Quick Take

In the past 24 hours, the two largest Bitcoin mining pools, Foundry USA and Antpool, have demonstrated significant dominance, each holding approximately 30% of the mining pool market and collectively mining just under 60% of the blocks in the past 24 hours. Both pools mined 41 blocks each during this period. The third-largest pool, ViaBTC, accounted for about 11% of the blocks.

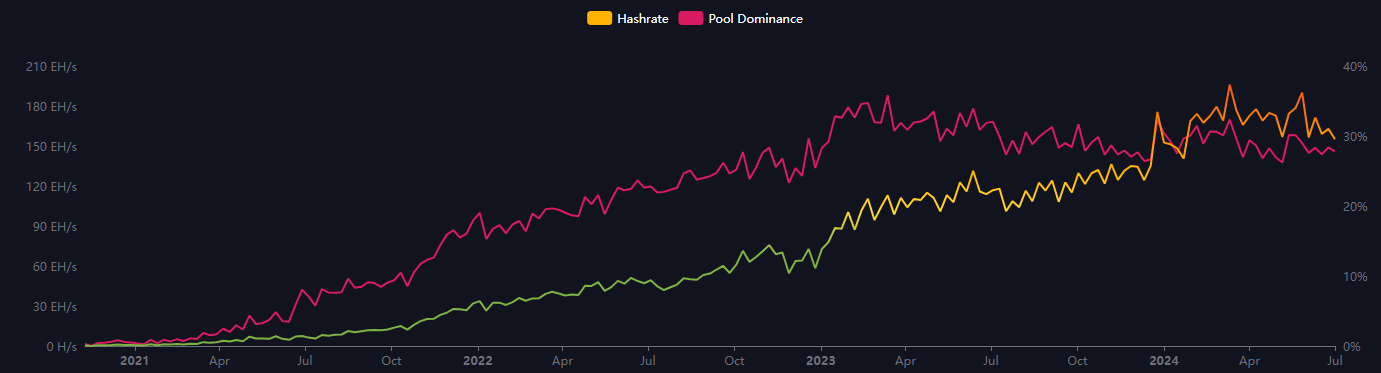

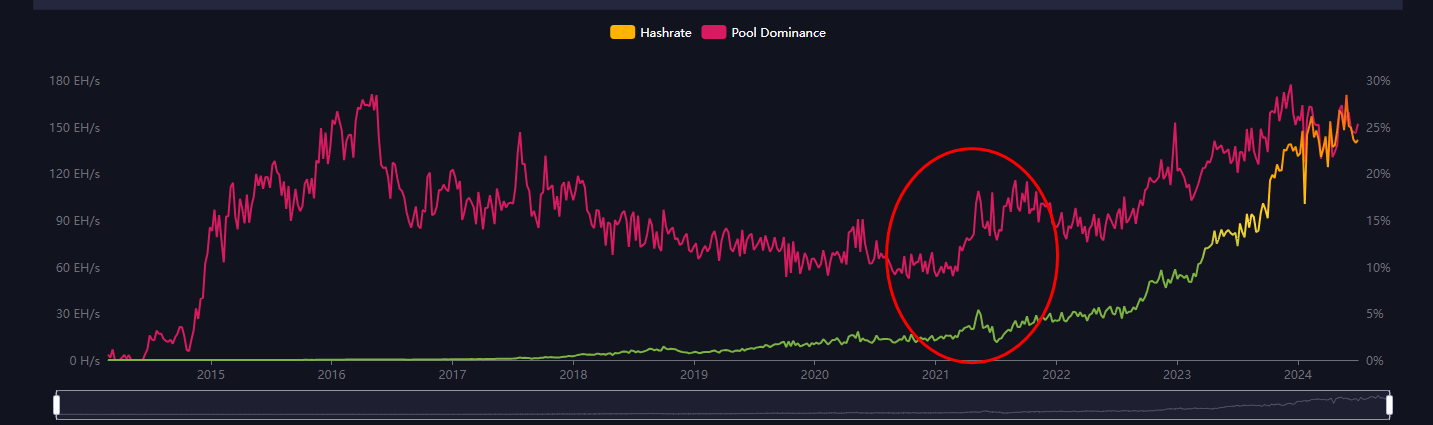

A year ago, Foundry USA held a 29% share, and Antpool had 25%. Three years ago, Foundry USA had a 24% share, and Antpool had 20%. This increase highlights the growing dominance of these two mining pools. Currently, Foundry USA boasts a hashrate of 181 EH/s, while Antpool has around 140 EH/s, raising concerns about mining centralization.

Bob Burnett, Founder and CEO of Barefoot Mining, pointed out these concerns, noting an instance where Antpool mined five out of six consecutive blocks between blocks 850448 and 850453. Many publicly traded Bitcoin miners, such as Cipher Mining, Bitfarms, and Hut 8, use Foundry USA.

Antpool, based in Beijing and owned by Bitmain, the largest ASIC producer, indicates a significant hash rate concentration in China and the USA. This centralization could pose future challenges, especially as weaker miners leave the network and stronger miners consolidate their positions, with publicly traded miners significantly increasing their hashrate.

It is worth noting that during the China mining ban in the summer of 2021, Antpool’s hash rate dominance increased from 10% to 18% despite an overall decrease in their absolute hash rate.

It’s not necessarily a concern if a mining pool holds a 51% share, as the risk of a 51% attack primarily arises if a single miner controls the majority of the hash rate. In such cases, it’s the centralization within the pool, rather than the pool itself, that poses the threat.

The post Foundry USA and Antpool command almost 60% of Bitcoin mining pool market appeared first on CryptoSlate.