Foundry USA and AntPool have been dominating the Bitcoin mining ecosystem in recent weeks.

Foundry USA is the largest mining pool, contributing over 34% of the total blocks mined in the past week. This is a remarkable achievement, given the size and decentralization of the Bitcoin mining industry. Such a high market share shows just how much of the hash power Foundry has — data from Mempool puts its estimated hashrate at around 233 EH/s.

Foundry’s dominance over the market isn’t recent, as its trajectory shows a consistent increase in hashrate and pool dominance over the years. An average health of 99.22% reflects the reliability of its mining network, ensuring minimal downtime and consistent contributions to the network.

AntPool is the second-largest mining pool, accounting for 17.54% of the blocks mined in the past week. Its hashrate of 183.3 EH/s makes it a major player in the industry, though it trails Foundry USA by a significant margin. The pool’s average health stands at 98.64%, slightly below Foundry’s but still reflective of a high level of operational efficiency.

The historical data for AntPool shows periods of strong dominance, although its share of the market appears more volatile compared to Foundry’s steady rise. This variability could be tied to shifting miner incentives or competitive pressures from other pools.

The broader mining landscape shows an increasingly concentrated market where the top two players — Foundry and AntPool — collectively account for over 50% of the blocks mined. While the network remains secure due to its total hash power distributed across various pools, the influence of these two players cannot be ignored, particularly during pivotal moments such as difficulty adjustments or protocol upgrades.

This centralization is not a new phenomenon but has been a persistent challenge in the industry for several years. A CryptoSlate report from January 2023 found that the two pools controlling over half of the global hashrate have been a recurring theme in the industry, showing the ongoing issue with mining centralization.

ViaBTC holds the third position, contributing 13.77% of the blocks mined with a hashrate of 124.7 EH/s and an average health of 99.11%. While it commands a notable market share, its dominance is considerably less than that of Foundry USA and AntPool.

The data also shows healthy competition among smaller pools like F2Pool and MARA Pool, but their combined market share is relatively modest. With only 4.67% of the blocks mined, MARA Pool boasts a remarkable 38.69% increase in average block fees, indicating a focus on mining blocks with higher transaction fees, possibly as a strategy to maximize profitability despite its smaller scale.

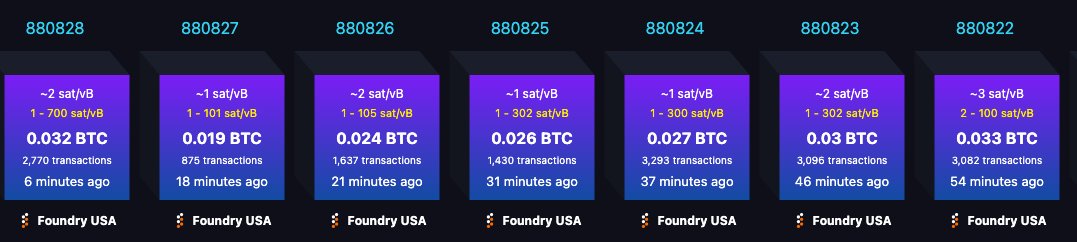

Foundry’s dominance over the market became evident on Jan. 26, when it successfully mined seven blocks in a row. This streak equates to approximately 70 minutes of uninterrupted control over block production. While this may be a statistical anomaly rather than a deliberate exercise of power, it reignites debates about the implications of concentrated mining power. When a single pool can consecutively mine multiple blocks, it temporarily controls transaction inclusion and prioritization, raising concerns about network centralization.

Despite the dominance of large mining pools like Foundry USA, it’s important to recognize that these pools aggregate hash power from independent miners who may be geographically decentralized globally. Although headquartered in the US, Foundry represents a collective of miners contributing their computational power from various locations. These miners join Foundry to benefit from its reliable infrastructure, competitive payouts, and operational efficiency.

This aggregation does not imply that all the mining activity under Foundry’s umbrella is physically concentrated in one region or controlled by a single entity. In practice, independent miners retain autonomy over their operations and can switch pools if economic or ideological incentives align elsewhere. This helps preserve a degree of decentralization within the network, even as large pools achieve significant market dominance and global hash power distribution.

The data shows a historical increase in the overall Bitcoin hashrate. This reflects the growth and maturity of the broader Bitcoin market and the continued investment in mining hardware and infrastructure.

However, the dominance of a handful of mining pools clearly shows a shift towards industrial-scale mining, with pools backed by large and publicly traded companies gaining the upper hand. Foundry USA’s ability to attract and retain a large number of miners by offering competitive incentives and a reliable operational framework supports this trend.

The post Foundry mined over a third of all Bitcoin blocks in the past week appeared first on CryptoSlate.