Grayscale Investments‘ flagship product, Grayscale Bitcoin Trust (GBTC), serves as a crucial bridge between the traditional financial world and the relatively new realm of cryptocurrencies. GBTC offers investors exposure to Bitcoin without the need for direct ownership, effectively bypassing challenges like storage, security, and regulatory concerns. By purchasing shares of GBTC, investors can gain exposure to Bitcoin’s price movements through a vehicle that trades on traditional markets.

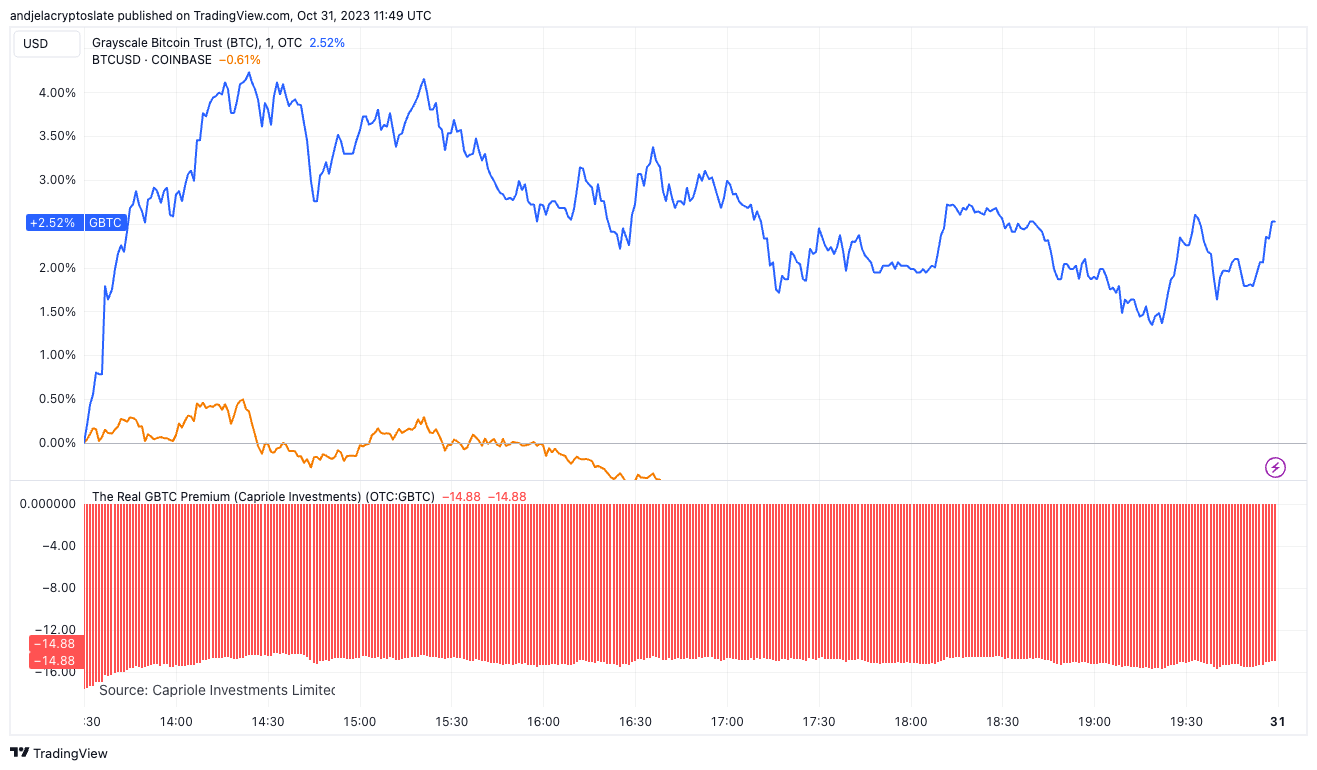

A striking observation from recent data is the divergence between GBTC’s daily performance and that of Bitcoin (BTC). On Oct. 30, while GBTC increased by 2.52%, Bitcoin saw a decline of 0.61%. Such a divergence raises questions about market dynamics and investor sentiment. Does this mean the traditional market’s appetite for Bitcoin exposure, as seen through GBTC, is stronger than the direct cryptocurrency market?

The data seems to suggest so, especially when we expand our lens to longer timeframes.

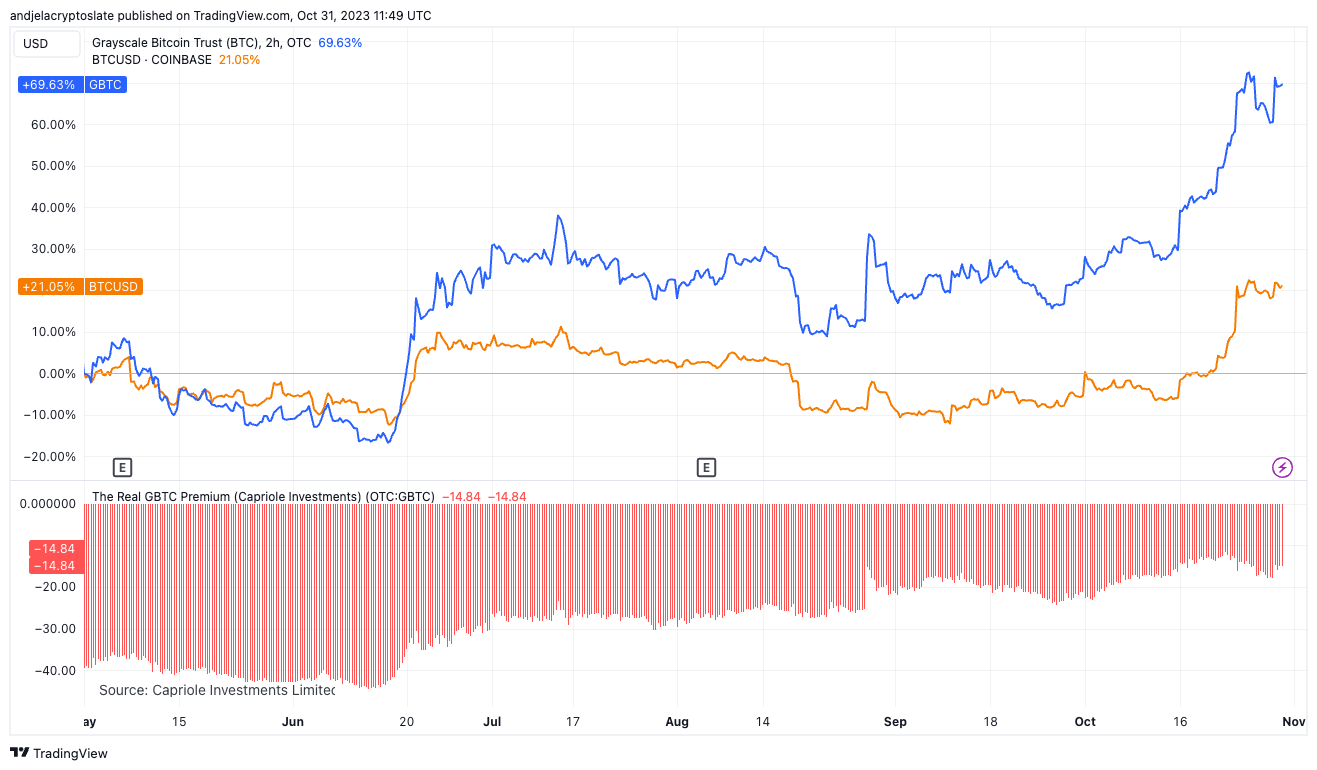

Over the past month, GBTC rose by 31.7% compared to Bitcoin’s 20.6%. The trend continues over three and six months, with GBTC growing by 39.1% and 69.6%, respectively, significantly outpacing BTC’s growth of 17.3% and 21.1%. Year-to-date, it grew a whopping 222.9%, doubling Bitcoin’s commendable rise of 106.9%.

| 1D | 1M | 3M | 6M | YTD | |

|---|---|---|---|---|---|

| GBTC | +2.52% | +31.7% | +39.1% | +69.6% | +222.9% |

| BTC | -0.61% | +20.6% | +17.3% | +21.1% | +106.9% |

| GBTC Premium | -14.88 | -14.87 | -14.86 | -14.84 | -14.98 |

However, while these numbers paint a rosy picture of GBTC’s performance, the persistent negative premium offers a more nuanced narrative. Despite its stronger returns, it consistently trades at a discount to the actual value of the Bitcoin it holds. This discount, hovering around -14.88 to -14.98 across the board, indicates that the market values the actual Bitcoin more than the GBTC shares representing it. Such a stable negative premium, even in the face of GBTC’s outperformance, could be a manifestation of various concerns. Investors might be wary of the asset due to its fee structure, potential liquidity issues, or the inability to redeem shares for actual Bitcoin. The consistency of this discount also suggests that the market sentiment regarding these concerns has remained unchanged.

The broader implications of this stable discount are manifold. It might indicate a latent demand for a more direct exposure mechanism to Bitcoin, which a U.S. Bitcoin ETF could satiate. The introduction of such an ETF would allow institutional investors to gain exposure to Bitcoin in a manner more aligned with the actual cryptocurrency, potentially offering more liquidity and the ability to redeem shares for actual Bitcoin. A Bitcoin ETF would also likely have a more competitive fee structure. With the growing interest in Grayscale’s Bitcoin Trust, the launch of a Bitcoin ETF in the U.S. could see a massive influx of institutional money into the crypto space, further legitimizing the asset class and potentially leading to price appreciation.

While GBTC has consistently demonstrated strong performance, outpacing Bitcoin over various timeframes, the persistent discount to the underlying asset cannot be ignored. It serves as a bellwether of market sentiment, indicating possible concerns or a desire for more direct exposure mechanisms.

The post Grayscale’s GBTC paradox: Performance at a discount appeared first on CryptoSlate.