FTX is in accumulation mode with the market near rock bottom. Although it’s a fire sale in the market right now, some institutions are well past saving.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

FTX Buys The Dip

In a massive announcement, it was reported that FTX is closing a deal to buy BlockFi for a major discount below their previous estimated $5 billion valuation at peak. Although news initially mentioned the deal was for only $25 million, it’s likely more around $275 million including the previous FTX revolving line of credit of $250 million. This comes right after CEO Zac Prince announced BlockFi faced 10% of asset withdrawals in a “massive stress test” just last week.

Either way, FTX is in accumulation mode with the market near rock bottom and BlockFi down roughly 95%. They even looked at acquiring Celsius but the state of its finances with a $2 billion hole in the balance sheet was too much. Although it’s a fire sale in the market right now, some institutions are well past saving. Celsius will likely continue down the most probable path: bankruptcy, years of legal proceedings with customers and a possible buyer getting distressed assets for cheap.

Knowing FTX is both working to expand their retail customer base and their FTX Earn product, acquisitions at these discounts make strategic sense. The move likely wipes out all BlockFi equity holders but saves customers’ deposits. It’s also in FTX’s interest to keep the contagion contained for the sake of the entire industry’s reputation. Either way, they look to be the industry’s lender of last resort and the show continues on.

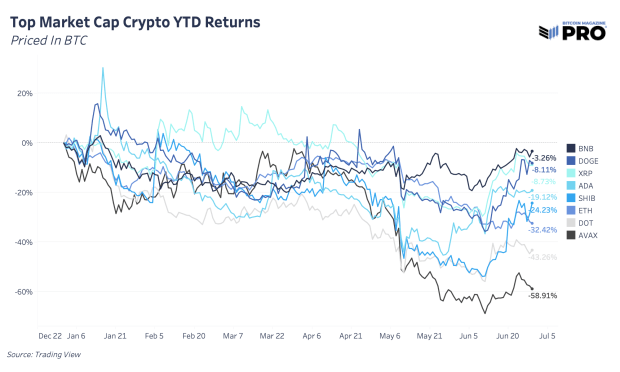

For now it’s not clear what’s going to happen with the Celsius assets or even if the market has priced in potential future liquidations. Alts and DeFi bets have been falling in BTC terms throughout the year, despite recent rallies, and it doesn’t look like the total damage is over yet.