Quick Take

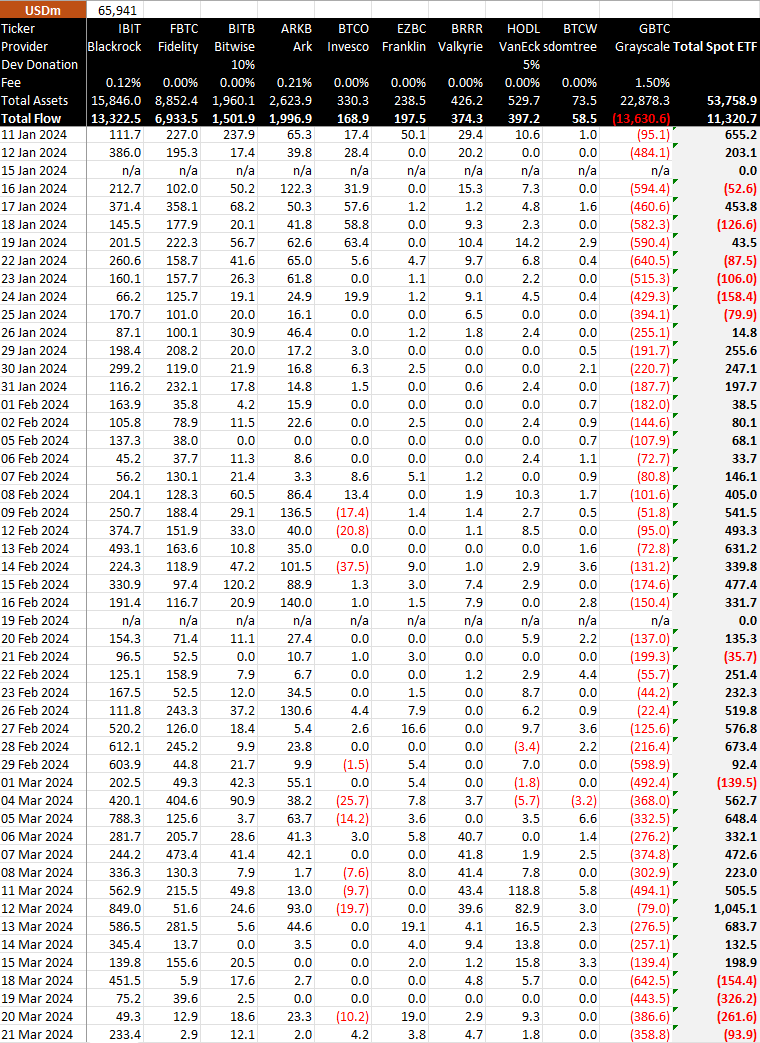

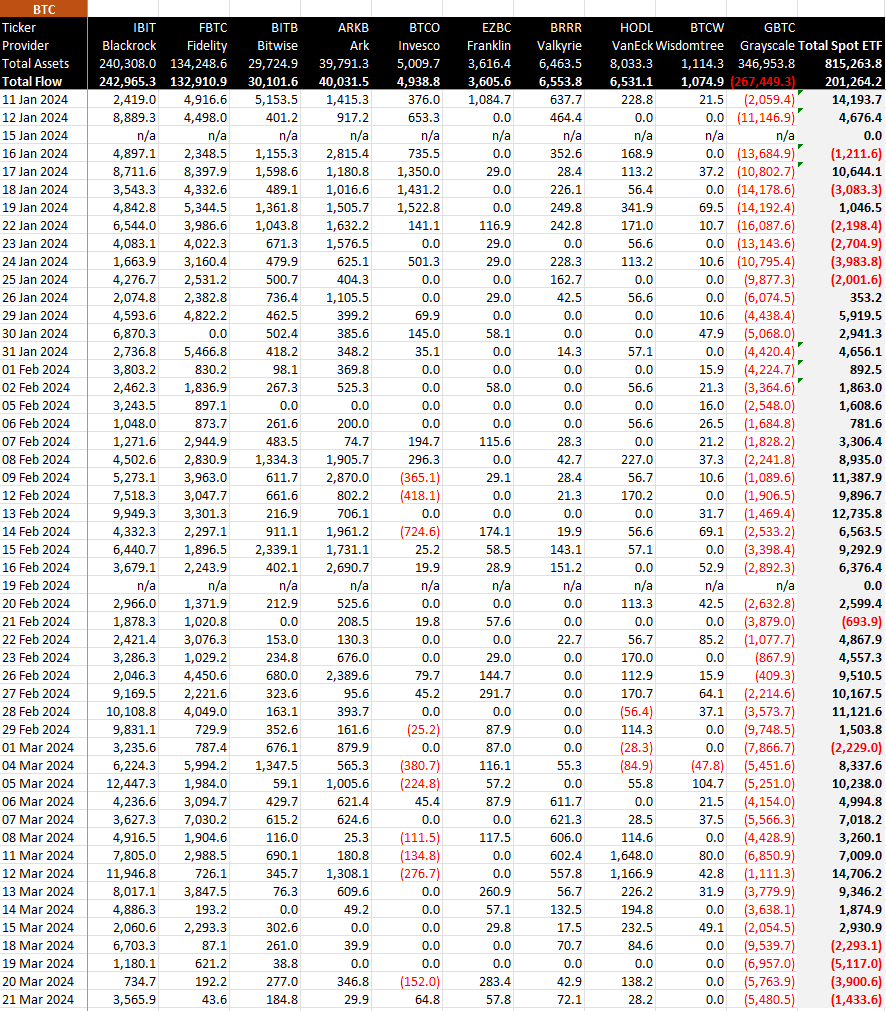

On March 21, Bitcoin ETFs experienced decreased outflows of $93.9 million compared to earlier in the week, corresponding to 1,433.6 BTC. BitMEX data highlights outflows extending over four consecutive days, an event that has occurred for the second time since the ETF’s launch on Jan. 11.

The Grayscale Bitcoin Trust (GBTC) reported an outflow of $358.8 million (5,480.5 BTC), which, while still considerable, is a further decrease in falling outflows. There has been a gradual decrease in the volume of outflows since March 18. To date, GBTC’s cumulative outflows have reached $13,630.6 billion (267,449.3 BTC), according to BitMEX data.

Contrasting this trend, BlackRock’s iShares Bitcoin Trust (IBIT) has seen an upswing with $233.4 million of inflows (3,565.9 BTC), pushing their total net inflows to a remarkable $13,322.5 billion (242,965.3 BTC), according to BitMEX.

Notably, Bitwise’s BITB reached a significant milestone, accumulating over $1.5 billion in net inflows, equivalent to 30,101.6 BTC. Meanwhile, Fidelity’s FBTC recorded its lowest-ever inflow, totaling just $2.9 million (43.6 BTC).

Since the start of ETF trading, the cumulative net inflows have amounted to $11,320.7 billion (201,264.2 BTC).

The post Fidelity FBTC experiences record low inflow of $2.9 million appeared first on CryptoSlate.