Quick Take

According to James Butterfill, analyst at CoinShares, net outflows have reached a staggering $424 million this week as investors increasingly opt for the more cost-efficient US funds. Since the launch of spot-based ETFs, Grayscale Bitcoin Trust (GBTC) has witnessed a significant trend reversal, with outflows totaling $1.18 billion. In contrast, the newly introduced US spot bitcoin ETFs have attracted a considerable influx of capital, with inflows reaching $2 billion, according to Butterfill.

A similar pattern is reflected in ProShares BITO’s financial data, with the fund recording $141 million in outflows during the same period, according to Butterfill.

ETF analyst James Seyffart echoes this sentiment, predicting Jan. 16 as a net outflow day for Bitcoin ETFs due to the impact of GBTC and BITO. Seyffart estimates about $594 million will exit GBTC to $1.173 billion in total outflows. At the same time, most other funds have seen inflows.

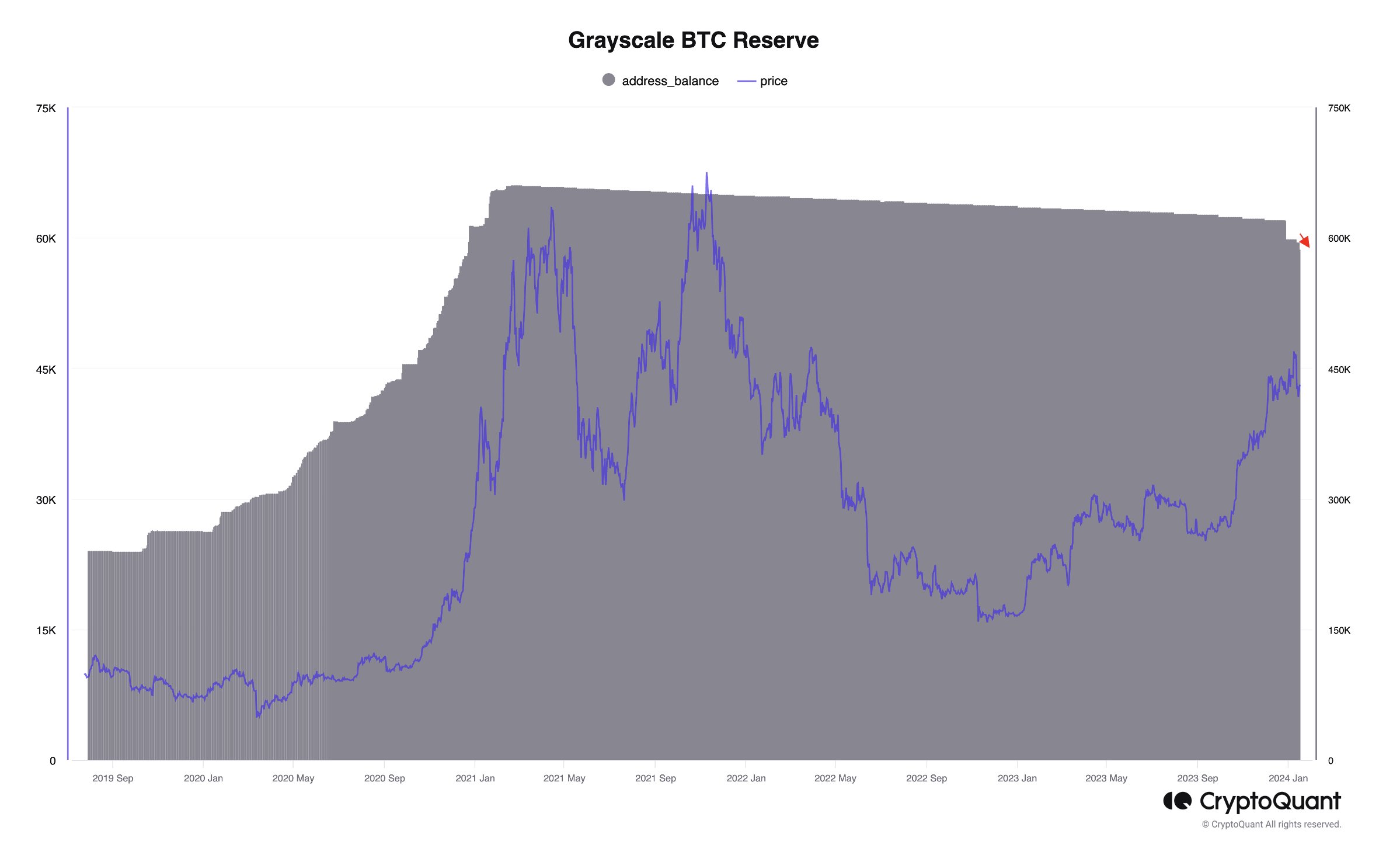

According to various sources, Grayscale now holds around 600,000 BTC in the reserve, with estimates ranging between 587,000 and 617,000 BTC.

The post Grayscale Bitcoin Trust sees $1.18 billion exodus amid spot ETF popularity appeared first on CryptoSlate.