Market experts and technical indicators imply that XRP might break out in a positive way. After a short rise and retracement, the cryptocurrency has been trading at levels that indicate a break in consolidation.

At the time of writing, XRP was trading at $0.5149, up 1.1% in the last 24 hours, but sustained a 19.7% drop in the last seven days, data from Coingecko shows.

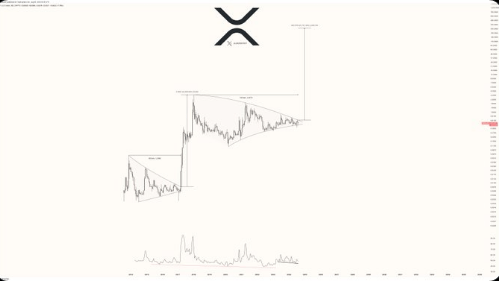

Javon Marks, a crypto analyst, has identified numerous significant technical indicators that support the optimistic outlook for the coin, despite it shedding a lot of value in the weekly frame. A symmetrical triangle structure is frequently observed in his chart analysis, which is frequently linked to substantial price increases.

$XRP recently broke out temporarily which looks to have been only an attempted breakout but, between Price Action and the RSI, there are patterns still present through bull divergences that can suggest a successful bullish breakout to be on the horizon!

On a conservative note,… https://t.co/BCrp9CwT6i pic.twitter.com/XGGiv0nBDp

— JAVON

MARKS (@JavonTM1) August 6, 2024

The MACD and RSI indicators both have levels that indicate a bullish divergence. The resiliency and upward trajectory of XRP are on display in these numbers.

Expect Short-Term Gains

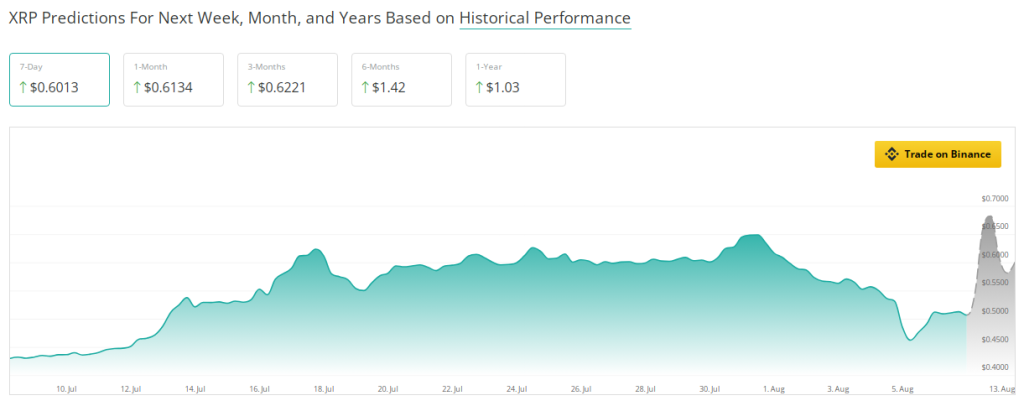

Over the next seven days, XRP is expected to show an uptick, indicating a positive short term perspective. Based on information from the crypto prediction tool CoinCheckup, XRP is trading 20.98% below the expected price for the next month right now. Technical signs, however, show a bullish change just ahead.

Rising purchasing pressure and the present price levels point to the coin maybe being set to surpass its recent resistance levels. The RSI and MACD both provide indications of positive momentum, therefore supporting the possibility for upward movement. Analysts think this might result in a successful breakout effort, driving XRP to fresh highs in the not too distant future.

Projected Medium-Term Growth

Looking further into the near future, XRP has similarly bright medium-term potential. Reflecting great market confidence and investor interest, CoinCheckup’s study projects a 22.68% price rise over the next three months. This predicted expansion fits rising acceptance of cryptocurrencies and more general market patterns.

Based on a thorough investigation, Marks’ symmetrical triangle formation shows that XRP maybe preparing for a notable price movement. This pattern, along with positive divergent RSI readings, suggests that XRP has the ability to break out from its present period of consolidation and go very significantly higher.

XRP: High Price Targets

With a one-year growth estimate of 103.77%, long-term XRP estimates remain quite positive. This continuous rise points to XRP as a useful altcoin for those looking for both quick profits and long-term development. Growth projections climb sharply to 180.60% over a six-month period, therefore indicating the prospect for significant increases.

More ambitious projections, including those from Marks, indicate that XRP may see its price rise to between $15 and $18, therefore reflecting a huge gain of over 2,101%. Such forecasts rely on technical analysis patterns and past market behavior that have lately shown large price swings.

Further driving these increases are the growing acceptance and integration of the wider cryptocurrency industry into conventional financial institutions.

The liquidity and trading volume for XRP are projected to increase as institutional investors and large-scale traders become more engaged, thereby maybe driving even more notable price swings.

These metrics emphasizes XRP’s transformative power in the changing digital asset scene as well as its appeal as a high-reward investment possibility.

Featured image from Pexels, chart from TradingView