Beercoin, the effervescent Solana-based meme coin that promised a taste of financial freedom, is experiencing a hangover of epic proportions. After a meteoric rise in price earlier this month, Beercoin has come crashing down, plummeting by nearly 70% in a matter of days. This dramatic decline reflects a confluence of factors, including a broader crypto market correction, a hawkish Federal Reserve stance, and a concerning trend of insider selling.

Fed Tightens The Taps

The Federal Reserve’s recent decision to adopt a more hawkish monetary policy, prioritizing inflation control over economic stimulus, has cast a dark cloud over the entire cryptocurrency market. Bitcoin, the bellwether of the industry, dipped below $66,000 this week, dragging most altcoins down with it.

This shift in central bank policy is particularly detrimental to highly speculative assets like meme coins, which thrive on easy money and investor exuberance. Meme coins, often lacking real-world utility or established fundamentals, are seen as the first to be dumped when risk aversion creeps into the market.

Whales Jump Ship

Adding fuel to the fire of Beercoin’s descent is a troubling trend of insider selling. Onchain analysis by LookOnChain revealed that several individuals with significant holdings, likely early investors who acquired Beercoin at a discount during pre-sales, have recently cashed out in large quantities.

Another wallet related to the #beercoin team sold 5.43B $BEER for $1.13M!

Although it has been transferred many times, we traced that the wallet received $BEER directly from the #beercoin team wallet “7yfvQX…o9v394” and “8VY4LF…fDd5G2”.https://t.co/vElDToYi5C pic.twitter.com/oYp41d3Naz

— Lookonchain (@lookonchain) June 16, 2024

This mass exodus by insiders, who presumably possess a deeper understanding of Beercoin’s potential or limitations, raises serious red flags for retail investors. Their actions can be interpreted as a loss of confidence in the project, potentially signaling that Beercoin may not be the golden ticket to riches it was initially touted to be.

Technical Indicators: Frothy Future

Technical analysis, the study of price charts and historical data to predict future market movements, paints a similarly grim picture for Beercoin. The token has not only fallen below a key support level, but it also continues to trade beneath crucial moving averages, technical indicators used to gauge momentum and identify potential trend reversals.

BEER Price Prediction

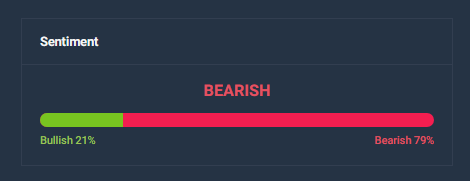

Meanwhile, the current BEER price prediction suggests a significant upward trajectory, anticipating a 220% increase to $0.0₁₀5119 by July 18, 2024. Despite this optimistic forecast, technical indicators show a bearish sentiment, indicating potential caution among investors.

The Fear & Greed Index is at 74, which denotes high levels of greed in the market, suggesting that the current bullish outlook may be driven by overenthusiastic sentiment rather than solid fundamentals.

Over the past 30 days, BEER has experienced an unusual trend, recording 100% green days with zero price volatility, an anomaly in typical market behavior. This consistent upward movement without any fluctuations may indicate a highly manipulated or illiquid market.

Featured image from Health | HowStuffWorks, chart from TradingView