The FTX bankruptcy estate has been involved in several asset liquidations over the past year, as they seek to fully reimburse former customers of the now-defunct exchange. In the latest development in the ongoing proceedings, the estate has sold the last part of its shares in the artificial intelligence (AI) startup Anthropic.

FTX Rakes In $800 Million From Anthropic Shares Sale

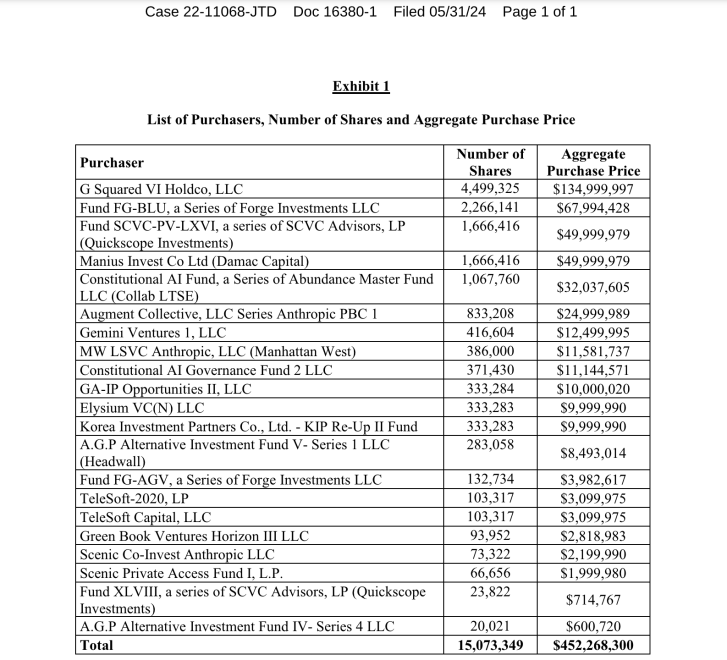

According to the latest bankruptcy filings, the FTX estate has cashed in on its remaining shares in Anthropic, the AI company behind the Claude chatbot. The estate dumped the remaining 15 million shares at $30 per share, receiving more than $452 million in proceeds.

The top buyer in this sale is G Squared, a venture capital fund, which purchased around one-third (4.5 million) of the remaining shares for roughly $135 million. Other buyers include Fund FG-BLU and over a dozen other hedge funds and investment companies.

It is worth mentioning that the latest sale comes a little over two months after the exchange sold the bulk of their Anthropic shares at the same $30 apiece, netting about $900 million in returns. This brings the total amount from the selloff of the FTX Anthropic shares to about $1.3 billion.

Originally, the FTX exchange and its sister company Alameda paid $500 million for the 8% stake in Anthropic in 2021. However, the subsequent explosion that rocked the AI industry caused the value of the shares to skyrocket, bringing the exchange’s profits to over $800 million.

As inferred earlier, the Anthropic shares are not the only assets that have been sold in recent months. Most recently, the liquidators in charge of FTX’s assets disclosed plans to sell off real estate properties the exchange acquired before bankruptcy.

FTX Bankruptcy Fees Surpass $700 Million

According to a recent report by a bankruptcy expert, the cost of FTX’s bankruptcy proceedings has exceeded $700 million. This cost includes legal and administrative fees over the past few years following the exchange’s collapse.

The report shows consulting firm Alvarez & Marsal is the highest earner in the FTX estate’s employ, charging a massive $212 million for its service. Sullivan and Cromwell, FTX’s legal counsel, has the second-largest bill of $202 million.

Another expense that caught the eye in the report is FTX CEO John Ray’s bill. The CEO has charged the estate $5.6 million since the start of the bankruptcy case, according to an hourly rate of $1,300.