Inflows into the Newborn Nine ETFs fell by more than 50% during the past week to $126 million from $254 million, according to CoinShares weekly report.

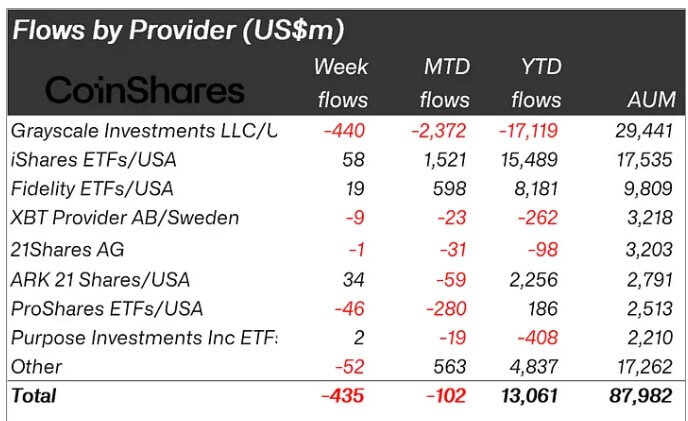

Per the report, these reduced inflows contributed to the third consecutive week’s outflow of $435 million—the largest outflow since March—that major crypto-related investment products recorded during the week.

Grayscale lead despite ‘decelerating outflows’

A breakdown of the flows showed that Grayscale’s GBTC remains responsible for most outflows, with $440 million exiting the product last week.

However, this marks GBTC’s lowest weekly outflow in nine weeks and a sign that outflows were decelerating. Nonetheless, the total outflows from GBTC on the year-to-date metric have surpassed $17 billion.

James Butterfill, CoinShares head of research, added:

“While Grayscale’s outflows continue to decelerate, we have also seen a deceleration in inflows from new issuers, which saw only $126 million in inflows last week, compared to $254 million the week prior.”

The weakening inflows also resulted in a decline in trading volume, which fell to $11.8 billion from $18 billion.

Last week, major ETF issuers like BlackRock and Fidelity recorded several days of zero flows. Market observers interpreted this trend as indicative of a waning investors’ interest in the asset class.

Altcoins draw interest

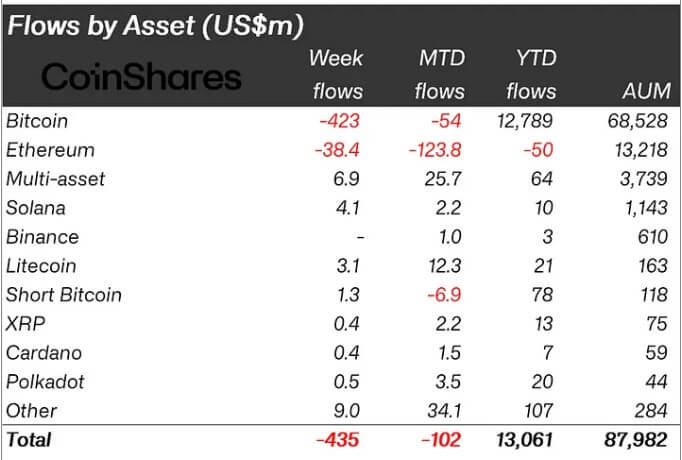

Investment products related to digital assets like Solana, XRP, Cardano, Polkadot, and Chainlink saw inflows last week. The CoinShares report pegged the cumulative inflows into these assets at more than $25 million.

On the other hand, Ethereum continued its outflow trend, experiencing an additional $38.4 million in outflows, bringing the total for the month to $123.8 million. The year-to-date flow is a negative $50 million.

Remarkably, the prevailing bearish sentiments in the market have attracted the bears who added $1.3 million to short Bitcoin investment products.

The post Grayscale’s outflows slow as investor interest in altcoins like Solana, Polkadot rises appeared first on CryptoSlate.