Ethereum, the world’s second-largest cryptocurrency by market cap, finds itself in a curious position. While the price struggles for direction, its underlying network is experiencing a surge in activity.

Ethereum Network Sees Increase In New Users

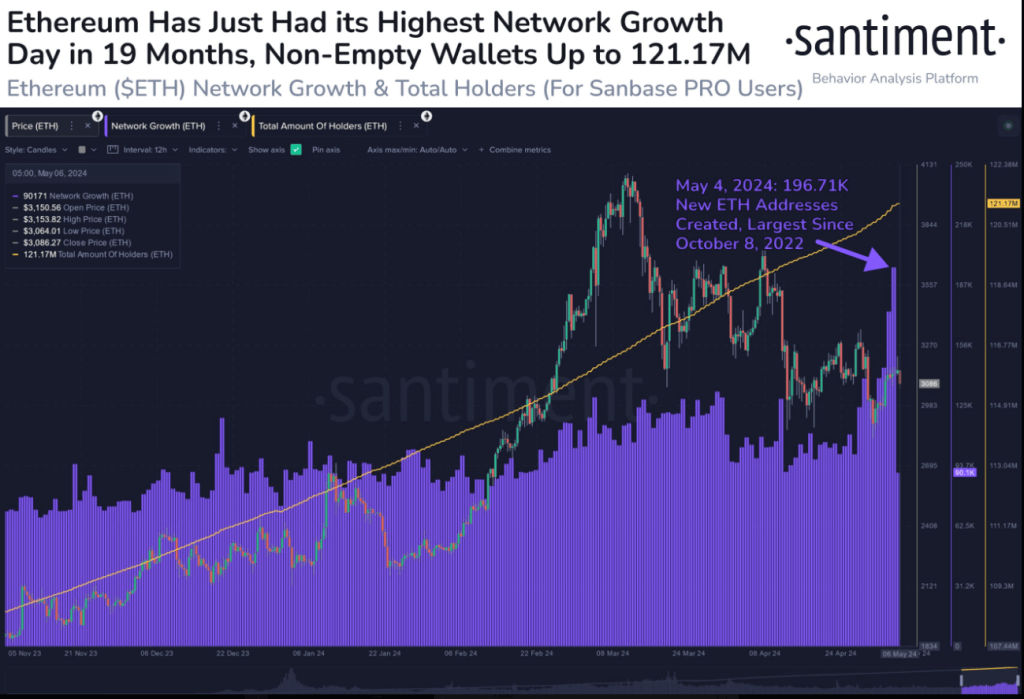

According to crypto data firm Santiment, May 4th saw a whopping 200,000 new Ethereum addresses created, marking the highest single-day growth in nearly two years.

This surge suggests a renewed interest in the Ethereum ecosystem, potentially driven by factors like the burgeoning Decentralized Finance (DeFi) space and the ever-evolving world of Non-Fungible Tokens (NFTs).

#Ethereum rebounded back above $3,200 this weekend, and saw massive network growth. 196.71K new addresses were created on the $ETH network on May 4, 2024, the largest single day of growth since October 8, 2022. This should be viewed as a #bullish sign. https://t.co/l9iFVWCJpE pic.twitter.com/MlHQTvKKN0

— Santiment (@santimentfeed) May 6, 2024

This network growth is a bullish signal, and indicates strong and increasing interest in Ethereum, which could translate to significant capital inflows when macroeconomic conditions become more favorable.

Is The Price Dip A Buying Opportunity?

While the network thrives, Ethereum’s price currently sits at $2,995, a 1.8% decline in the past 24 hours. This puts it precariously close to falling below its 200-day Exponential Moving Average (EMA), a technical indicator often interpreted as a sign of bearish momentum.

However, a closer look reveals a potentially bullish twist. The price decline is accompanied by a drop in trading volume, which could indicate that selling pressure is waning. Historically, such a scenario has sometimes preceded a price reversal, where buyers re-enter the market, pushing prices upwards.

Investor Optimism Buoyed By Potential Fed Pivot

The recent weakness in the US economy, highlighted by a disappointing jobs report, has sparked speculation that the Federal Reserve might consider easing interest rates. This could inject fresh liquidity into the market, potentially benefiting riskier assets like cryptocurrencies.

According to analysts, a dovish pivot from the Federal Reserve could be a game-changer for Ethereum. Lower interest rates generally make holding cryptocurrencies more attractive compared to traditional fixed-income investments.

The future path of Ethereum remains uncertain. While the network’s fundamentals appear robust, the price faces immediate challenges. Navigating this complex scenario will require investors to carefully consider both the on-chain activity and the broader economic landscape.

Regulation and Innovation: Key Factors to Watch

Regulatory clarity around cryptocurrencies will undoubtedly play a crucial role in attracting institutional investors, a potential catalyst for significant price growth.

Related Reading: Cardano (ADA) Trading Activity Goes Quiet: Will This Drag Down The Price?

Featured image from Book My Flight, chart from TradingView