The post FTX News: Could $12 Billion in Repayments Spark a Bitcoin Rally? appeared first on Coinpedia Fintech News

The bankrupt crypto exchange, FTX, is preparing to return over $12 billion to its creditors. This payout plan is raising hopes for a possible shake up in the crypto market. FTX owes around $11.2 billion to its creditors. However this amount will rise as the exchange also has to provide interest oven investments. Crypto enthusiasts are eagerly waiting to see if some of this cash will flow back into digital assets.

Will FTX’s Cash Injection Revive Crypto?

The first repayment of $1.1 billion might be small, but it could still impact Bitcoin. According to Alex Thorn from Galaxy Digital, this injection might give Bitcoin a much-needed boost. Traders have been waiting for something to stir the market. Recently, the top 100 coins dropped by 3%, despite October usually being a strong month for crypto. Could this mean the rally is running out of steam? Some experts seem to think so.

Benjamin Celermajer, Magnet Capital’s co-chief investment officer, believes this liquidity could drive some market movement. He pointed out that the payouts will hand over liquidity to traders who are well-known in the space. This could act as a much-needed price catalyst.

What’s Next for the FTX Repayments?

These repayments won’t be immediate. FTX still needs to set up a trust and hire a firm to manage the process. Smaller creditors might start seeing funds in December, but larger payouts could stretch into next year. Some claims may even take up to three years to resolve, according to estimates from Galaxy Digital.

K33 Research estimates that $2.4 billion of these funds might find their way back into the crypto market. However, the impact may be slow since repayments will happen over the course of a year.

What to Expect from the Market

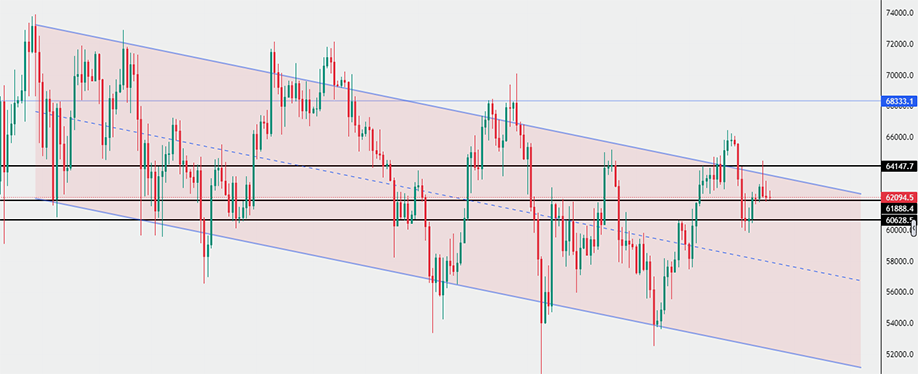

Bitcoin is holding steady at around $62,000 support. While the market hasn’t seen major moves recently, traders are hoping these payouts could give it a push. Earlier this year, demand for Bitcoin exchange traded funds helped the coin hit $74,000. If some of FTX’s funds return to the market, it could trigger fresh interest and drive up prices.

Stay tuned to see how these repayments will impact the market in the coming months. Will FTX’s payouts help breathe life back into a stagnant market? Only time will tell.