The latest data from Goldman Sachs shows that Bitcoin has cemented its position as the go-to store of value among many investors.

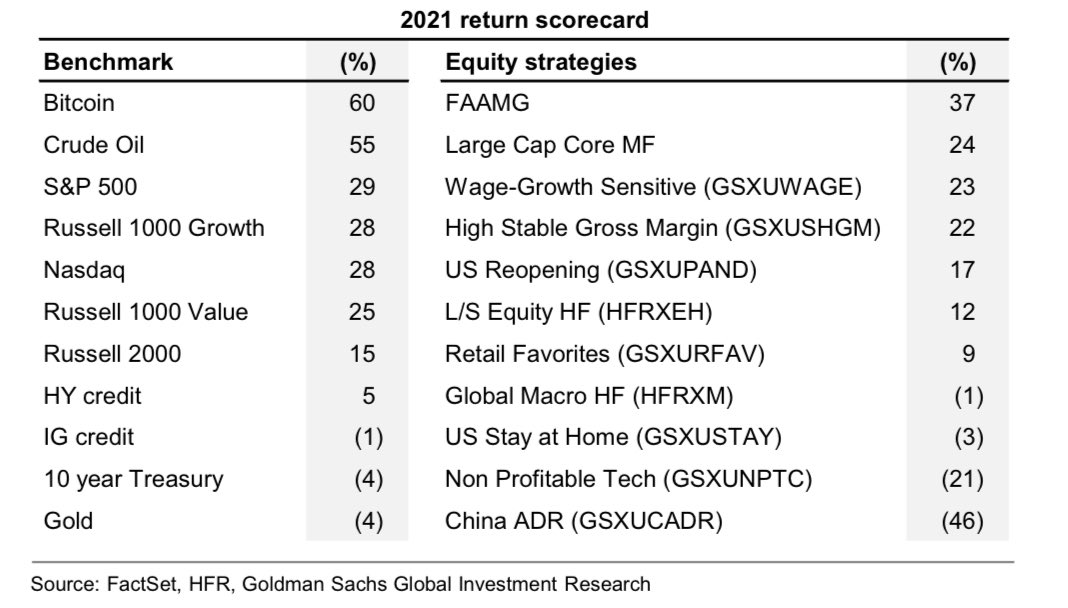

According to the bank’s 2021 return scorecard, Bitcoin’s returns last year outperformed all capital markets, including global indexes the S&P 500 and Nasdaq, and equities such as FAAMG. Gold, the traditional go-to store of value, posted returns of just 4% and is beginning to look less and less interesting to investors.

Gold is losing its dominance as a store of value as Bitcoin posted solid and stable returns in 2021

Last year’s market volatility yielded some unlikely winners in the crypto industry, with novel meme coins leading the way when it came to gains exceeding, in some cases, several thousand percent. In the world of Flokis and Shibas, Bitcoin’s modest returns of just around 60% had almost removed it from the minds of most crypto investors.

However, zooming out and changing perspectives shows that Bitcoin is becoming increasingly popular among traditional investors, many of whom now see it as a go-to store of value asset that has been outperforming all capital markets.

According to the Goldman Sachs 2021 return scorecard, Bitcoin posted returns exceeding 60% last year. This has put Bitcoin on top of all capital markets, including both benchmark and thematic equity baskets. Global indexes such as NAsdw, the Russell 1000, and S&P 500 all showed returns of less than 30%.

Even high-value equity baskets such as FAAMG fell way beyond Bitcoin, with returns of just 37% in 2021.

The biggest loser on the Goldman Sachs scorecard, however, was gold. With a 4% return on investment, it ranked at the very bottom right next to 10-year Treasury bonds. This is in line with the general market sentiment toward gold, where more and more investors have been abandoning the asset class as their go-to store of value.

The demand for gold as store of value is inter-subjective

I don't know any wealthy ppl in my generation who own any gold

Have no gold objects in my homes, no gold on my items, no jewelry

GLD ETF has been in nonstop redemption mode since Covid money-printing started https://t.co/LwHBAdIyyS

— Zhu Su

(@zhusu) January 3, 2022

The post Goldman Sachs shows Bitcoin outperformed all capital markets in 2021 appeared first on CryptoSlate.