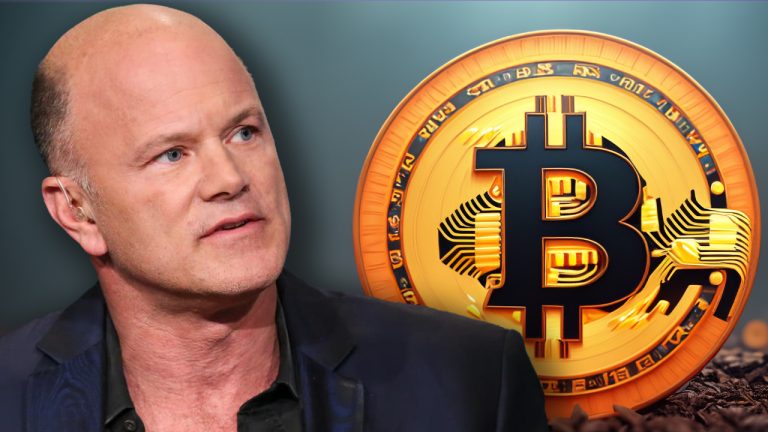

Galaxy Digital CEO Mike Novogratz expects a spot bitcoin exchange-traded fund (ETF) to be approved in 2023. “It’s going to get approved, we think it happens this year,” the American investor said on Wednesday.

Billionaire and Crypto Investor Mike Novogratz Say There’s Been a ‘Huge Psychological Shift’

After predicting in August, Galaxy Digital CEO Mike Novogratz has accelerated his forecast regarding a spot bitcoin ETF. In mid-August, Novogratz believed the U.S. Securities and Exchange Commission (SEC) would approve one within four to six months. But on Wednesday, while speaking with Andrew Ross Sorkin on CNBC’s “Squawk Box,” he said it’s likely to be approved in 2023.

“It’s going to get approved, we think it happens this year in 2023,” Novogratz remarked. He added that all the indications point to it happening this year. The Galaxy CEO further cited public commentary and filings noting that “people’s comments are much more constructive.”

Galaxy Digital has partnered with Invesco and competes with several major financial firms aiming to launch a spot-settled exchange-traded fund. The company collaborates with Invesco on the Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF, known as “BLKC,” and the “SATO” ETF. Novogratz mentioned that the SEC has been in discussions with Galaxy regarding the ETF.

“[The SEC is] no longer talking about how [bitcoin] works or why it’s important. It’s just a recognized macro asset and that’s a huge psychological shift,” Novogratz explained on Wednesday.

He believes that current events indicate approval is imminent. His statements come after Blackrock CEO Larry Fink described the recent surge, following false ETF approval rumors, as a “flight to quality.” Novogratz highlighted Blackrock’s comments, emphasizing that interest from the world’s largest fund manager is a positive indicator. He also stressed, “The public wants this.” Novogratz’s statements follow Fidelity amending its spot bitcoin ETF filing on October 17.

What do you think about Novogratz’s commentary about a spot bitcoin ETF being approved this year? Do you agree with his prediction? Share your thoughts and opinions about this subject in the comments section below.