In a dramatic turn of events, bankrupt crypto lender Genesis has initiated a new legal battle against its long-standing rival, Gemini. The lawsuit claims that Gemini received “unfair preferential transfers” of approximately $700 million shortly before the company declared bankruptcy.

The complaint, filed on November 21, asserts that these transfers significantly disadvantaged Genesis’s other creditors and seeks their recovery.

New Revelations In Genesis Lawsuit

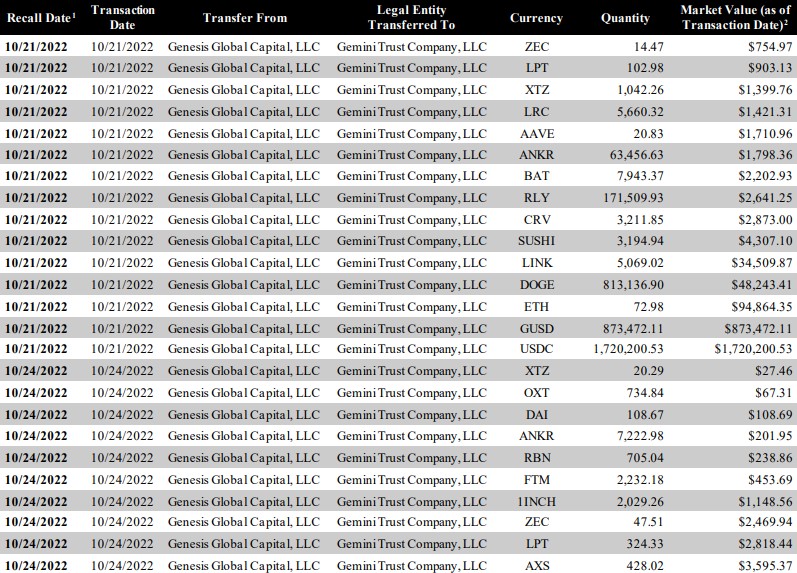

According to the filed document, the crypto lender alleges that, during the 90 days preceding its Chapter 11 bankruptcy proceedings, Gemini withdrew an aggregate gross amount of no less than $689,302,000 from Genesis.

This action allegedly “purportedly benefited” Gemini at the expense of other creditors and continues to provide an advantage by retaining the disputed property.

The complaint requests to utilize the remedies under the Bankruptcy Code to rectify the perceived unfairness and restore parity among Genesis’s creditors.

The lawsuit is brought under Sections 547, 550, and 502 of Title 11 of the United States Code, with Genesis seeking a judgment that avoids the preferential transfers, directs Gemini to relinquish the transferred property or compensate the company for its value, and disallows any claims by Gemini.

Genesis has conducted an ongoing investigation and, based on currently available information, has identified the transfers made during the 90-day preference period as avoidable under Section 547 of the Bankruptcy Code.

The company reserves the right to amend the complaint to include additional transfers or parties discovered during the adversary proceeding, ensuring a comprehensive pursuit of restitution.

Bankruptcy Battle Unveils Suspected Wrongdoing

The lawsuit casts light on potential improprieties concerning Gemini’s alleged receipt of preferential transfers, which Genesis believes were made to satisfy antecedent debts while the crypto lender was insolvent.

The bankruptcy filing estimates that general unsecured creditors will receive less than full value for their claims against Genesis’s estate, indicating the potential impact of the disputed transfers on the overall distribution.

Should the court rule in favor of Genesis, the avoidance and recovery of the transfers would help restore balance among creditors and address the alleged preferential treatment received by Gemini.

The outcome of the lawsuit could have far-reaching implications for the future of both firms and the broader landscape of the cryptocurrency industry.

As the legal proceedings unfold, the crypto community eagerly awaits further developments in this high-stakes clash between Genesis and Gemini, which could shape the regulatory framework surrounding preferential transfers in the crypto lending sector.

Featured image from Shutterstock, chart from TradingView.com