Quick Take

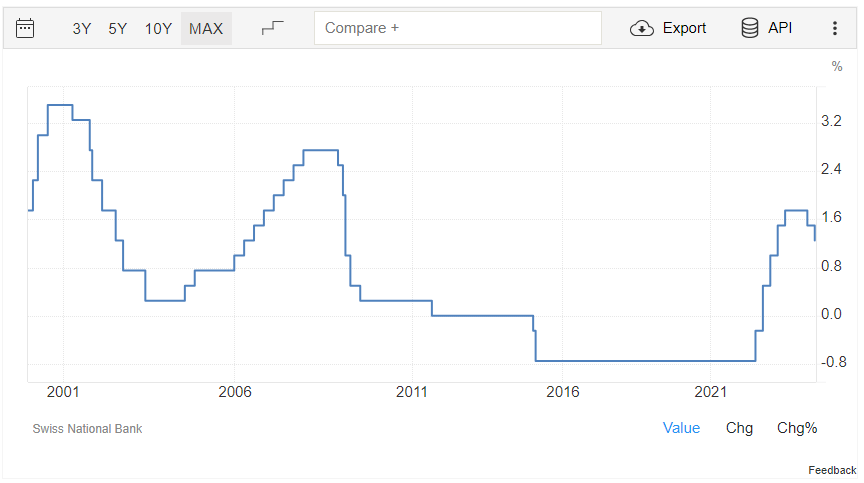

Data from Trading Economics shows that on June 20, the Swiss National Bank once again cut its benchmark interest rate by 25 basis points, bringing it down to 1.25%. This marks the second consecutive rate cut by the Swiss Central Bank, mirroring similar moves in the Euro Area and Canada. The Euro Area also recently cut its interest rates by 25 basis points, reducing them from 4.5% to 4.25%, while Canada has lowered its rates from 5% to 4.75%.

In contrast, Japan has taken a different approach. Back in March, Japan raised its interest rates for the first time since 2008 to tackle inflation and a weakening currency. The Bank of England maintained its current rates at 5.25% on June 20, despite headline CPI inflation dropping to 2.0%, meeting the central bank’s target, while core inflation remains at a challenging 3.5%, according to Trading Economics data.

Meanwhile, the US Federal Reserve maintains its federal funds rate at 5.25-5.5%, with no signs of a cut expected until at least Q3 2024. This diverse range of monetary policies highlights a significant departure from the usual synchrony among central banks, which often follow the Federal Reserve’s lead. Each nation is now addressing its unique economic challenges, including rising unemployment, in this new era of independent monetary policy decisions.

| Country | Last | Previous | Reference |

|---|---|---|---|

| Japan | 0.1 | 0.1 | Jun/24 |

| Switzerland | 1.25 | 1.5 | Jun/24 |

| Singapore | 3.42 | 3.53 | Apr/24 |

| China | 3.45 | 3.45 | Jun/24 |

| South Korea | 3.5 | 3.5 | May/24 |

| Euro Area | 4.25 | 4.5 | Jun/24 |

| Australia | 4.35 | 4.35 | Jun/24 |

| Canada | 4.75 | 5 | Jun/24 |

| United Kingdom | 5.25 | 5.25 | May/24 |

| United States | 5.5 | 5.5 | Jun/24 |

| Saudi Arabia | 6 | 6 | Apr/24 |

| Indonesia | 6.25 | 6.25 | Jun/24 |

| India | 6.5 | 6.5 | Jun/24 |

| South Africa | 8.25 | 8.25 | May/24 |

| Brazil | 10.5 | 10.5 | Jun/24 |

| Mexico | 11 | 11 | May/24 |

| Russia | 16 | 16 | Jun/24 |

| Argentina | 40 | 50 | Jun/24 |

| Turkey | 50 | 50 | Jun/24 |

Source: Trading Economics

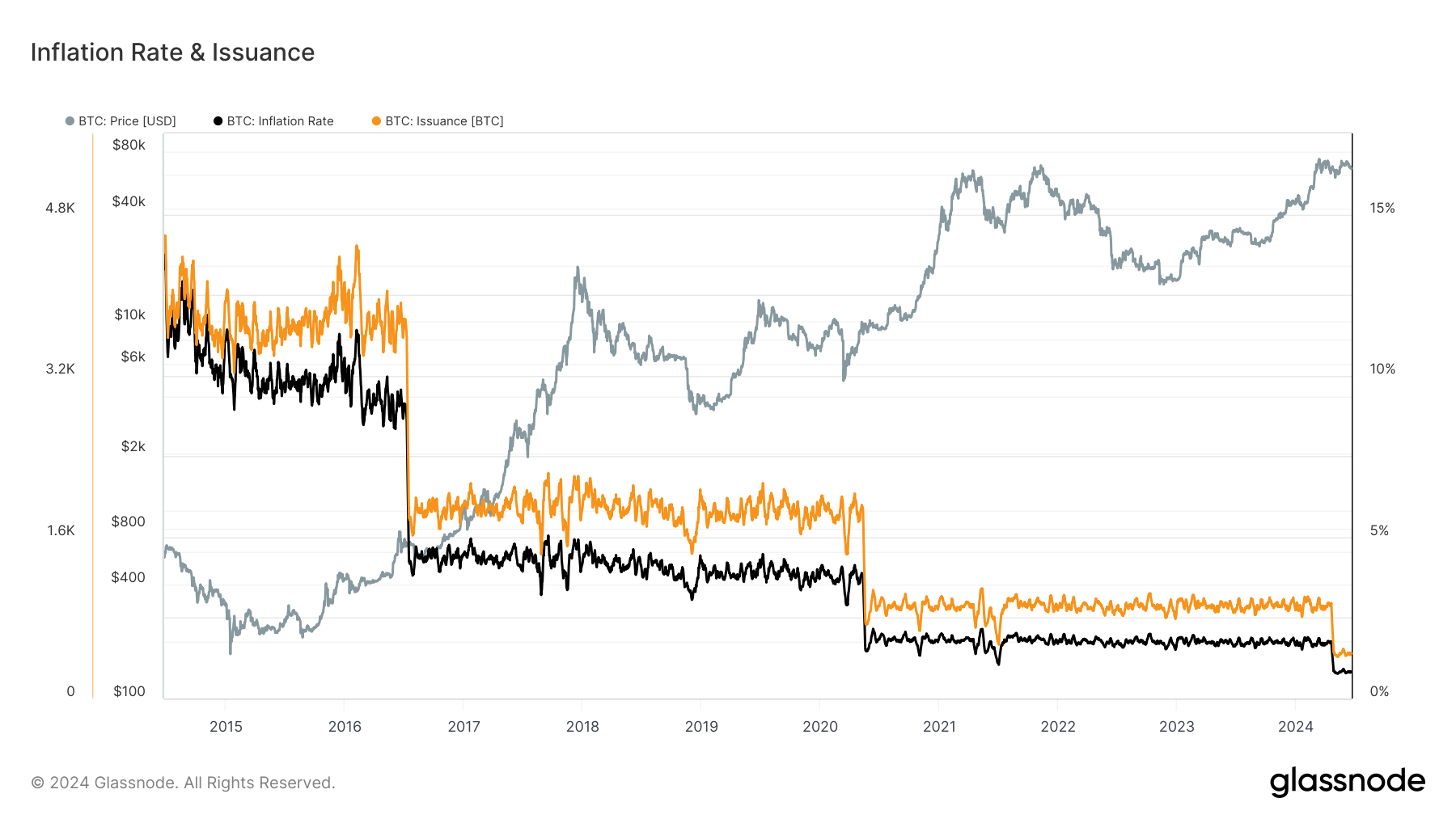

However, Bitcoin maintains a predictable monetary policy, with an inflation rate of approximately 0.8% and an issuance rate of around 450 BTC produced daily.

The post Global central banks break synchronization: Swiss National Bank cuts rates again appeared first on CryptoSlate.