Crowdfunding platforms like Kickstarter and GoFundMe are no strangers to controversy, finding themselves caught between different sides of the political divide, their users, and even governments when contentious issues reach their sites.

Like social media platforms, they can lean on their ToS (Terms of Service) to revoke service when activities pose a risk to their business—even in the middle of fundraising.

No wonder crowdfunding has become the latest model disrupted by blockchain.

Juicebox is a crowdfunding platform where the rules for donations, refunds and disbursement are codified on-chain. What will decentralization mean for crowdfunding, and why is Juicebox trending among DAO projects?

A Closer Look at Juicebox

Launched last July, Juicebox is a programmatic treasury management protocol for Ethereum-based projects.

Unlike Kickstarter or GoFundMe, the deployment of funds is governed by code-based rules, rather than the discretion of the platform’s staff.

It is the first Web3 project built by @me_jango who met the earliest Juicebox team members on Discord. Juicebox has yet to be audited or funded by any VC.

Besides transforming the traditional crowdfunding model, Juicebox also aims to simplify the process of building a treasury and issuing tokens to the community of a decentralized project, currently a complicated process. In other words, it makes it easy to start a DAO.

How Does Juicebox Work?

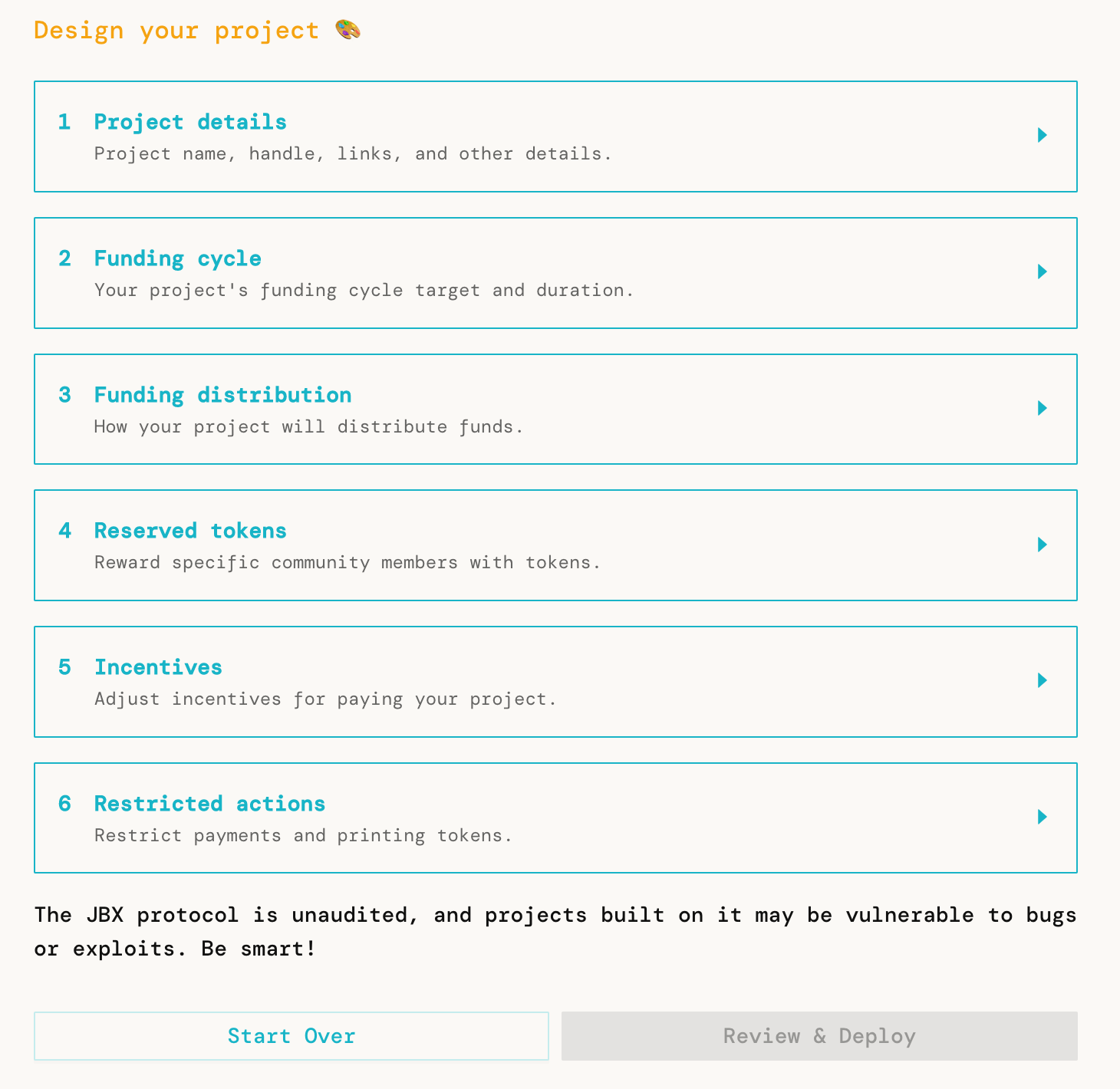

Anyone can use Juicebox to configure and deploy a smart contract for fund management and token distribution for any project.

- Project Details: Display the project name, description, website, and official media (e.g., Twitter, Discord)

- Funding Cycle: Manage funds by setting a funding target and duration.

- Distribution: Commit portions of every withdrawal to other Ethereum wallets or Juicebox projects to pay contributors, charities, other projects or anyone else.

- Reserved Token: Set the rewarded tokens to the community when they contribute, as well as the reserved percentage.

- Incentives & Restricted Actions: Set additional configuration such as the discount rates and other restrictions.

As an individual investor who wants to support a project, you can donate your ETH and get the project token at an exchange rate. For example, you can get 1 million of JUSTICE by donating 1 ETH for the AssengeDAO.

Currently, there are 372 projects powered by Juicebox, which together have raised 44,195 ETH in total. The top project is AssangeDAO (17,422 ETH), followed by ConstitutionDAO (11,613 ETH). Together, they account for 66% of all funds raised.

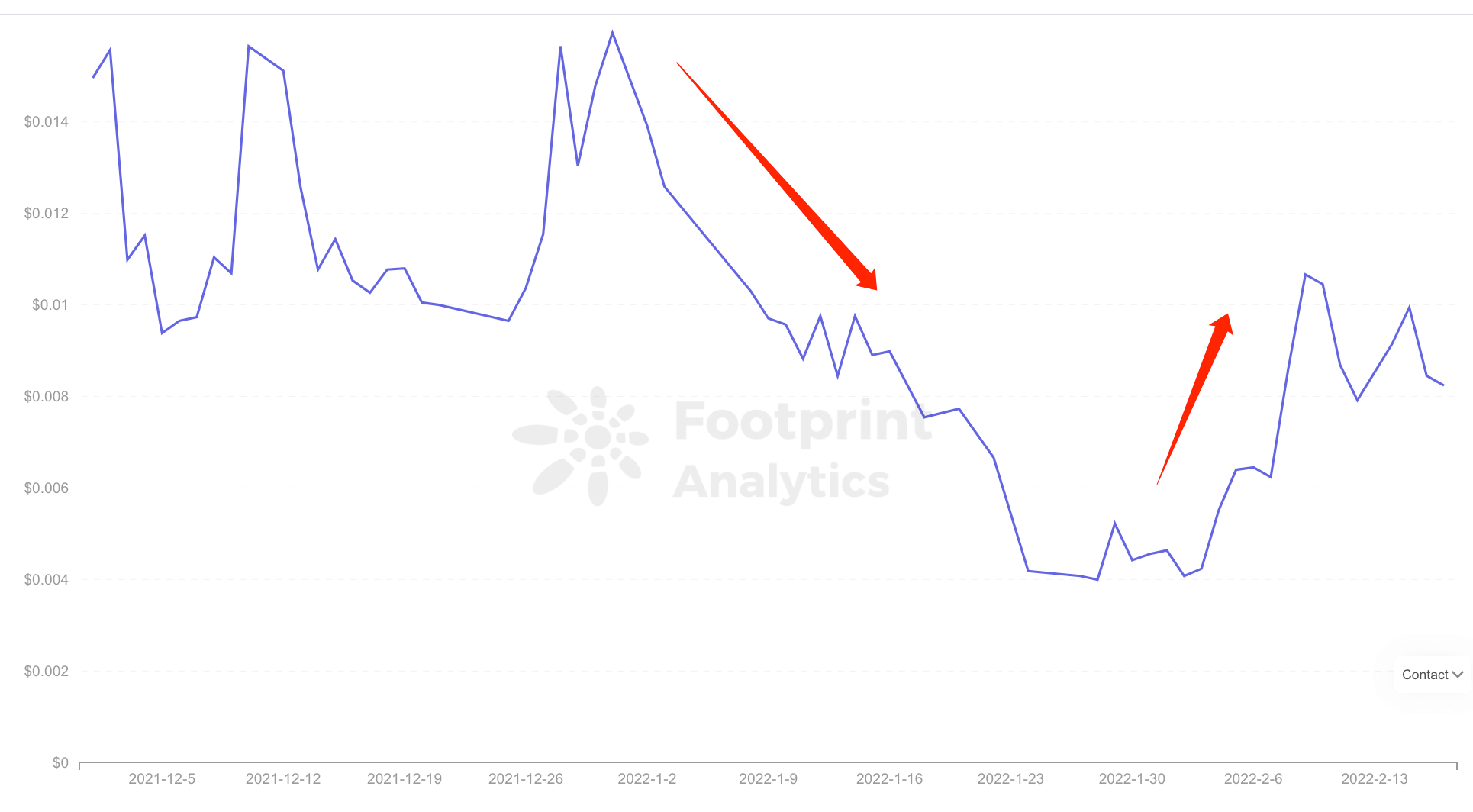

Juicebox charges a 5% fee from all funds in exchange for $JBX, the governance token of Juicebox. From the price trend of $JBX shown in Footprint Analytics, it fluctuates with the popularity status of the above projects.

Why is Juicebox Trending Among DAOs?

Although Juicebox has not been funded by any VCs, it has already raised 6,721 ETH (approx. $18M) funded by its own community in JuiceboxDAO through 15 funding cycles (14 days each). Such funding size is as large as a Series A or even Series B round on average in the crypto industry.

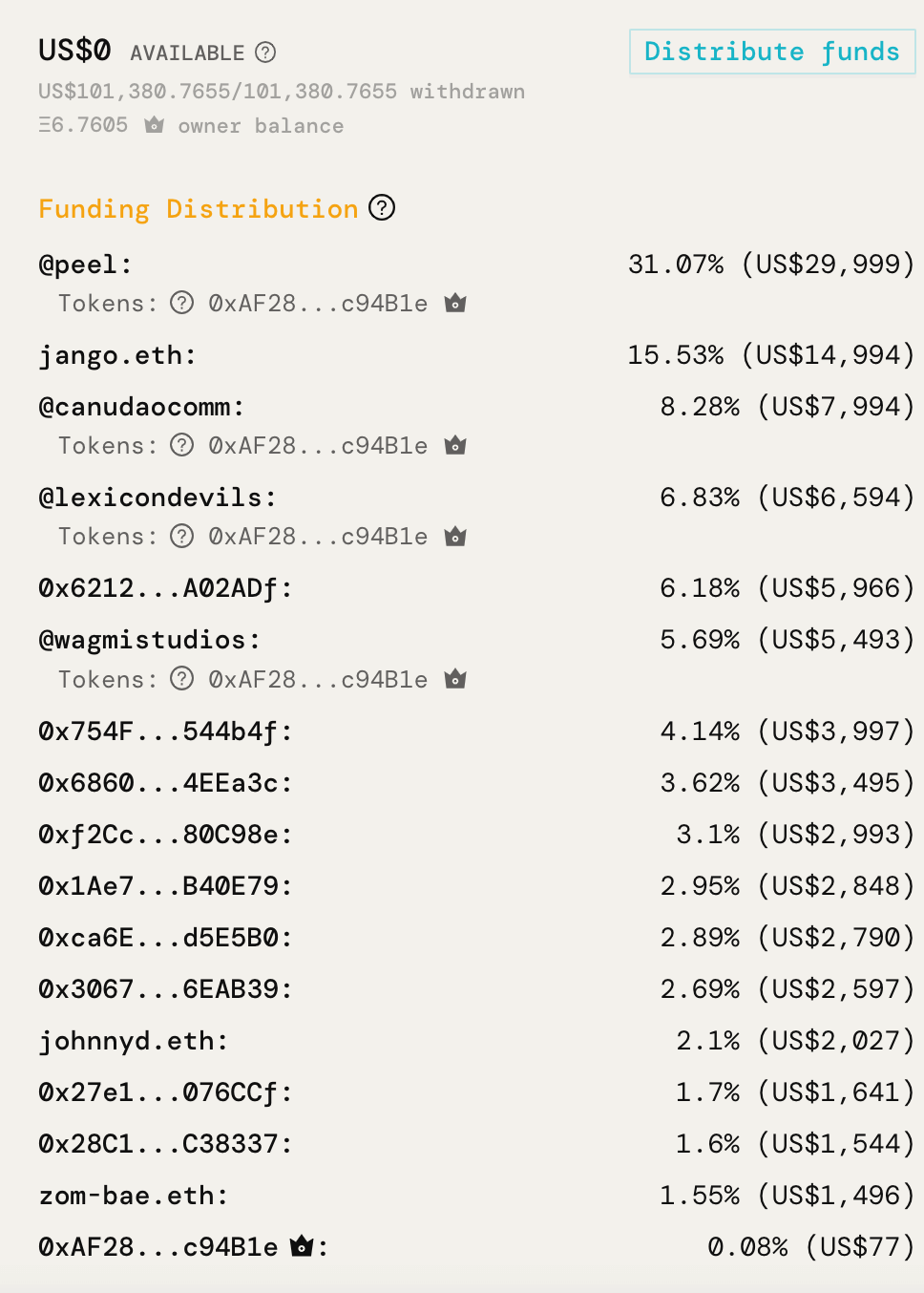

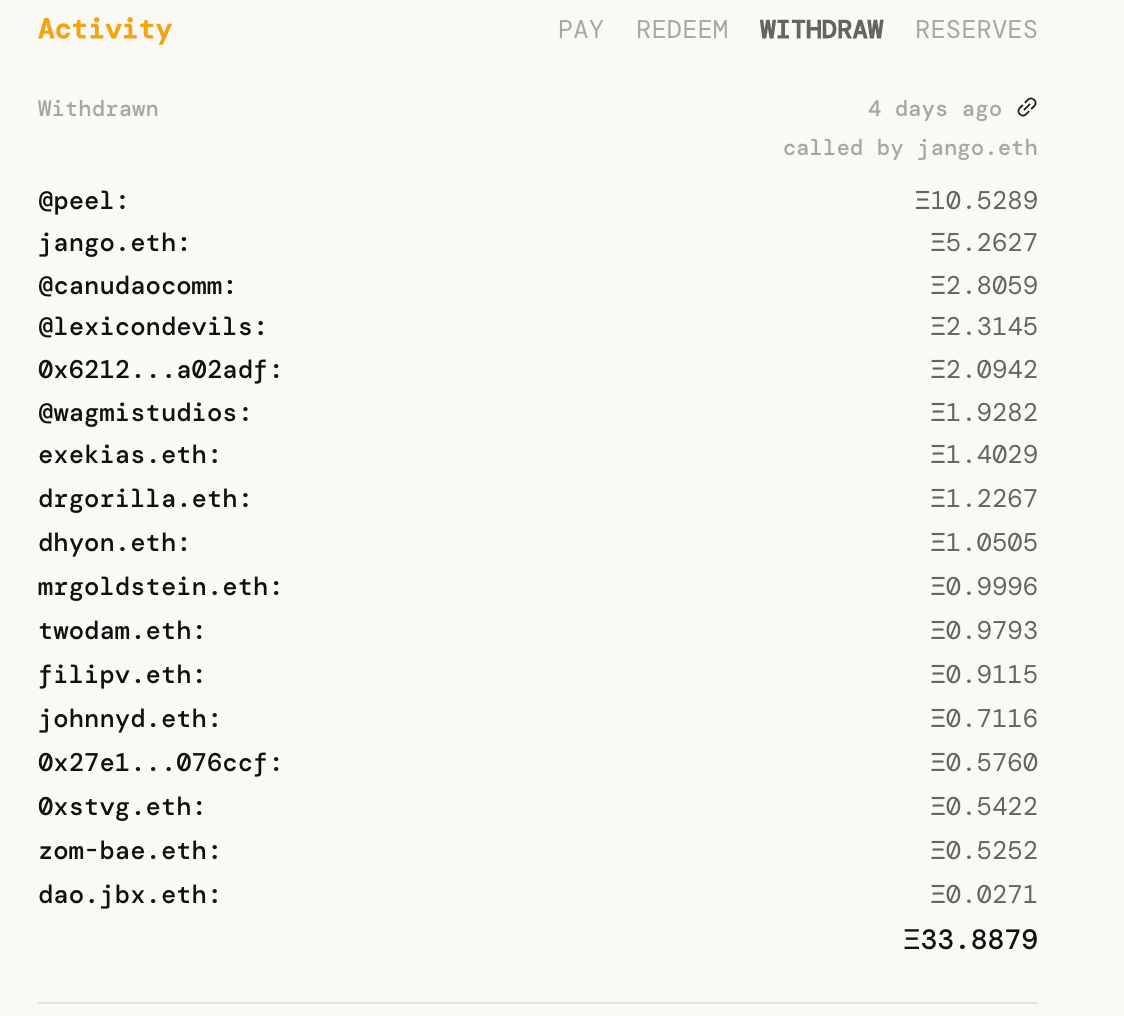

Its project page shows the funding distribution and the current holdings of each receiving address. This transparency sets it apart from most crypto projects, which usually show this in one section of their whitepaper.

So it is the transparency of each donation, redemption, withdrawal and of the reserves.

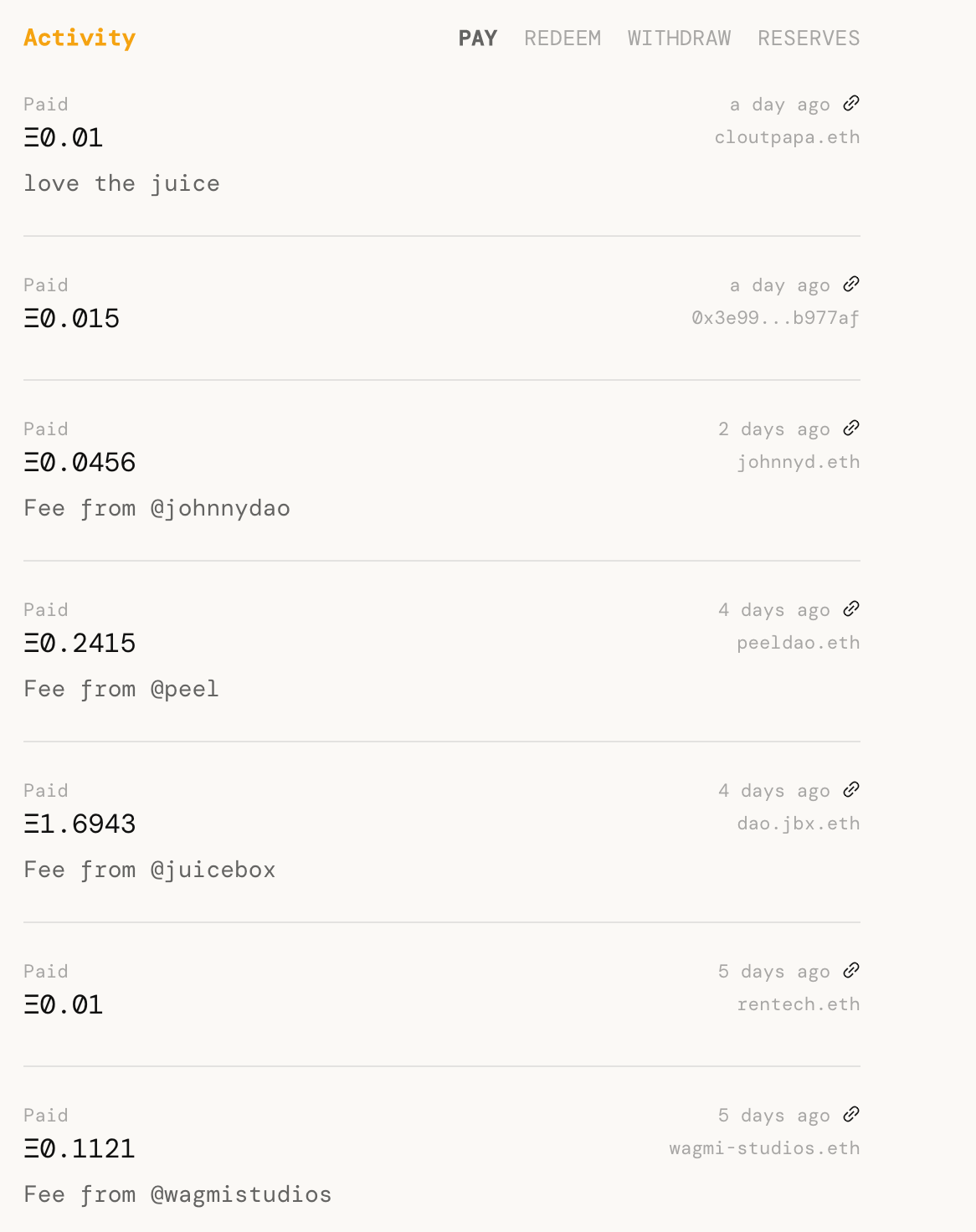

JuiceboxDAO Activities include Pay, Redeem, Withdraw and Reserves

Juicebox makes it crystal clear where funds are coming from and going to, and leaves it in the community’s hands to assess a project’s value and risk.

This meets the requirements of DAO. It also represents the spirit of Web3, from the community to the community: decentralized, token-based economics.

Thoughts on Decentralized Crowdfunding

With blockchain technology, community power has evolved from ICOs to IDOs to pools within those DEXs, e.g. Curve CIPs (Curve Improvement Proposals) and factory permissionless pools.

Throughout the blockchain industry, anybody can propose a project, which has led to many interesting advanced, but also many scams.

On Juicebox, everyone can start their own DAO and it shows.

There’s a MoonDAO whose mission is to send people to the moon. A Crypto Island DAO proposes to co-own an island in the Bahamas. Clearly, not every DAO is reasonable.

With AssangeDAO, a heated controversy arose among the community because of the dramatic price drop of its token, $JUSTICE. Some have asked if it’s a call for justice or a scam? Many donors have become suspicious of the project and its founding team.

Juicebox is a great example of Web3, where anybody can raise funds directly from the community. However, not every individual investor has enough of an understanding to assess the risks and benefits of these unvetted permissionless projects or DAOs.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

The post Has decentralized crowdfunding for DAOs finally arrived with Juicebox? appeared first on CryptoSlate.