![]()

While Bitcoin’s hashrate has been coasting along above 175 exahash per second (EH/s) and recently reached an all-time high, a global shortage of semiconductor chips could slow the growing industry. The shortfall of supply worldwide has disrupted major industries, and manufacturers like Taiwan Semiconductor Manufacturing Company Limited (TSMC) have seen stocks sink in value. At the same time, application-specific integrated circuit (ASIC) manufacturers are dependent on these chips.

Ongoing Semiconductor Shortage Creates Skyrocketing Demand, US Bureaucrats Want to Strengthen American Competitiveness

During the last 12 months, bitcoin mining operations have been securing million-dollar deals so they can pre-order thousands of ASIC bitcoin mining rigs. ASIC manufacturers such as Microbt, Bitmain, and Canaan have been selling batches of new models by the thousands to operators running data facilities.

Meanwhile, the semiconductors ASIC bitcoin mining rigs leverage are extremely hard to obtain as hundreds of industries worldwide are suffering from a global chip shortage. According to a U.S. Department of Commerce survey of 150 companies, the firms only had five days of supply left when usually they have 40 days of supply on hand.

“With sky-rocketing demand and full utilization of existing manufacturing facilities, it’s clear the only solution to solve this crisis in the long-term is to rebuild our domestic manufacturing capabilities,” Gina Raimondo, the U.S. secretary of commerce, said on Wednesday in a press release. The same day, reports showed that China plans to establish a Shenzhen sourcing strategy for semiconductors.

China’s issues with the U.S. and the semiconductor shortage have reportedly led to the America Competes Act of 2022. The controversial bill’s proponents, like the speaker of the United States House of Representatives, Nancy Pelosi, claim the bill could help ease supply chain woes and the semiconductor shortage by strengthening American competitiveness.

The Biden administration agrees and the U.S. president said the proposals will “help bring manufacturing jobs back to the United States, and they’re squarely focused on easing the sort of supply chain bottlenecks like semiconductors that have led to higher prices for the middle class.”

Recently Revealed Next-Generation ASICs and Sold Out Units

Meanwhile, the ASIC bitcoin mining rig manufacturer Bitmain announced the launch of two new bitcoin mining machines in the last three months. In mid-November, Bitmain revealed the Antminer S19 XP and on January 17, 2022, the company announced the launch of the Antminer S19 Pro+ Hyd.

Moreover, it was said that five companies had exclusive access to the S19 XP pre-orders and firms like Greenidge Generation Holdings and Bitnile were two participants. Neither of the Bitmain-manufactured machines are due to ship until May and July 2022.

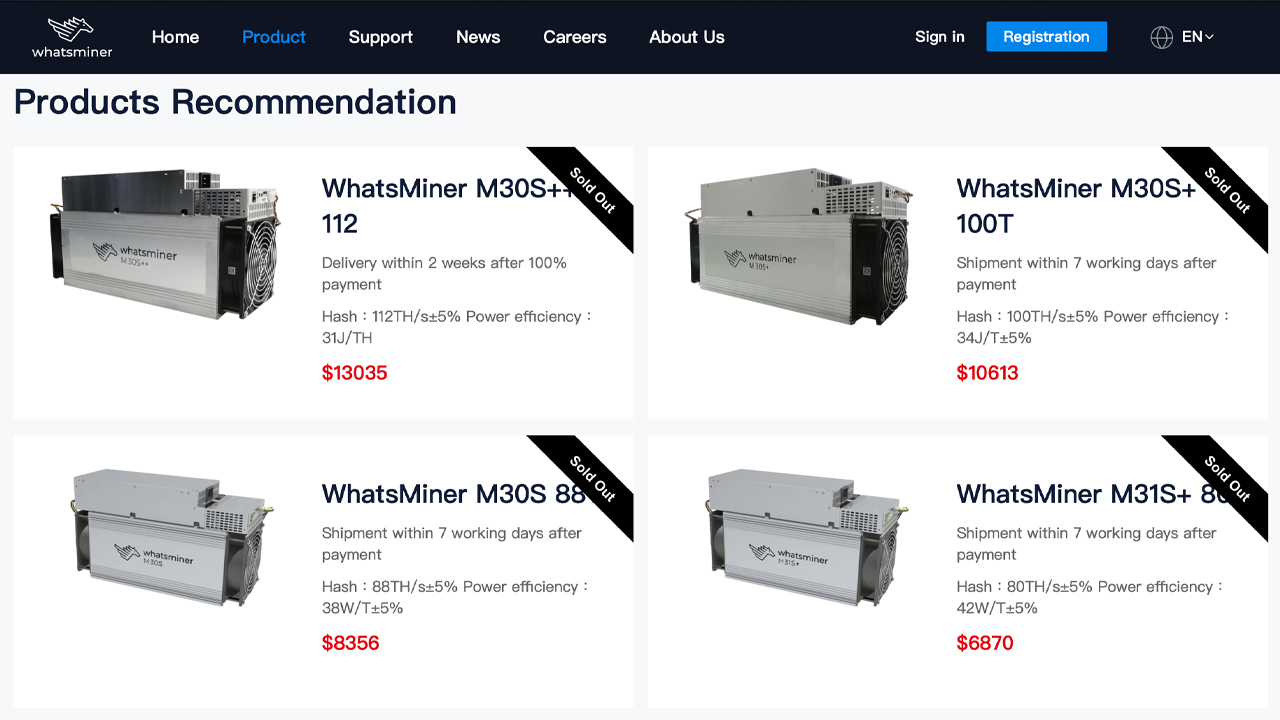

Two of the largest ASIC bitcoin mining rig suppliers, Bitmain and Microbt, are sold out of most of their latest models. At the time of writing, Bitmain has Antminer S19j Pro (104 TH/s) machines available for spot orders at $11,024 per machine with a maximum purchase limit of 50 units per user. The company promises units will ship in five working days after they are fully paid.

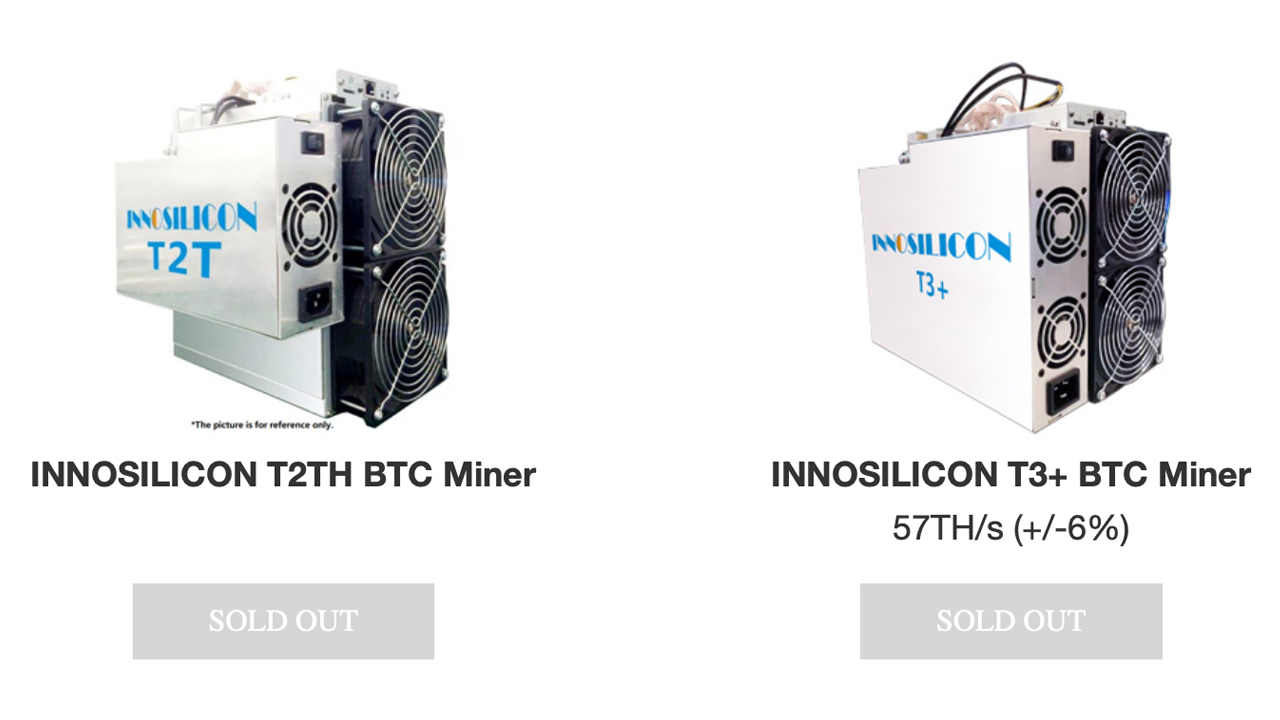

Canaan’s website details the customer must inquire with a representative in order to find out about available stock. The ASIC manufacturer Innosilicon’s supply is currently sold out, according to the website’s miner shopping section. This leads interested customers to deal with the ASIC bitcoin mining device secondary markets where mining rigs can be more expensive and the supply is not as good as it is with direct batches from the producers.

Currently, the semiconductor crunch has not affected miners a great deal and past scares and chip supply shortages have been happening since 2020. This week the shortage has caused semiconductor company shares to fall as a few manufacturers like TSMC, Qualcomm, and Micron saw stocks drop in value.

What do you think about the semiconductor chip shortage? Do you think it could affect the supply of ASIC bitcoin miners in the future? Let us know what you think about this subject in the comments section below.