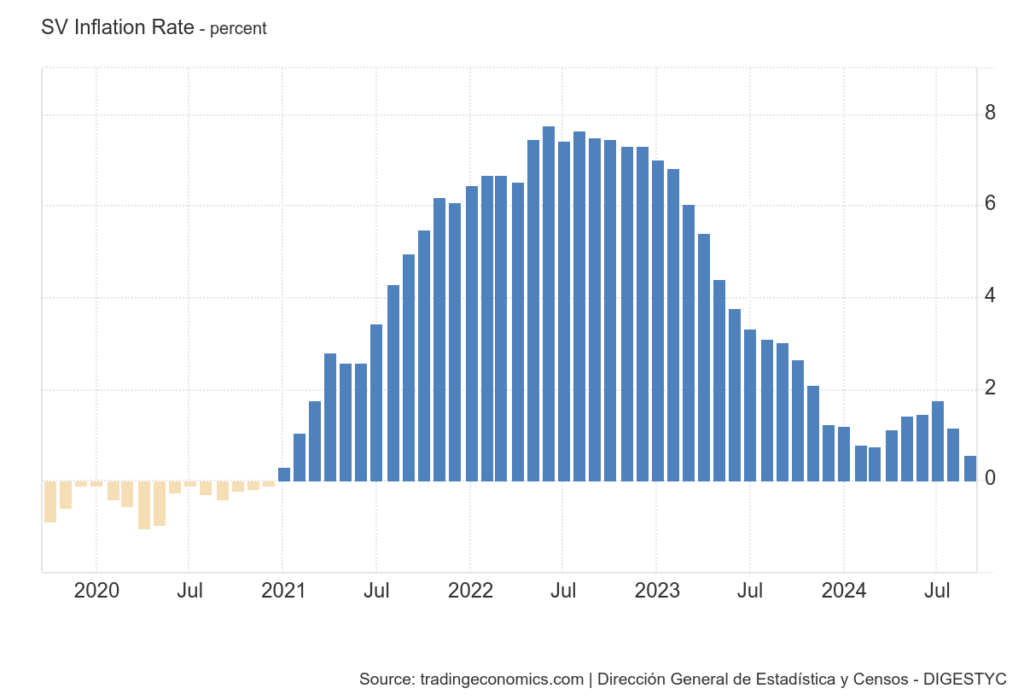

El Salvador’s adoption of Bitcoin as legal tender in Sept. 2021 coincided with notable shifts in the country’s inflation rate. Inflation stood at 4.9% when the government first purchased 200 BTC on Sept. 6, 2021. By June 2022, inflation peaked at 7.76%, then began a steady decline to 2.6% by Jan. 2024 and further to 0.58% by Sept. 2024.

The government’s Bitcoin holdings have grown to 5,898 BTC, valued at $364 million. This move aimed to diversify the economy and reduce dependence on the US dollar. The initial surge in inflation mirrored the global impact of the pandemic but may also reflect market adjustments to integrating crypto into the national economy. As Bitcoin became more established, inflation rates decreased, suggesting a potential correlation between adoption and price stabilization.

Although the country’s trade deficit widened slightly to $785 million in August 2024 from $769 million, the current account shifted to a surplus of $243 million in June 2024 from a deficit of $182 million. Government debt decreased substantially to 59.08% of GDP in Dec. 2023 from 78.03%, enhancing fiscal sustainability.

While the data indicates a temporal relationship between Bitcoin adoption and inflation trends, other factors likely played significant roles. Fiscal policies leading to a reduction in government debt from 78.03% to 59.08% of GDP by Dec. 2023 also contributed to controlling inflation. Additionally, changes in global economic conditions and commodity prices would have impacted the inflation rate independently of Bitcoin’s influence.

El Salvador continues to purchase 1 BTC per day.

In August, Max Keiser, a Senior adviser to El Salvador President Nayib Bukele on Bitcoin, commented,

“Bitcoin ‘de-risked’ El Salvador.”

The post How El Salvador’s Bitcoin gamble impacted inflation appeared first on CryptoSlate.