Swiss asset manager 21Shares has openly endorsed Dogecoin, stating that the cryptocurrency has developed a long way from its origins as an online meme. The company cited Dogecoin’s whopping 130,000% price appreciation over the last decade as evidence of its longevity within the turbulent crypto space.

Meme Currency Sees Serious Growth

What began as an online joke in 2013 has become what 21Shares refers to as a “movement” in the crypto space. Dogecoin’s performance, the asset manager says, speaks for itself. The coin has recorded an annual growth rate of 125% since its inception, making it the best performer among the market’s top 25 largest cryptocurrencies by market cap.

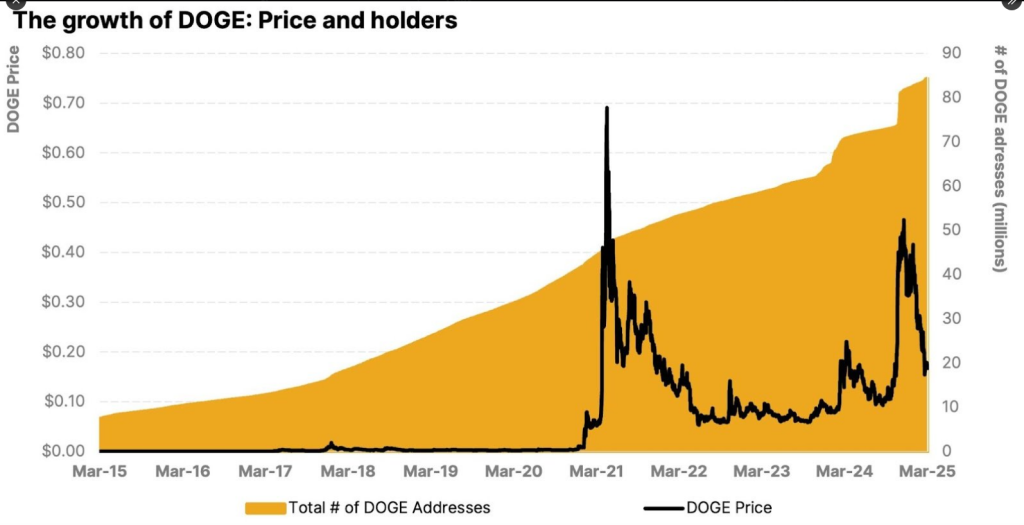

The growth is not just in value. User adoption has nearly doubled in recent years, with wallet addresses rising from 44 million to 84 million in four years. Such rapid growth shows that more people are holding and using the cryptocurrency despite its lighthearted origin.

Dogecoin isn’t just a meme—it’s a movement.

With 130,000%+ returns, a $30B market cap, and 84M+ wallets, DOGE is rewriting what value means in the digital age.

Explore how culture, community, and memes drive this phenomenon. Read the full blog → https://t.co/wNFYdM2pjS pic.twitter.com/ojfYEkVCwQ

— 21Shares (@21Shares) April 10, 2025

ETF Filing Marks Major Step For Dogecoin

The Swiss company recently submitted an S-1 form to the US Securities and Exchange Commission for a Dogecoin ETF. The filing is a significant step forward for cryptocurrency, which began life as a prank. If accepted, the ETF would allow ordinary investors to own exposure to Dogecoin without buying or owning the cryptocurrency itself.

According to regulatory filings, the new fund would be commodity-based, providing an alternative method of bringing Dogecoin into portfolios using traditional investment vehicles.

21Shares Announces Partnership With Dogecoin Foundation

21Shares also announced that it has partnered with the House of Doge, the official business entity of the Dogecoin Foundation. From reports, the partnership is said to further entrench Dogecoin with conventional financial systems.

The alliance brings a new legitimacy to the currency, with traditional financial institutions now viewing it as a legitimate asset class and not merely an internet fad. Institutional support may entice more risk-averse investors who shunned the meme-coin in the past.

New Exchange-Traded Product Launches With Physical Backing

In a further demonstration of its dedication to Dogecoin, 21Shares has introduced an exchange-traded product fully supported by the Dogecoin Foundation. This investment product will be collateralized by real Dogecoin in a 1:1 ratio, such that every share equates to holding real cryptocurrency in cold storage.

The firm will charge a management fee of 0.25% for this product, which is fairly competitive against peer cryptocurrency investment products. This physical backing model provides investors with confidence that their investment holds a real-world basis in the form of coins and not synthetic derivatives.

Featured image from Unsplash, chart from TradingView