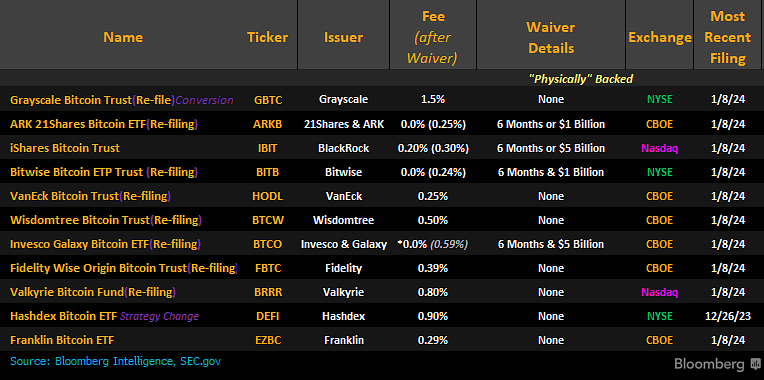

Prominent digital asset manager Grayscale will slash its management fees to 1.5% from 2% for its proposed spot Bitcoin exchange-traded fund (ETF), according to an updated S3 filing submitted to the U.S. Securities and Exchange Commission on Jan. 8. The asset manager said the fees are payable in the top cryptocurrency.

The filing further revealed that the asset manager added Jane Street, Virtu Americas, Macquarie Capital, and ABN AMRO Clearing as authorized participants (APs) for its proposed ETF. It also named Jane Street, Virtu Flow Traders, and Flowdesk liquidity providers for the ETF.

High fees

Despite Grayscale’s fee cut, the firm’s rate remains notably higher than the proposed fees by ETF issuers like BlackRock and others, who have mostly charged under 1%.

Ark and 21 Shares reduced its fees to 0.25% from 0.8% earlier today while waiving its fees for the first six months or $1 billion. Another asset manager, VanEck, also plans to charge 0.25%.

In contrast, BlackRock has outlined a fee structure starting at 0.2% for the initial 12 months and $5 billion of its ETF, which will increase to 0.3% later. Bitwise opted for a 0% charge during the first six months, followed by a 0.24% fee thereafter.

Others, like Wisdomtree, Invesco Galaxy, Fidelity, Valkyrie, Hashdex, and Franklin Templeton, charge between 0.39% and 0.9%, respectively.

Grayscale stands out among ETF applicants by strategically targeting the transformation of its Bitcoin Trust into a spot ETF. This unique approach positions Grayscale favorably against competitors due to its substantial existing holdings of BTC. The firm holds nearly 620,000 units of BTC, worth almost $27 billion.

Ryan Selkis, Messari founder and CEO, further explained why the firm might be maintaining a high fee, pointing out that:

“The new ETF issuers are racing to the bottom on fees where every BILLION dollars in AUM leads to $3-5 MILLION in annual revenue. Grayscale’s head start means starting ARR [annual recurring revenue] of $420 million.”

Eric Balchunas, Bloomberg’s ETF analyst, also noted that reducing Grayscale’s fees might kill their margins.

The post Grayscale to slash fees to 1.5% after spot Bitcoin ETF conversion, still highest among rivals appeared first on CryptoSlate.