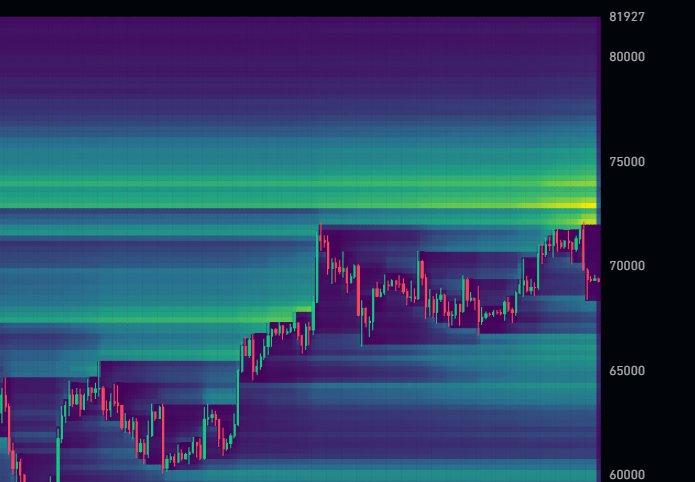

Looking at the formation in the daily chart, there is no relief for Bitcoin at spot rates. Following the flash crash on June 6, prices reversed sharply from the $72,000 level, further highlighting the significance of the liquidation level.

In the past, Bitcoin prices have recoiled from this level, with analysts expecting a short squeeze to print once this line is breached.

Hedge Funds Are Short Selling Bitcoin Futures: Will This Strategy Backfire?

Amid this slip, one analyst on X notes that hedge funds and Wall Street firms have increasingly taken short positions on Bitcoin futures contracts, expecting BTC prices to plunge.

Though they could be net long on the spot market, taking advantage of the fee differential, the trader notes that this strategy is risky. If anything, massive losses could occur should prices unexpectedly spike.

Between the current price point and slightly above all-time highs at $74,000, exchange data and trader notes show $12 billion worth of short positions on BTC futures.

This move means that hedge funds are net bearish, and since everyone knows the big boys of Wall Street are shorting, this move could backfire spectacularly.

Even so, hedge funds selling BTC futures are nothing new. Often, hedge funds tend to short the futures of a given product and simultaneously buy the spot markets, taking advantage of the carry trade to profit.

The problem is that this hedging tactic is popular in traditional finance and has been profitable before. On the other hand, Bitcoin is a new asset class that is outside the traditional finance system.

Accordingly, the strategy might not pan out exactly as expected, leading to massive losses.

BTC Fragile But Spot ETF Issuers On A Buying Spree

Whether Bitcoin will recover from spot rates remains to be seen. As it is, BTC is under immense selling pressure, dropping from $72,000.

Although the uptrend remains, buyers are yet to reverse the June 6 losses, meaning the path of least resistance in the short term is southwards. A break below $66,000 would completely wipe out gains of May 20, signaling a trend shift.

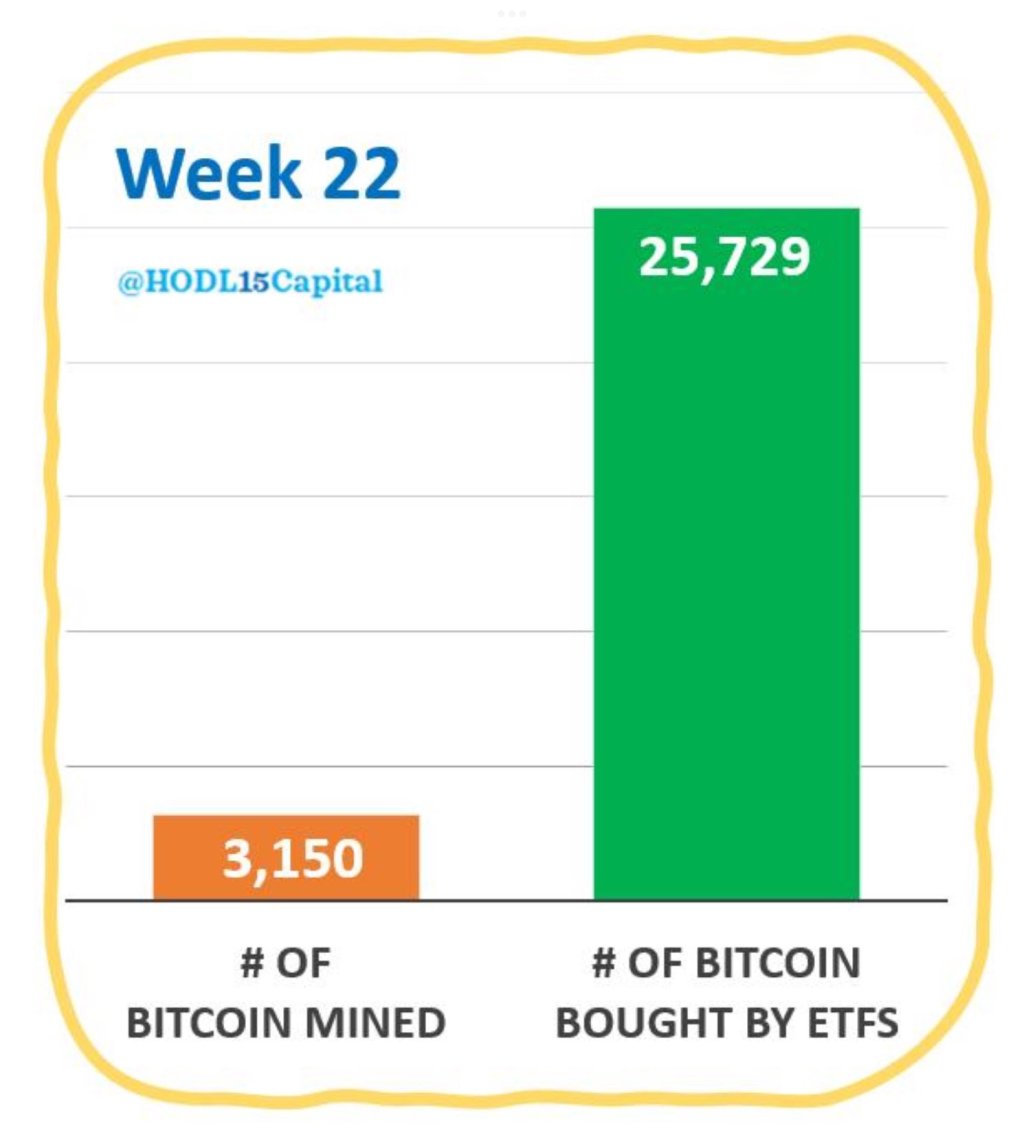

Still, buyers are upbeat about what lies ahead. Last week, despite the contraction, all spot Bitcoin exchange-traded fund (ETF) issuers in the United States have been on a buying spree.

According to HODL15 Capital, in the first week of June, they added 25,729 Bitcoin. This stash is equivalent to roughly two months’ worth of mined coins and is the highest weekly buying activity since mid-March. Then, BTC rose to all-time highs of around $73,800.