Quick Take

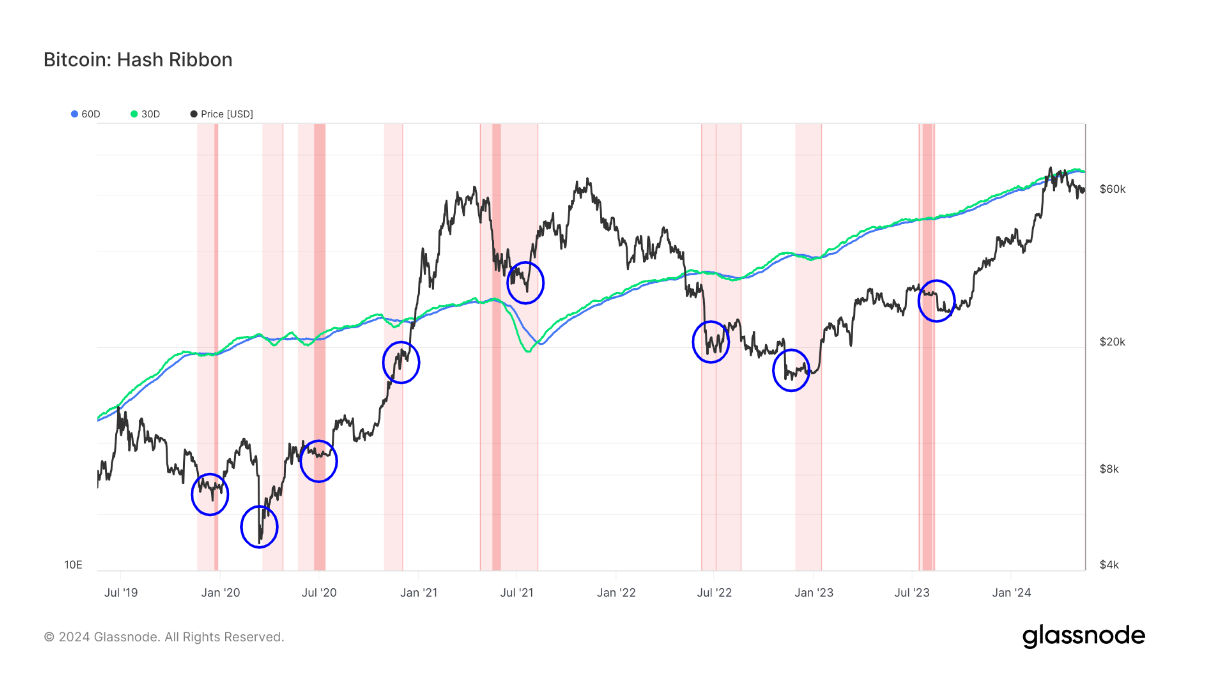

The Hash Ribbon metric by Glassnode, which has marked most of the bottoms in Bitcoin in the past five years, is finally signaling miner capitulation. This technical indicator assumes Bitcoin tends to bottom when miners are forced to capitulate due to mining becoming too costly relative to revenues.

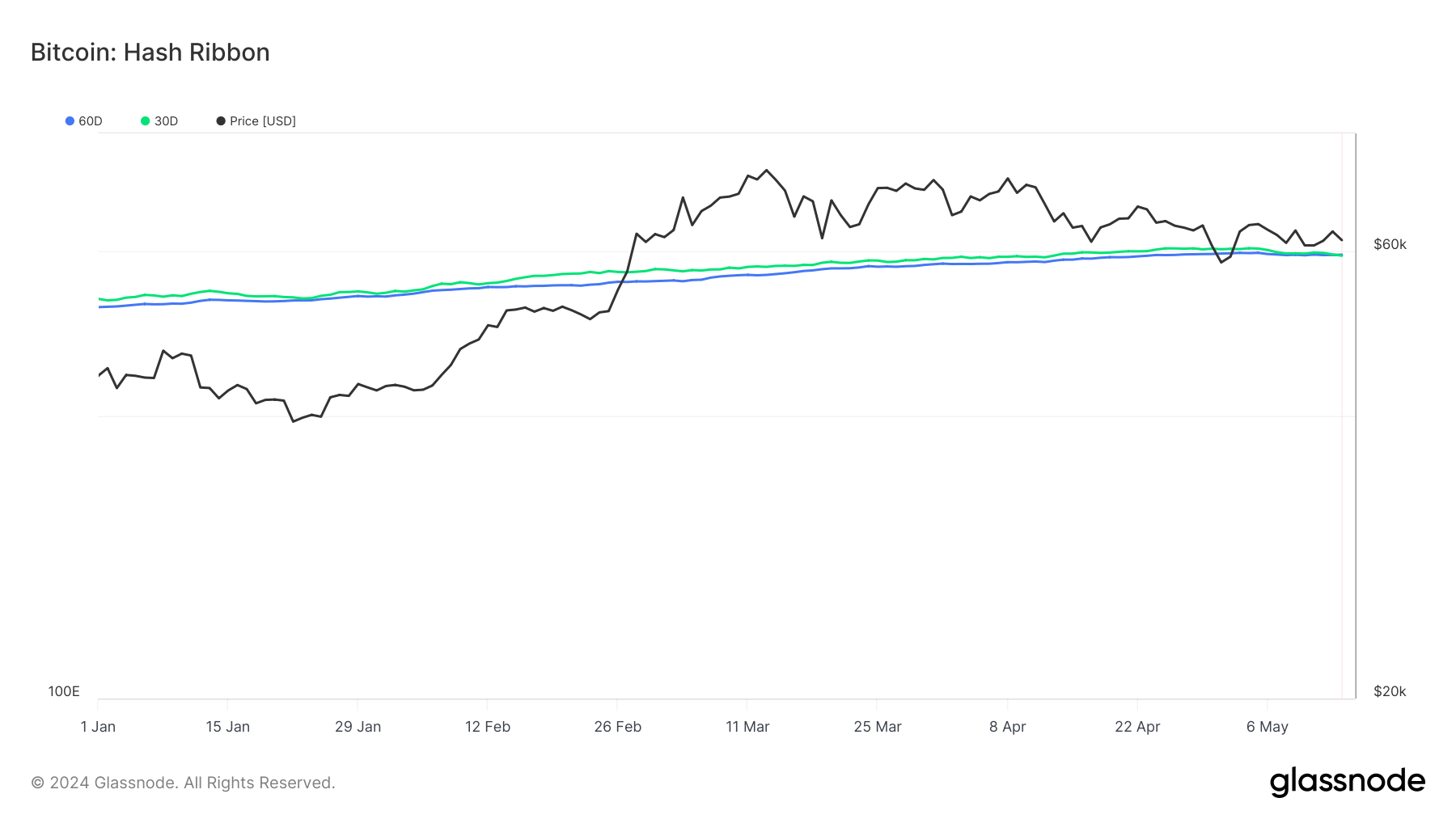

The Hash Ribbon compares the 30-day and 60-day moving averages of the Bitcoin hash rate. When the 30-day MA crosses below the 60-day MA, it marks the start of miner capitulation (indicated by red regions on the chart). Historically, when this trend reverses, and the 30-day MA crosses back above the 60-day MA, marking the end of capitulation, it tends to correspond with price bottoms and the start of new bull runs.

In the current cycle, we see the long-awaited miner capitulation after the recent Bitcoin halving. As anticipated, the hash rate has declined substantially as less profitable miners shut off their rigs. As a result, we saw the most significant drop in difficulty since the FTX collapse.

While capitulation can last around a month on average or two difficulty adjustments, historical patterns suggest the Bitcoin bottom could already be around the $56,500 level. The Luxor Q1 report forecasts a resurgence in the Bitcoin hash rate over the upcoming five months.

The post Hash Ribbon metric signals miner capitulation, possibly marking Bitcoin’s price bottom at roughly $56,500 appeared first on CryptoSlate.