Popular meme-based cryptocurrency Dogecoin (DOGE) has just seen a dramatic downturn that makes investors wonder about its future course.

Driven by market volatility of Bitcoin (BTC), DOGE’s value dropped by around 20% over the past week. DOGE currently trades at $0.2551; its market value is $38.09 billion and its trading volume is $3.42 billion.

Whale Accumulation Signals Investor Trust

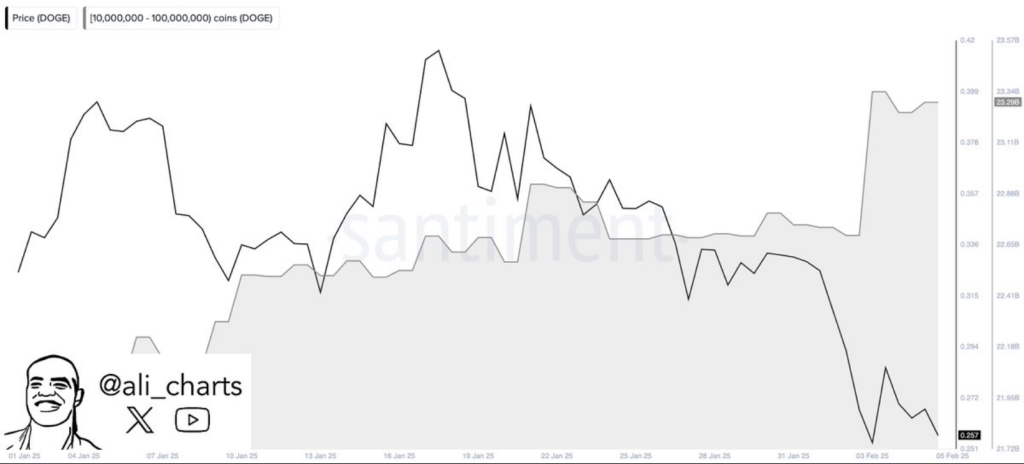

On-chain data shows that despite the current downturn, big investors—often referred to as “whales”—have grabbed the chance to amass significant amounts of DOGE.

Whales have specifically accumulated 750 million units of the meme coin during this downturn. Usually preceding big price swings, this large accumulation shows a strong conviction in the long-term possibilities of Dogecoin.

The current price of $0.25 is an ideal opportunity for investors who are ready to ride the wave of a possible recovery, according to some analysts, while others think DOGE may drop to about $0.17.

Whales seized the opportunity during the recent dip, buying 750 million #Dogecoin $DOGE! This is a strong sign of confidence in the market! pic.twitter.com/LyjIuZCF15

— Ali (@ali_charts) February 6, 2025

Dogecoin: Historical Patterns Point To Potential Growth

Analysts claim that Dogecoin’s current market sentiment is a reflection of its 2017 bull cycle. Alongside similar corrections during that period, there were impressive rallies that led to new all-time highs.

If this historical pattern is accurate, DOGE may have reached its local low and is getting ready for a significant ascent. Technical indicators also reveal hints of buildup and possible trend reversals, therefore supporting this positive view.

Market Sentiment And Future Outlook

The possible comeback of DOGE depends much on the general attitude of the Bitcoin market. Should Bitcoin settle and the mood in the market changes, Dogecoin might be set for a significant increase.

Recent whale growth and historical assessments support this idea. Investors are closely watching the market, expecting that DOGE will regain its previous high prices and possibly hit new records.

Temporary Hiccup For DOGE?

Investors might worry about the recent drop in Dogecoin’s price, but there are other things to consider. Factors like large investors buying more, previous price patterns, and potential market stability indicate that this decline could lead to strong recovery.

As usual, investors should be cautious and undertake thorough research before choosing what to buy.

But a change in the general market vibe or higher demand could contradict the negative view, thus monitoring it price movement in the following few weeks is quite important for deciding its main direction.

Featured image from Dogster, chart from TradingView