Jack Dorsey made headlines by leaving Twitter to focus full-time on Square (now Block) and Bitcoin. But how will the company advance the protocol?

Twitter founder Jack Dorsey’s new company, Block, is leading the charge to establish technology for the Bitcoin network that builds on both the company’s mission statement and Bitcoin’s founding principles.

Genesis Block

“If I were not at Square or Twitter I’d be working on bitcoin.”

Those are Jack Dorsey’s words from Bitcoin 2021 in Miami. In less than a year since this statement, Dorsey has left Twitter and rebranded his other major company, financial services provider Square, to Block, further cementing his belief that Bitcoin is the most important thing in our lifetime to work on.

Before Dorsey decided to go full-time with Block, the company, then known as Square, was tangentially involved with Bitcoin. By August 2018, users of Square’s payment app, Cash App, were able to buy and sell bitcoin in all 50 U.S. states. The significance of can easily be understated: for the first time, a fiat payment provider offered their customers the opportunity to directly buy bitcoin (neither Venmo or Robinhood allow users to send their bitcoin to a cold-storage wallet, so they cannot really be thought to offer “bitcoin” in a real way, though Robinhood offered bitcoin buys before Cash App).

In October 2020, Square doubled down on its bitcoin venture by purchasing 4,709 bitcoin to hold on its balance sheet. It has since added another 3,318 bitcoins to its balance sheet. It was not the first company to enter a bitcoin standard (Michael Saylor’s MicroStrategy claims that title), but the conviction shown by Square and its team before the most recent surge in bitcoin’s price should help you understand that nothing that has happened in the last couple of years was an accident.

Shortly after Dorsey came to Square full time, it announced the name change.

“Building blocks, neighborhood blocks and their local businesses, communities coming together at block parties full of music, a blockchain, a section of code, and obstacles to overcome,” the announcement read.

I know you noticed it too: the fact that Square specifically mentioned “blockchain” was a nod to all of us paying attention to everything Dorsey and Square have been saying and doing.

At its core, Square will continue to build tools to help increase access to the economy. Cash App helped serve millions of unbanked people by offering debit cards and direct deposits to those who were previously unable to get access. They developed cheap hardware so standalone businesses can accept credit cards (those little white cubes that you see independent retailers using to accept card payments are usually Square’s original product).

But I’m getting ahead of myself — let’s examine the different divisions of Square and see how they can fit into the future of Block.

The Building Blocks

A quick peek into Block’s new company website shows us how the company defines itself and its different business components (shown in the image above). The divisions listed on its site are Square, Cash App, Spiral, TIDAL, and TBD54566975. We have already touched on Square (basically, the white blocks that let retail businesses accept credit card payments) and Cash App (a payments app), and now we will go a little out of order with the rest of these building blocks.

TIDAL

TIDAL is a music streaming service that was built up by various artists (Jay-Z being the most notable) that was purchased by Square in 2021. While this is a completely different venture than any other financial endeavors the company has attempted, there is surely a much larger play being worked out by Square.

We’re going down a thought experiment that requires some non-Bitcoin technologies, so forgive my shit-coinery for the moment: NFTs are all the buzz now. Everyone seems to either own an NFT or claims to have decades of experience in this brand-new technology. While I do not fall on either side of that spectrum, I do believe the concept of smart contracts (a foundational component of NFTs) is here to stay and how this technology continues to evolve will be interesting. I am purely speculating here, but conversations with NFT “experts” suggest the music industry could see a shift in the way musicians interact with their fans.

Musicians have slowly begun to break away from the record label mold that has been the standard operating procedure for generations, apps like SoundCloud and TikTok allow artists to share their music with fans on a scale that has never been seen before (thank you, internet). The other key point to factor in is that artists get paid less than a penny for each stream. So, if we know that it is easier than ever for a talented musician to release their music, but they are being paid less than they ever have been for that music, how do we find a better balance for all parties involved? Enter TIDAL.

Dorsey is a Bitcoiner. Not a crypto enthusiast, a Bitcoiner. So, if we assume that he stays true to this and TIDAL’s mission to bring fans closer to their favorite artists, a reasonable assumption would be that TIDAL will be building out unique offerings for musicians and their fans built directly onto the Bitcoin blockchain. Could TIDAL be the first music streaming service built on the Bitcoin blockchain?

Does this mean that the next Taylor Swift or Drake album will exclusively be sold as a part of the blockchain? Or will you be buying Coachella tickets through the blockchain? Ultimately, we won’t know what this future will look like until it is announced, however, with the information we have access to, we are able to see what direction TIDAL is headed, and that is toward Bitcoin.

Spiral

Spiral was formerly Square Crypto, but changed its name to “Spiral” and made it abundantly clear that it is now focused on making Bitcoin more than an investment… by investing in Bitcoin projects. Spiral has three projects already underway: Lightning Development Kit (LDK), Bitcoin Design, and Bitcoin Development Kit (BDK).

LDK is a fast and easy way to integrate the Lightning Network into your Bitcoin wallet. It really is as simple as that, but if you want more details, check out this hilarious video put together by the Spiral team. The impetus behind LDK is not far off from the motivation to found Square in the first place: to give anyone the opportunity to receive a payment and never miss a sale. Now, any creator building an app can focus on the product they are building out and can easily integrate Lightning into their program. This is a huge win for Bitcoin’s development into a medium of exchange.

Bitcoin Design is a community that has been built out on Slack to allow people from all over the world to share and discuss Bitcoin. While this is nothing new or revolutionary the action of creating this community speaks volumes about the importance of building out this technology in the open. All of the technology discussed in Bitcoin Design is open source and available on GitHub. This is a fundamental difference between the burgeoning Bitcoin industry and the industries of yester-year that required a “formal” education before considering you worthy to learn the trade secrets (looking at you, Hollywood).

As of this writing, the final branch of Spiral is BDK (note: Spiral is offering grants to any Bitcoin developers — new developments can become new branches of Spiral or offshoots within Block’s larger ecosystem). BDK goes hand-in-hand with LDK in that it (BDK) is a simple way to integrate Bitcoin wallet features into any app. It’s as if the team at Spiral considered, “what is the easiest way to have developers integrate Bitcoin wallets and the Lightning network to their applications?” and then built both steps out.

While Block and Spiral have not made public the number of apps using these offerings, the more important takeaway at this moment is that the access to this technology is being given to those who seek it out. These are not insignificant moves: they may seem to not add much financially to Block, but the foundation being set is vital to the long-term prosperity of Bitcoin.

TBD54566975

The final building block of Block is TBD54566975. While this endeavor is still being built out, the goals are simple: “Create ubiquitous and accessible on-ramps and off-ramps that allow the average individual to benefit from crypto innovation.”

In layman’s terms: they want to create a near-frictionless system to get new users involved with the broader crypto market. I specify “crypto” and not “Bitcoin” here because the white paper mentions “crypto” 32 times, while it mentions “Bitcoin” just 12 times.

Now, before the Bitcoin maxis reading this throw a fit and label me a shitcoiner after my NFT rant and now this: We need to recognize what is really being built is a decentralized cryptocurrency exchange where bitcoin, fiat currencies and real-world goods are able to be liquidated (sold) in real time for whatever asset you want.

Imagine being able to buy bitcoin, stocks, a house, art or to get fiat for your upcoming international trip all in the same place with minimal friction (and lower costs than anywhere else). These are some of the asset classes that we agree upon today in 2022, but what about the next batch of assets that get developed for the metaverse or on Layer 3+ of the Bitcoin protocol? That is why the term “crypto” is being used, I think. I urge you to keep an open mind here — it is not to allow for shitcoinery, but rather to be flexible enough for future technologies that we aren’t even imagining, that will eventually become necessary for our future lives. When you think of TBD54566975, I hope you think of a decentralized Robinhood that offers more than you can imagine, literally.

Future Blocks

While these building blocks make up Block’s core business, there have been some recent announcements that could add even more to these blocks, as well as to the Bitcoin ecosystem at large.

Bitcoin Mining

A missing piece in all of these Bitcoin conversations around Block is mining. In October 2021, Dorsey said that Block is “developing a Bitcoin mining system based on custom silicon and open source for individuals and businesses worldwide.”

The motivation in this statement stems from the high cost of mining equipment and Dorsey’s long-standing value of making anything he can more accessible to everyone (access to your favorite celebrity: Twitter; access to payments: Square; access to banking without a bank: Cash App).

Block had been quiet for some time on any mining news, until last week. Twitter went into a frenzy trying to understand exactly what Dorsey meant when he tweeted, “We’re officially building an open bitcoin mining system.”

Further explaining Block’s intentions was their general manager of hardware, Thomas Templeton. Templeton’s Twitter thread response to his boss’s post helped clarify Dorsey’s statement by laying out three main objectives for the initiative: availability, reliability and performance.

Availability focuses on making mining equipment more readily available and cheaper to people all over the world. If finding rigs and the cost of buying and shipping them is prohibitively high, it stands to reason that building the parts yourself should reduce the issues of access and delivery and then naturally decrease the cost (so long as the increase in supply outpaces the increase in demand).

Making equipment more reliable would mean that these rigs are not overheating and shutting down. The rebooting process when this happens takes too long and for an individual miner, it could result in significant loss of profit. Increasing performance not only means building stronger and faster computers, but also requires a balance between performance and other factors, like lower power consumption.

If Block is successful in this endeavor to help push mining toward a more open-source model, the impacts would be felt all over the world. Publicly-traded miners and large mining pools may attempt to obstruct the path towards this, as this directly attacks their core business, however, based on the current block reward of 6.25 bitcoin and a four-year halvening cycle, mining rewards will be less than one bitcoin starting in 2032.

A short tangent here, but many publicly-traded mining companies have adopted a HODL strategy: they are not selling any of the bitcoin that they mine. This works today because the block reward is more than one bitcoin and cash/debt is so cheap (if you factor inflation into loans, most loans have a negative real interest rate as a result). If we do get to a point where real interest rates turn positive, watch for publicly-traded miners to slowly begin to sell their bitcoin if and when they need to make payments. With these smaller miners entering the fray, publicly-traded miners will look to shift business into other avenues — most likely further developing out Bitcoin as they see necessary.

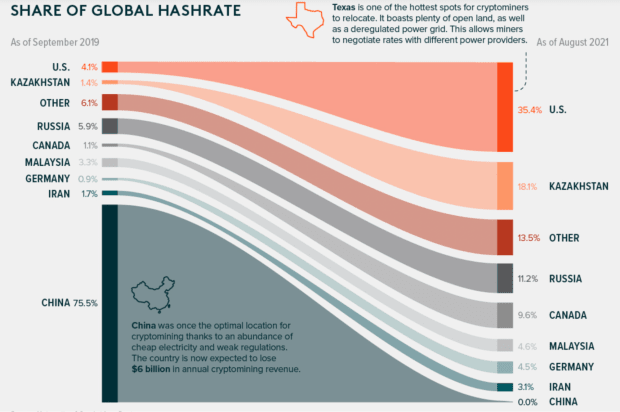

For the Bitcoin network itself, further democratizing the access to computer hardware will help spread the hash rate globally to places where businesses may not have previously been incentivized to operate. The fallacy of “China mines all the bitcoin and controls the network” was proven wrong last year, after the China mining “ban” which prompted a redistribution of the hash rate globally. We are beginning to see some concentrated mining pockets: the U.S. and Kazakhstan account for over 50% of the global hash rate, per Visual Capitalist. Making mining an open-source process will continue to spread the hash rate globally and only serve to secure the Bitcoin network at large.

Cash App Lightning Integration

Earlier this week, Cash App announced that it will be integrating the Lightning Network onto the app and allow U.S.-based users to send bitcoin for free to anyone in the world. While the news drew a lot of attention and excitement, it should come as no surprise given the work of Spiral and specifically the LDK team. This is exactly what LDK was designed to do, and Block is using its payment app (Cash App) as the medium to showcase how simple and easy its functionality can be for users. Free advertising done in-house.

This is also a huge step toward making bitcoin a more realistic medium of exchange. We can debate the pros and cons of skipping “store of value” and jumping straight to “medium of exchange,” however, I sit in the camp that thinks all news is good news for Bitcoin. More people see Bitcoin work as peer-to-peer money that is accepted quickly and cheaply. We slowly begin to chip away at the holdouts with each Lightning transaction done on Cash App.

Bitcoin Legal Defense Fund

Another proposal shared by Dorsey last week was the Bitcoin Legal Defense Fund. As of this writing, Block is not officially involved with this fund, but Dorsey’s endorsement would suggest that Block fully supports this endeavor.

The fund is headed by Dorsey, Chaincode Labs Founder Alex Morcos and University of Sussex Academician Martin White. The goal of this fund is to “defend developers by finding and retaining defense counsel, developing litigation strategy and paying legal bills,” per CoinDesk.

The key here is Dorsey’s desire to remove any fears for people who want to work on or in Bitcoin. He does not want bright minds to be uneasy about diving down the Bitcoin rabbit hole, which many contend is a growing concern. He continues to make sure all of those who desire to learn and have access to Bitcoin are able to do so, regardless of where you are located and what your circumstances may be.

Block Financial Chart Analysis

However, analyzing Block’s financial chart paints a much different picture than the optimistic tone given to its describing business ventures. I took the time to break down the daily, weekly and monthly financial performance to help give short term, medium term and long term perspective, respectively.

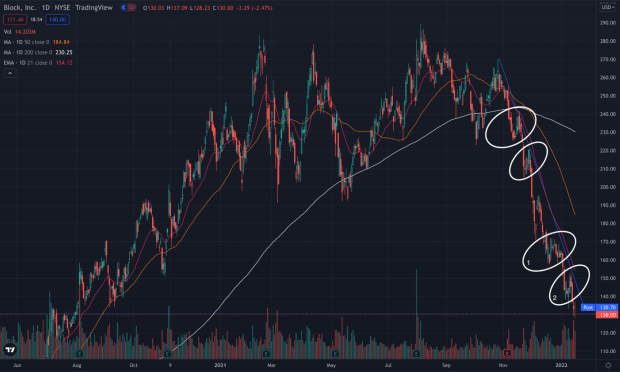

Short-Term Perspective (Block Daily Chart, October 2021 To Mid-January 2022)

At first glance, things are ugly on Block’s chart. The sharp downtrend (blue line) began in late October and is yet to subside. Even moving sideways for some time would be welcome at this point. The four white circles on the chart below show failed attempts at Block attempting to slow the sell-off and move sideways, only to continue selling once it approached the blue line.

One important note is this blue line is arbitrarily drawn by me — it is not a perfect science but as you can see with these many attempts at breaking through an invisible line, we can make our best judgment to draw the line and set expectations accordingly. While a break of the blue line could lead to an end in this sell off, that is not guaranteed. It is still possible for Block to get to the other side of the blue line, but still continue to sell off.

(Block Daily Chart, June 2020 To Mid-January 2022)

A quick look to the left side of the image will show you the current price level for Block shares of about $130 per share, which sits at an area of resistance turned support that stems back to July 2020 (follow the dashed lines). This area has not been tested since Block stock broke above this level and can be considered support; however, the last two white circles (one and two) both occurred in areas that I would consider support that had not been tested in over a year.

Seeing a break through of those two suggests weakness in the stock. Those two areas in particular will become areas of resistance when Block is ready to rally to higher prices.

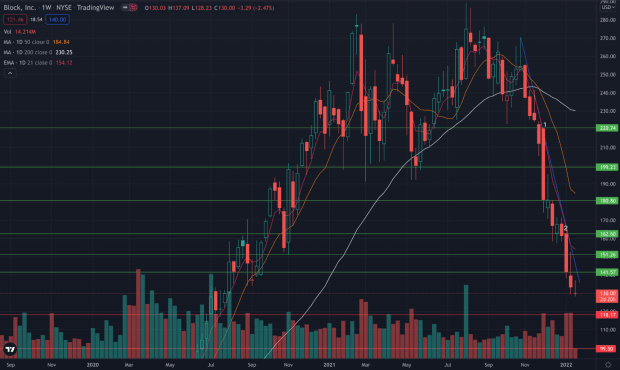

Medium-Term Perspective (Block Weekly Chart, September 2019 To Mid-January 2022)

A key takeaway from the weekly chart is the inability for Block to get over the $280 price level. This is also seen in the daily chart, however it becomes much clearer when looking at the weekly chart. This tells us how far we need to get before buying needs to be ramped up. What does that actually mean?

Block stock is at roughly $130 per share, as of this writing. To get just to $280 per share, that would be a roughly 115% increase. In order for a stock to go up, more buy orders need to be submitted than sell orders (a basic rule which runs true for stocks, bitcoin and any other asset). With the exception of meme stocks, stocks requiring such large moves need the big money on Wall Street. However, it is important to know that what I have said is also true in the inverse: this sell off we are seeing in Block stock is due in large part to the big money on Wall Street selling Block stock at a rate much higher than that at which buy orders are coming in.

The weekly chart typically gives a better view for traditional base patterns to form (cup with handle, double bottom, etc.). The Block chart shows no signs of a base pattern forming at this time. The downtrend is too steep for a “healthy base”: a drop of over 50% is greater than a “healthy base,” however there are always exceptions to the rule.

If we are not yet at the bottom, we are coming very close to the end of this downturn. I cannot stress this enough: Buying a falling stock is like trying to catch a falling knife, you may get lucky one or two times, but a bad mistake here can cost you a lot.

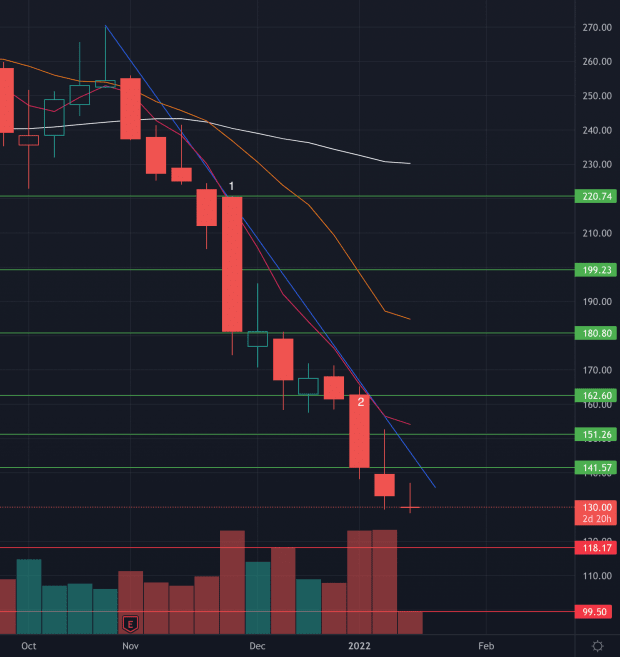

(Block Weekly Chart, October 2021 To Mid-January 2022)

The key levels shown in the weekly chart can help set expectations. The current level of $130 is a support area. If we break below, we can expect to continue to fall until around $118 per share. Below that would be the $100 psychological hurdle area. This does not mean Block cannot fall below $100, it just suggests these three areas can be the floor for Block.

On the upside, I focused on two recent candlesticks (one and two). Both of these are large, red candlesticks with high volume. The high volume suggests big money on Wall Street was doing the selling. As I’ve touched on before, there is an old Japanese candlestick technique that says the top, middle and bottom of a large candlestick with significant volume can be support/resistance. We do not know which of these levels will become true resistance, however, it is important to recognize where these levels are as they may provide opportunities to add/sell shares along the way.