A brief description of the founding and subsequent purchases within Stackchain, a Bitcoin-stacking subculture.

This is an opinion editorial by Mason Price, an emerging number cruncher, meme maker and aspiring writer.

This article was originally published here.

Stackheight 1762

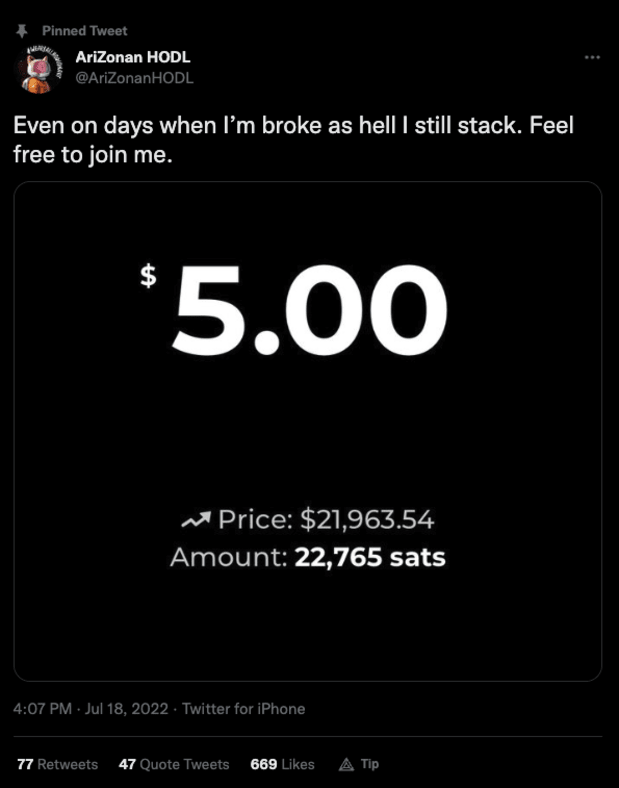

Almost two months before he deleted his account, @ArizonanHODL tweeted an unassuming screenshot of a $5 Bitcoin purchase. Any regular person — and by “regular” I mean not a psychopathic, dark tetrad Bitcoin fanatic — wouldn’t have batted an eye, but those of us that are familiar with Bitcoin Twitter know that the community, like Bitcoin itself, is an unstoppable force even through a bear market. This was the case for @ArizonanHODL’s tweet, from which a new Bitcoin subculture full of stacking sats and making memes was born.

What Is The Stackchain?

The Stackchain is the gamification of stacking sats with your fellow Bitcoin plebs. It all takes place on a single Twitter thread which consists of screenshots of bitcoin buys called “blocks.” Each block is $1 more than the previous and the latest block, known as the “tip,” can be found by searching the hashtag #stackchaintip and sorting by latest.

The story goes like this: @ArizonanHodl posts his $5 bitcoin buy, @Happyclowntime, also known as Bob, followed it up with a $6 buy and Satskeeper followed Bob’s with a $7 buy. You can see where this is going and so did Bitcoin twitter. In a matter of weeks, the Stackchain had drawn in 400 unique plebs into stacking on the Stackchain. The $1 incremental purchases have continued and there’s no end in sight.

Stackchain Accomplishments

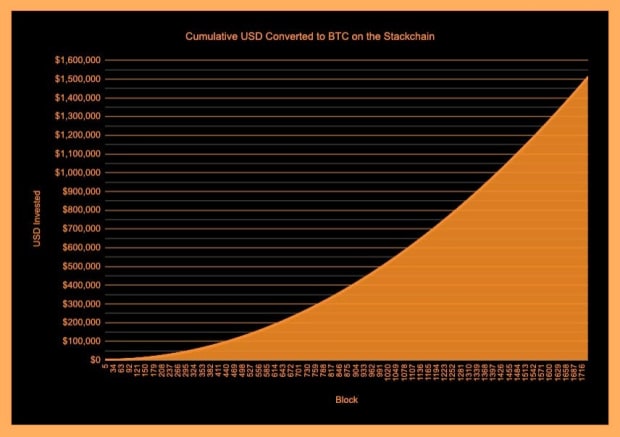

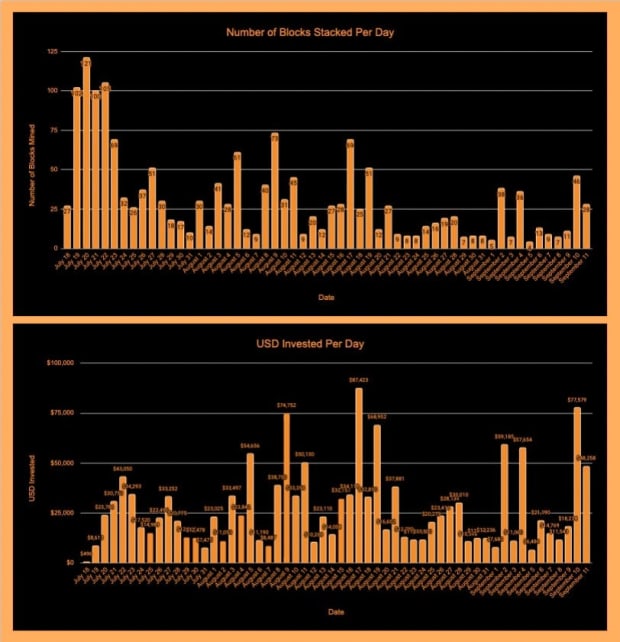

Many plebs have speculated that the Stackchain is the single largest thread on Twitter and that isn’t the only crazy Stackchain statistic. In eight weeks those participating in the Stackchain went from having bought a mere $5 of bitcoin to a whopping $1.5 million of bitcoin cumulatively, or in bitcoin terms, from accumulating a few thousand sats to over 7.5 billion sats (75 bitcoin).

Stackchainers not only have an undeniable goal of growing their stacks but they also aim to further Bitcoin adoption. Coordinating fundraisers for Bitcoin-related initiatives is very much aligned with that goal. Here are a few projects the Stackchain has donated to:

- Stacks For Bitcoin Beach: An initiative where Stackchainers raised over $6,000 to help fund Bitcoin education in El Salvador.

Link to embedded Tweets one and two.

- The Flashstack For Bitcoin Ekasi: The donations funded the purchase of ~30 phones for kids in an African township so that they could have the opportunity to learn about Bitcoin by working for and earning rewards in Bitcoin.

- Flashstack For Hodlonaut: Stackchainers raised several thousand dollars using the tag #Stacks4Hodlonaut to help fund Hodlonaut in his legal battle against Craig Wright, aka Faketoshi.

Rules And Stackchain Improvement Proposals (SIPs)

Stackchain’s ruleset continues to grow. For a deeper dive into the ruleset and Stackchain apps check out our GitHub here.

Three Important Stackchain Components To Remember:

- Stackjoins

A stackjoin is when multiple plebs combine their Bitcoin purchases so that the sum of all the purchases equals the stack height. As an example, let’s say the stackheight is $500. 5 people can each stack $100 and include all of the buys in link and/or photo form in the stackjoined block. Tag your Bitcoin buy #stackjoin and it will be added to the stackjoin mempool. It can be as little as $1. - Solo Blocks

This is when someone purchases the total block. To do so find the Stackchain tip and comment the amount of the previous buy +$1 directly to the Tip. - Forks

This occurs when two or more people stack the same block creating a chain split. These forks can continue for multiple blocks as Stackers fight over which fork should win. This was the case for many blocks including blocks 888, 1492, and the three forks that are currently being resolved.

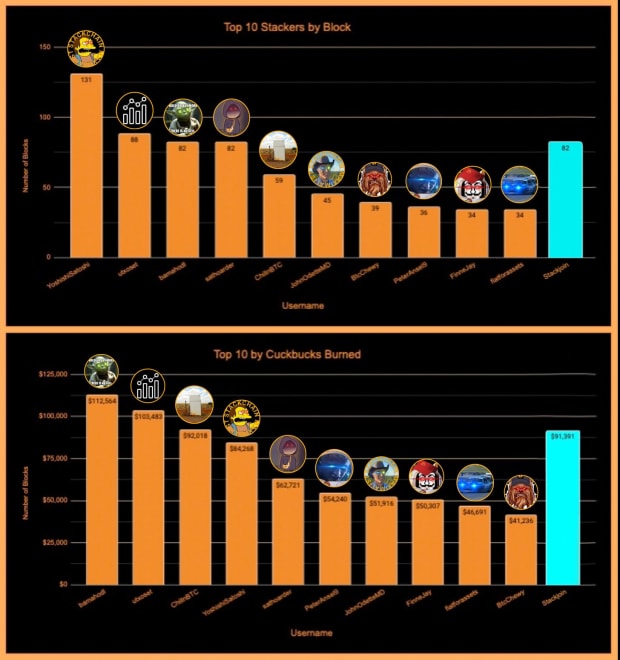

Stackchain whales have been a huge help in increasing the stack height and leaderboards have been a fun way to gamify stacking sats. From the leaderboards, we can see that stackjoins have become an ever-increasing contributor to growing the stack height. They have been steadily growing into the largest spot on the leaderboards and are expected to continue to do so as blocks get more expensive.

Stackjoins are tied for third on the block count leaderboard and are fourth place on the cuckbucks burned leaderboard

The Stackchain Timeline

In memory of our beloved @ArizonanHODL’s Twitter account.

This is a guest post by Mason Price. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.