Quick Take

After the launch of the first Gold ETF SPDR Gold Shares (GLD) in 2004, the precious metal embarked on a remarkable bull run, soaring from around $430 to $1,800 per ounce by August 2011.

This surge has fueled optimism that Bitcoin could potentially experience a similar, if not more impressive, ascent for the remainder of the decade after the launch of the Bitcoin ETFs in January.

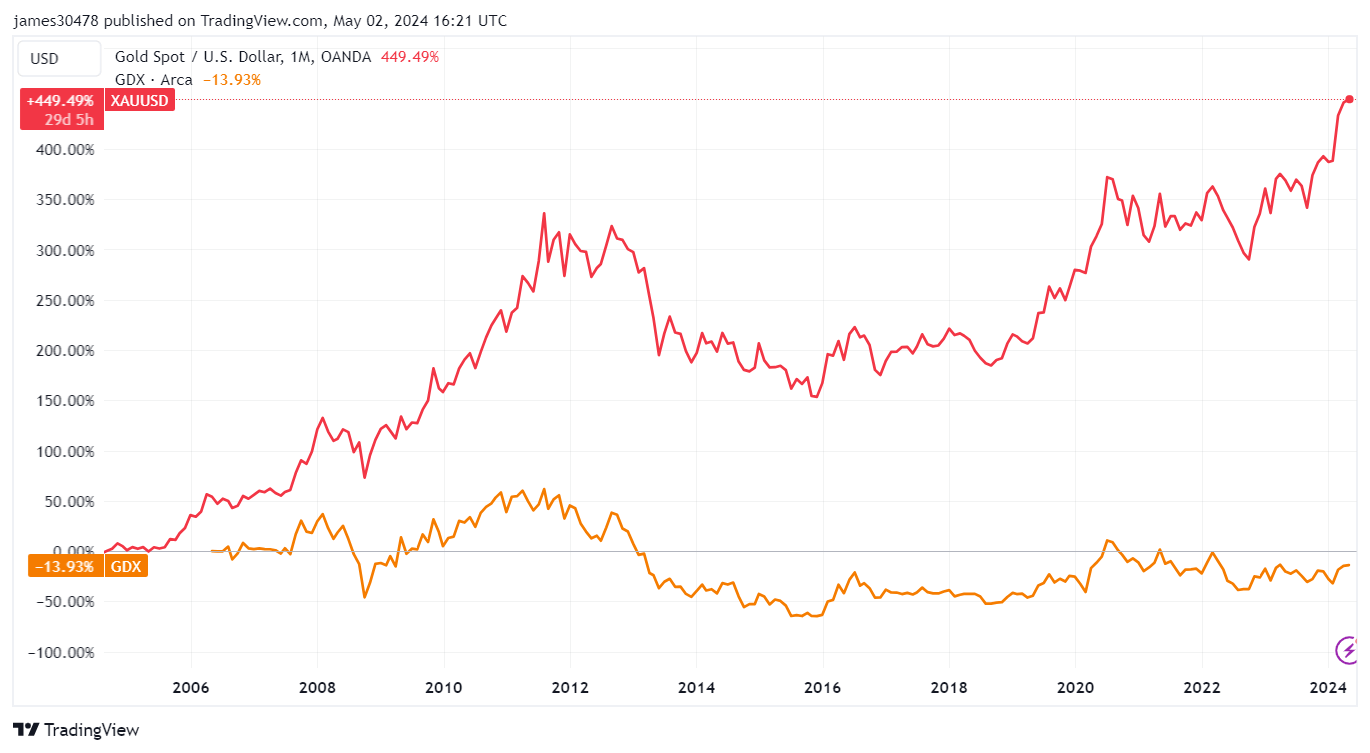

However, a closer examination of the performance of gold miners’ ETFs, such as the $13 billion VanEck Gold Miners ETF (GDX), reveals a stark contrast. While GLD has appreciated by an impressive 449% since its inception, GDX, which debuted in 2006, has declined by 14%.

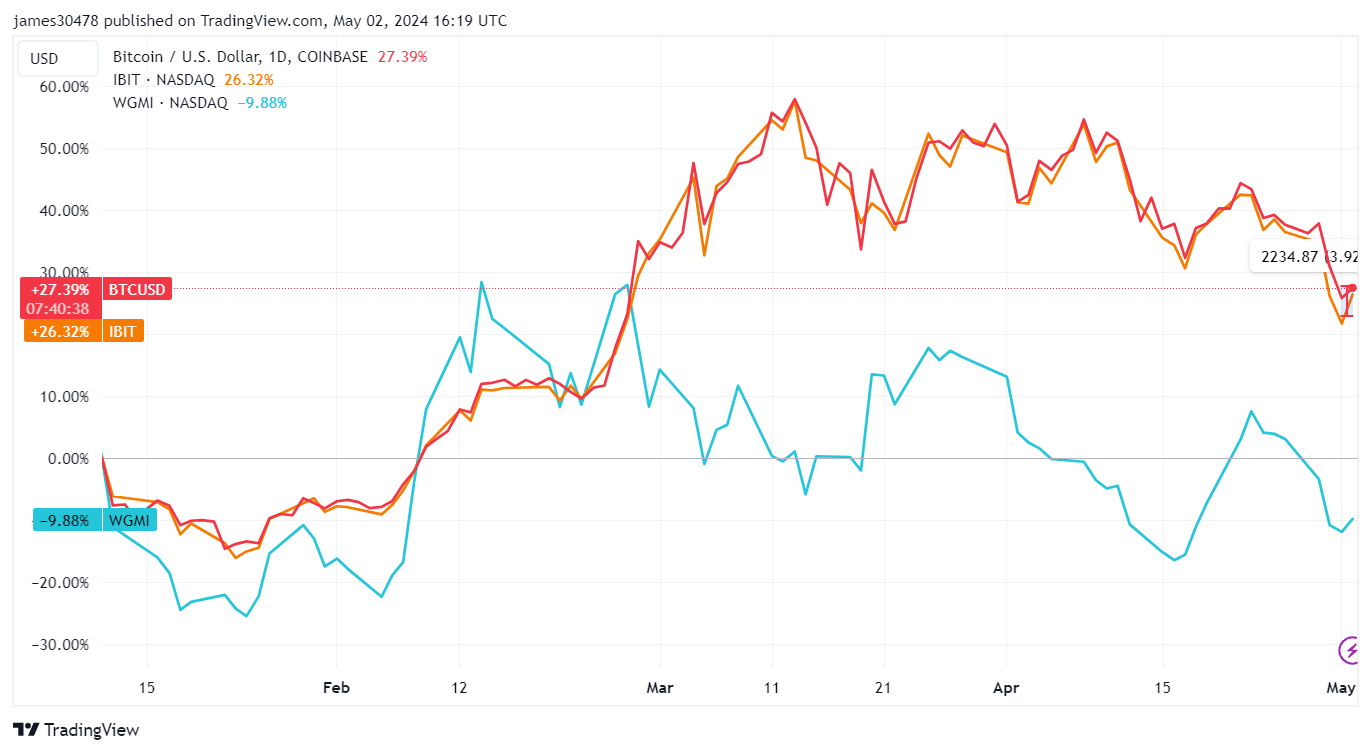

Interestingly, a similar divergence appears to unfold in the digital assets space. Since the launch of IBIT by BlackRock on Jan. 11, Bitcoin itself and the ETF have risen 27%. However, the Valkyrie Bitcoin Miners ETF (WGMI), which tracks mining companies, has shed 10% of its value during the same period.

The post From gold to Bitcoin: ETFs excel while miners falter post-launch appeared first on CryptoSlate.