Quick Take

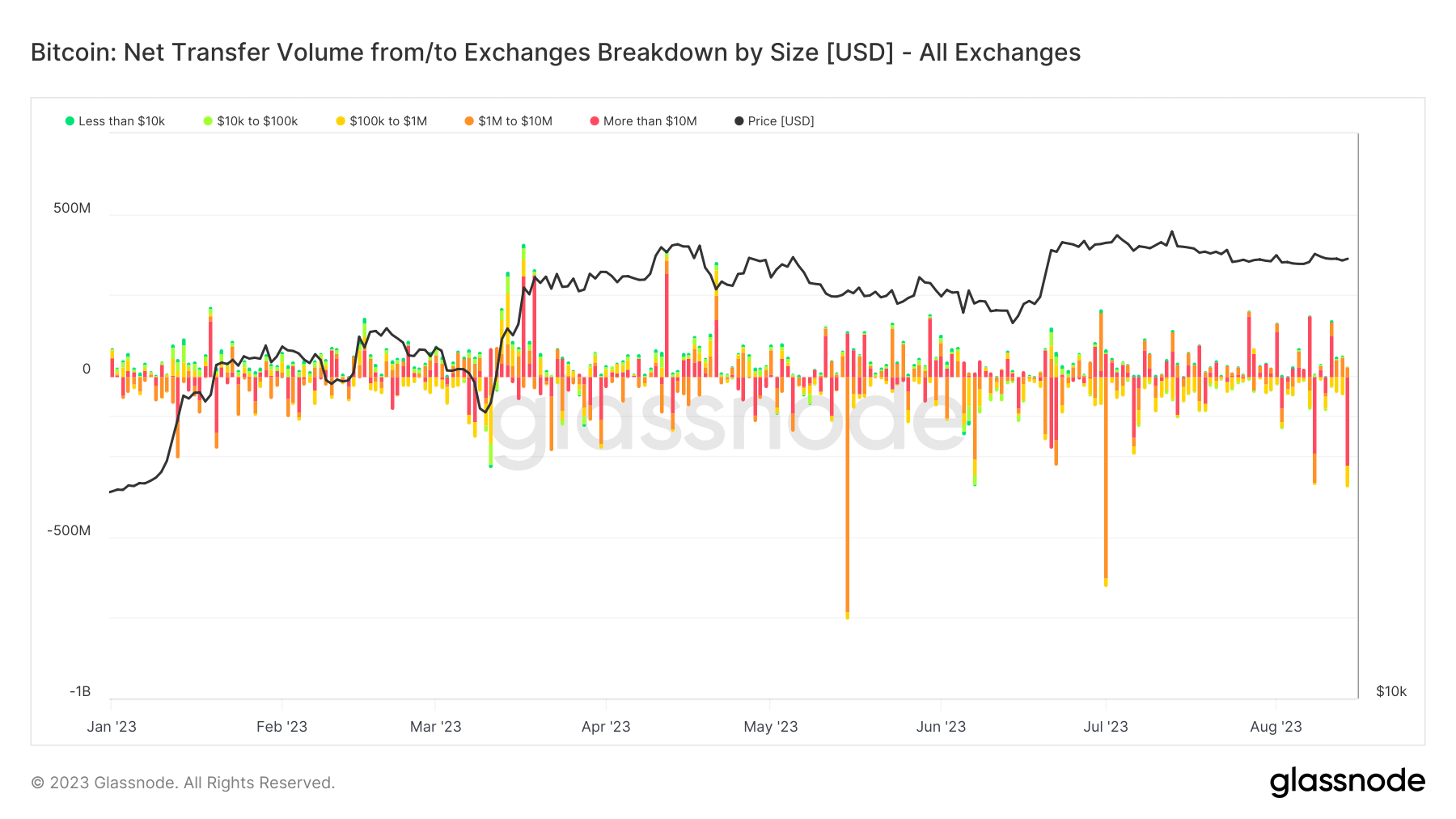

CryptoSlate data reveals a significant development in Bitcoin market dynamics, with the third biggest Bitcoin withdrawal this year outpacing last week’s substantial outflow.

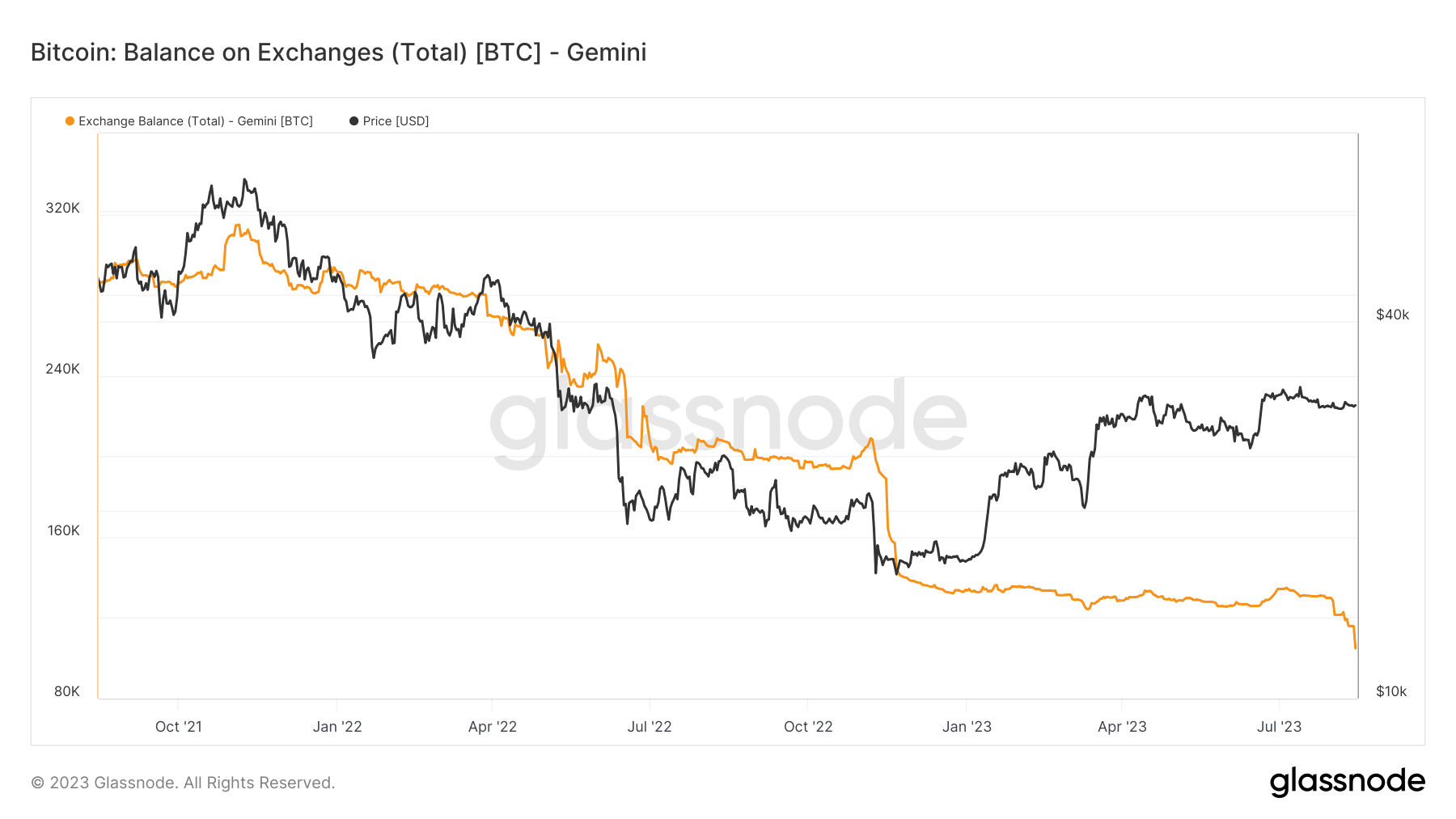

The epicenter of this activity was the Gemini exchange, witnessing a near $400 million Bitcoin exodus, chiefly led by large-scale investors or ‘whales.’ This withdrawal further solidifies a decreasing trend in Bitcoin’s exchange presence, with a year-low of 2.77 million Bitcoin currently observed.

Echoing this trend, Gemini itself has seen a considerable reduction in its Bitcoin reserves. From a robust reserve of 314,000 Bitcoin in Nov. 2021, Gemini is now left with 105,000 Bitcoin.

This pattern could suggest a potential shift in investor behavior, possibly pointing to a trend of long-term holding or the search for alternative custodial services. However, without conclusive correlation or causation, these interpretations remain speculative.

The post Gemini sees near $400 million Bitcoin withdrawal as ‘whale’ activity stirs market appeared first on CryptoSlate.