trajectory via X, noted optimism for a near-term breakout, stating, “ETH – Looking more optimistic for a Q3 breakout. Liking the chances of a run towards $4,000 this or next month.” According to the chart shared by him, ETH price needs to hold the region of $3,300 to $3,350 in order to rally to $4,000.

Supporting this sentiment, Cold Blooded Shiller highlighted the crucial need for Ethereum to demonstrate momentum at the current price levels, specifically around the $3,400 mark, as a key indicator for a potential high-time-frame impulse.

“ETH is still in a fine position but it really needs to start showing some momentum soon. LTF divergences around this $3400 low are probably where I take one stab at trying to capture any HTF impulse away from the consolidation,” he remarked via X.

Adding historical perspective, analyst Jelle (@CryptoJelleNL) compared the current market phase to Ethereum’s long consolidation in 2016-2017 before its massive rally, urging persistence and optimism: “In 2016-2017, ETH consolidated for 50+ weeks before rallying nearly 12000 percent. Today, people are giving up after less than 20 weeks, with ETH ETFs right around the corner. Stick to the plan boys. The best is yet to come.”

At press time, ETH traded at $3,353.