The post Gemini vs. CFTC: New York Court Reschedules Civil Case to January 2025 appeared first on Coinpedia Fintech News

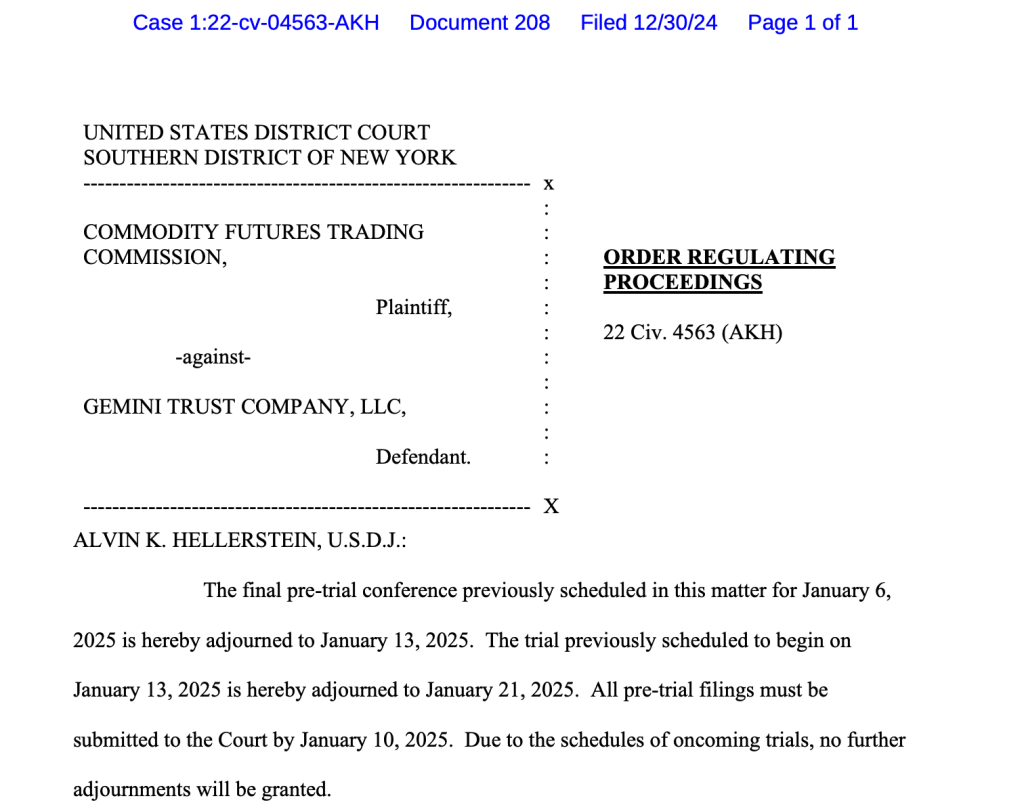

New York court Judge Alvin Hellerstein has ruled to postpone the civil case between Gemini Trust and the US Commodity Futures Trading Commission (CFTC) from January 13 to January 21, 2024. According to the court document dated December 30, 2024, the final pre-trial conference previously scheduled for January 6, 2025, has been pushed to January 13, 2025.

Without issuing the reasons, Judge Hellerstein noted that all pre-trial filings must be submitted to the court by January 10, 2025. Additionally, Judge Hellerstein highlighted that no further adjournments will be granted until the case hearing dates.

Closer Look at the Case Between Gemini and CFTC

In June 2022, the US CFTC accused Gemini Trust of issuing misleading material facts in connection with its Bitcoin futures product. The CFTC therefore sought to compel Gemini to give up the gains in addition to civil monetary penalties.

Earlier this year, New York Attorney General Letitia James recovered $50 million from Gemini Trust to repay more than 230k investors in the Earn Program. Additionally, Gemini Trust agreed to cease offering crypto lending operations in New York.

Gemini Exchange

–

[email protected]

Centralised Exchange

has been at the center of several controversial cases fueled by the 2022 crypto bear market. Late last year, Gemini and Genesis were sued for allegedly defrauding investors more than $1.1 billion.

What Next?

The Gemini vs CFTC case is expected to take a different trajectory in 2025 following the inauguration of prof-crypto President-elect Donald Trump in a few weeks. Moreover, Trump is considering a crypto-friendly CFTC chair including Brian Quintenz, a former commissioner of the CFTC, and Summer Mersinger, a Republican CFTC commissioner.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.