Helium (HNT) defeats the market’s bearishness as its new developments drive hype for the long term. According to CoinGecko, HNT rose by 13% despite the market’s continued fall in the short term.

HNT has been boosted by continued on-chain developments that have driven the limelight towards the platform. However, with the market dips continuing to mount losses for investors, the token’s future gains might already be in jeopardy.

New Proposals And Expanding Network Drive New Growth

In an X post, Helium revealed that HIP 124, titled “ Securing IOT Governance Through Voting Rewards”, was passed in a recent voting round. According to Helium, the vote swung in favor of HIP 124 with over 95% of users agreeing to the implementation of the proposal. This is due to the proposal’s main points.

HIP 124: Securing IOT Governance Through Staking Rewards Passed

HIP 124 introduces rewards for veIOT holders who actively participate in governance votes on the IOT subnetwork. This proposal is aimed at boosting voting turnout in the IOT Network’s governance. HIP 124 passed…

— Helium Foundation

(@HeliumFndn) September 5, 2024

HIP 124 is mainly concerned with the governance side of Helium which, as of writing is an “opportunity cost” for users of the platform. To vote on Helium, a user must lock IOT to gain veIOT, the token’s version used for voting on the platform. Since there are no rewards for users participating in governance, participation is still relatively low compared to Helium’s users.

To offset the cost related to participating in governance, HIP 124 will enable rewards for veIOT holders which will come from HIP-52’s 7% bucket allocated emissions that are dedicated to decentralized oracles which, according to the platform, is currently “not emitted.”

With Helium lowering the financial barrier for governance participation will greatly affect voter turnout once a new proposal is under the voting process.

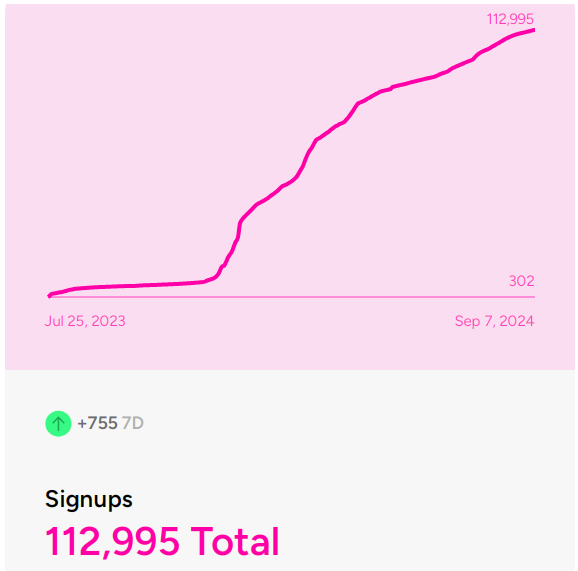

In addition to this new development, Helium Mobile’s network has expanded once more. According to its official website, the Carrier Offload Program is now covered by a whopping 767 hotspots. This led to users on the platform growing with nearly 200,000 non-Helium subscribers using the network.

Exhausted HNT Might Fall Below $7.455

HNT’s position was the result of continued bullishness that started last month, but the current rejection by the $8.689 resistance level will drive the token downward despite positive on-chain developments. This will lead to HNT dropping below $7.455 in the short to medium term.

The token’s nearly maxed-out relative strength index (RSI) suggests that momentum is still in the hands of the bulls. However, the bulls have lost a ton of momentum since the start of the upward drive which will hurt gains in the long term.

Fundamentally, HNT has great support with continuing on-chain developments and overall bullish investor sentiment. However, investors and traders should monitor the broader market as any broad swing by the market can make or break HNT gains in the long term.

Featured image from Pexels, chart from TradingView