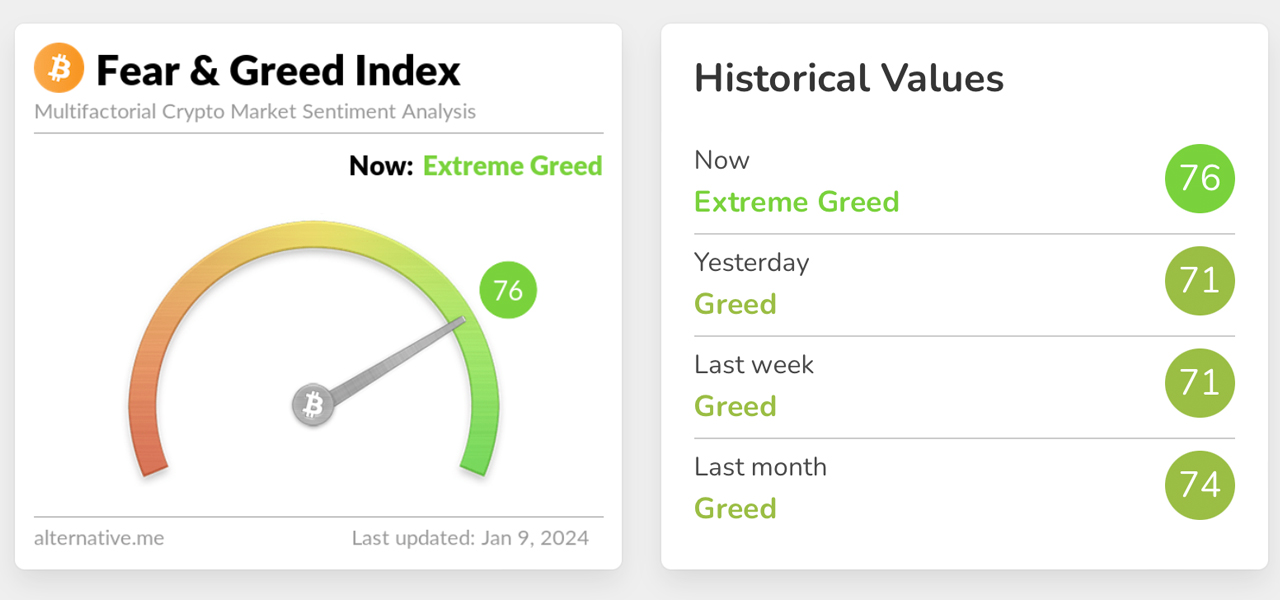

Hovering just below the $47K mark, bitcoin’s price rise has coincided with the Crypto Fear and Greed Index (CFGI) reaching a notable 76 on Jan. 9, 2024. This signals a phase of “extreme greed,” a sentiment intensity not witnessed since the cryptocurrency’s previous bull run in November 2021.

Soaring Bitcoin Drives Greed Index to New Highs

On Jan. 9, 2024, the CFGI, available on alternative.me, soared to its highest level of 76 out of 100 since its last peak in November 2021. The index functions on the premise that extreme fear can cause bitcoin (BTC) to trade significantly below its fair value, whereas extreme greed might lead to an overvalued state. The CFGI assesses various elements, including volatility, market momentum and volume, social media sentiments, dominance, and trends.

This tool mirrors the stock market’s Volatility Index or Fear Index, commonly known as the VIX. The VIX, overseen by the Chicago Board Options Exchange (Cboe), gauges the stock market’s expected volatility through S&P 500 index options. The alternative.me Crypto Fear and Greed Index has shown a persistent “greed” sentiment since late October 2023.

On Tuesday, the CFGI metric escalated and flashed to “extreme greed,” climbing to 76 from the previous day’s 71, which indicated mere “greed.” In comparison, coinmarketcap.com (CMC) also presents a Crypto Fear and Greed Index, albeit with a slight variance, marking a 74 out of 100 on Tuesday afternoon (2 p.m. ET), still within the “greed” category. While these fear indexes are insightful tools, they are best utilized alongside other analytical methods and various factors.

Many analysts argue that such indexes are instrumental in gauging market sentiment by compiling diverse indicators, leveraging the ‘wisdom of the crowd.’ Research suggests that this collective approach yields a more nuanced and holistic perspective of market emotions, potentially guiding investors toward more informed choices. Yet, it’s important to note that dependence on these indexes is not without its pitfalls. The volatile nature of the crypto market can be swayed by short-term events, which may not accurately reflect the crypto market’s core fundamentals.

What do you think about the latest CFGI metric for bitcoin? Share your thoughts and opinions about this subject in the comments section below.