Quick Take

- In the past two days, a lot of macro data has come out for the U.S., which shows significant signs of a slowing economy in the U.S.

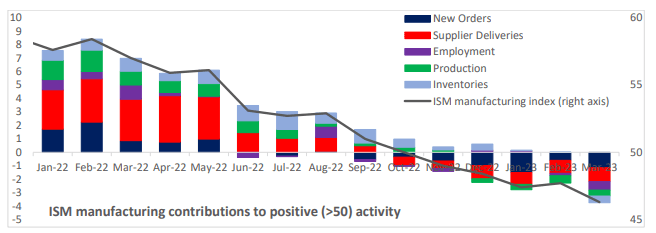

- Yesterday, the US manufacturing slump deepened as the manufacturing ISM index fell further into contraction, which fell below expectations and fell to its lowest level since May 2020.

- Today, JOLTS data printed 9.93 million vs. the 10.5 million expected. This was the smallest print since April 2021.

- Labor demand is falling; companies are posting fewer jobs and fewer plans for hiring people.

- The next shoe to drop should be unemployment which comes out on Friday.

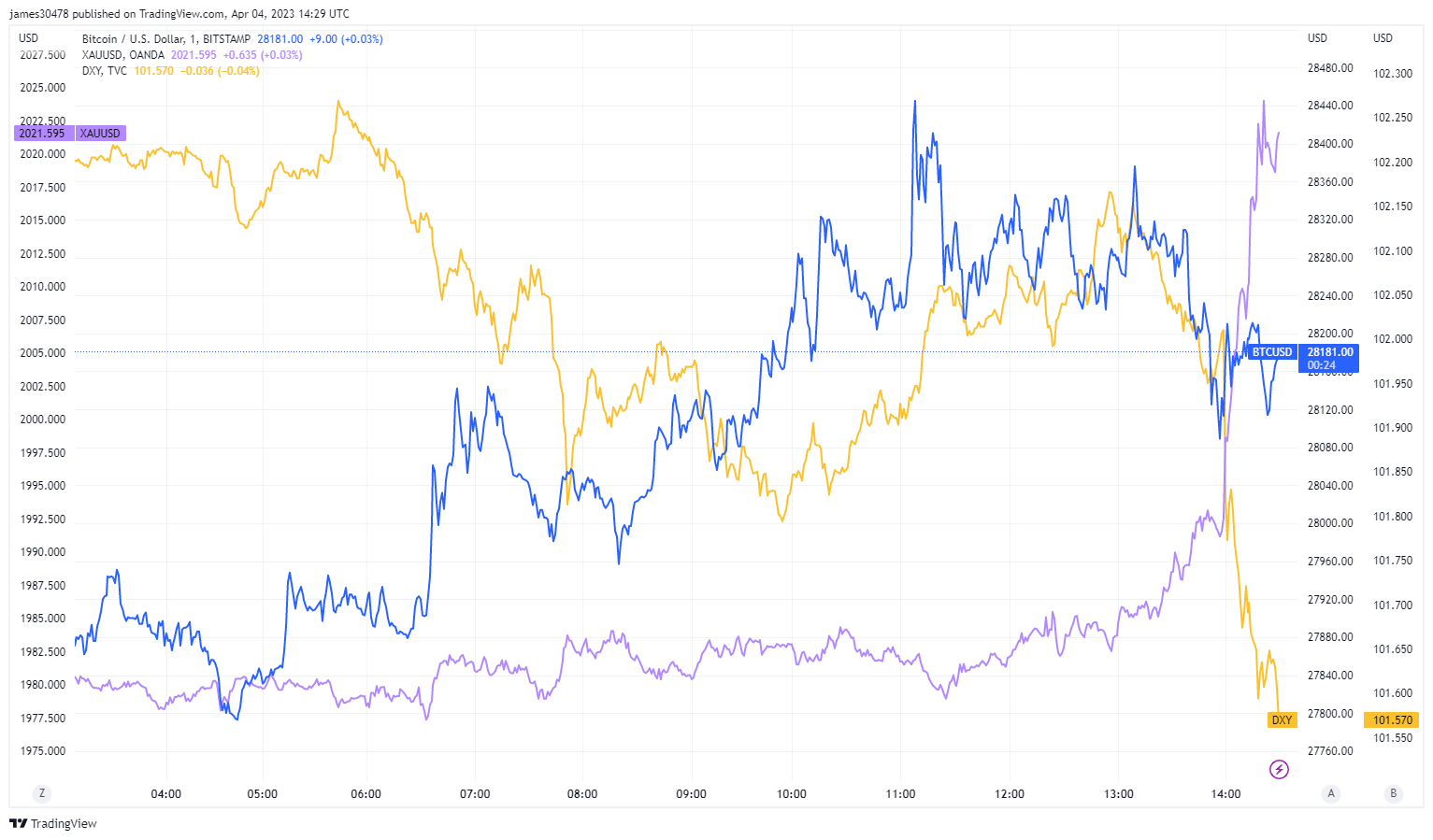

- As a result, the DXY index dropped to 101.6, and US yields dropped.

- While gold breaks out to $2,020

- Bitcoin remains above $28,000

The post Gold breaks out to new highs as US economy starts to slow down appeared first on CryptoSlate.