Although the broader market is experiencing a strong start this year, Filecoin has opened the year at a snail’s pace. According to Coingecko, the token is up over 4% in the past 24 hours. However, the week started with FIL bleeding nearly 27%.

With investors uninspired by the ongoing broader market rally, FIL might be in for a rough few months after ending 2023 on a positive note.

On-Chain Growth Prevents A Bigger Disaster

In their most recent blog post, they highlight the recent achievements of the ecosystem. Over 2,442 unique smart contracts deployed on-chain, with over 3,000 projects native on Filecoin. But overall, Filecoin has been fairly silent in terms of development, despite boasting an extremely active developer base with over 15,000 contributors on GitHub.

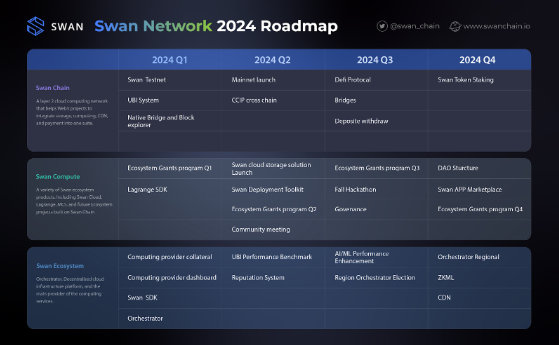

Swan Chain – a layer-2 protocol powered by Filecoin itself – is the one creating a positive noise. In their recent post on X, the protocol posted a roadmap for this year.

If Swan’s planned roadmap is followed and implemented, it may reverse the overall bearish attitude on FIL. However, this will inevitably take time, costing investors precious moments on the red rather than starting the year on the green.

But 2023 was a bountiful year for Swan Chain. In the blog post detailing the protocol’s achievements last year, their testnets Lagrange and Mars covered different aspects of the ecosystem and saw great success. This might be a sign that investors should be in for the long term rather than expect short-term gains.

Filecoin: More Pain In The Short To Medium-Term?

As of writing, the token is completely in the red after an impressive year-end rally. The bulls are now fighting over control of the $5.825 price level which will provide a better platform for higher highs in in the long term. However, this may not be the case in the next couple of days.

FIL’s market is dominated by the bears that will inevitably bring the token’s price to sub-$5 if the bearishness continues. But this also presents the opportunity for the bulls to slow the token’s descent until they find strong support for the long haul.

At the moment, $5.231 will be the point at which the bulls will slow FIL’s downward spiral. If they can hold on to this price level in the long run, investors and traders will see gains trickle in little by little.

Featured image from Shutterstock