The post How MicroStrategy’s BTC Holdings Are Driving Stock Market Gains appeared first on Coinpedia Fintech News

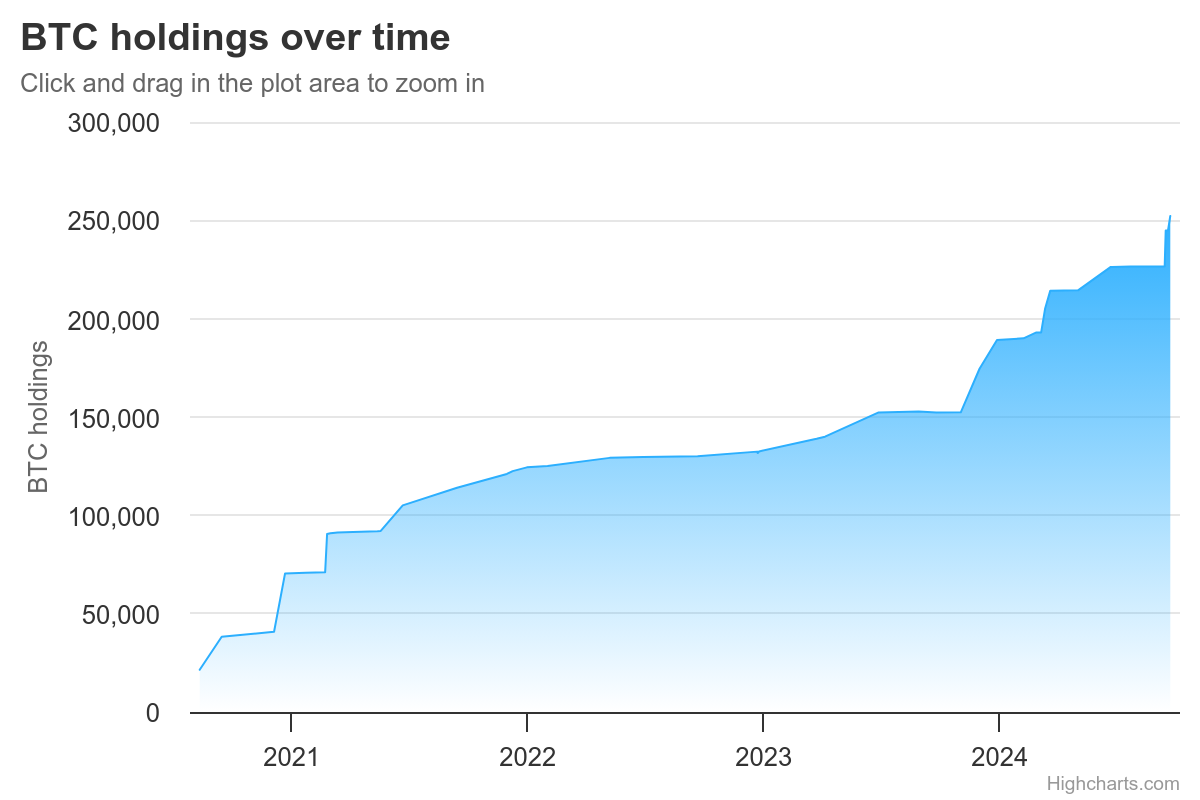

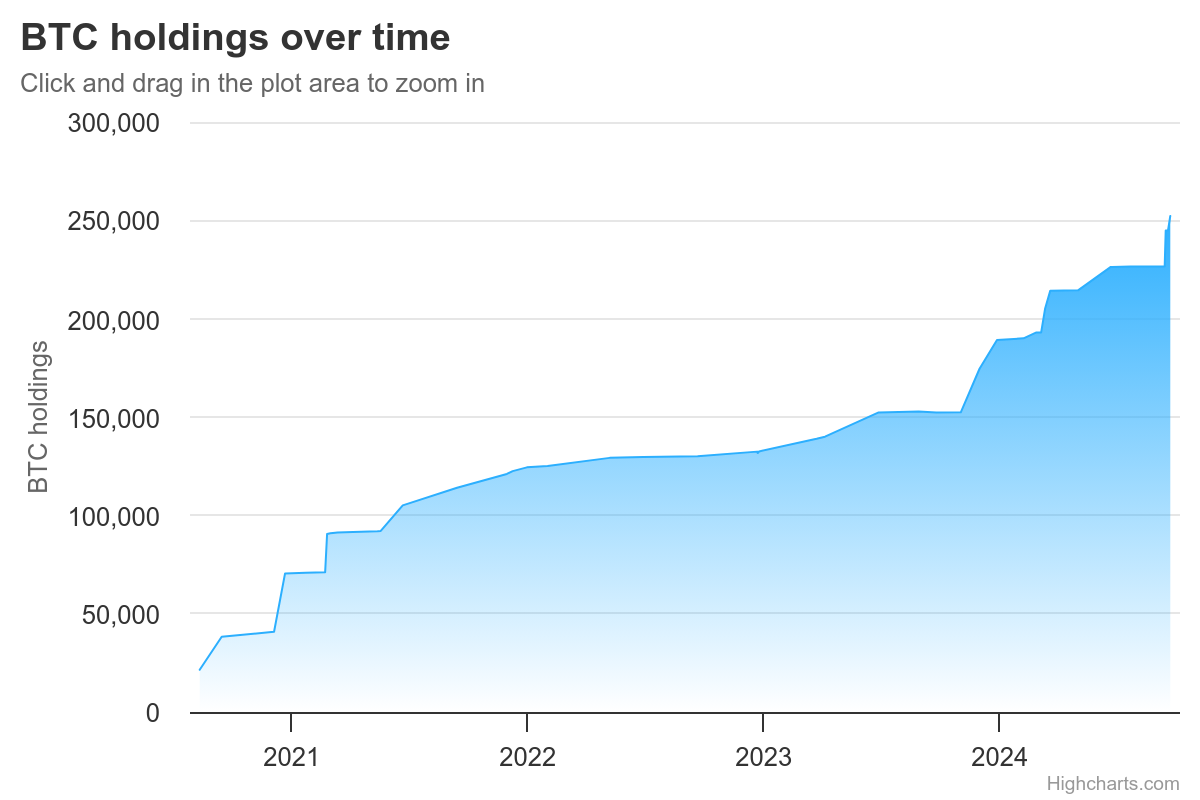

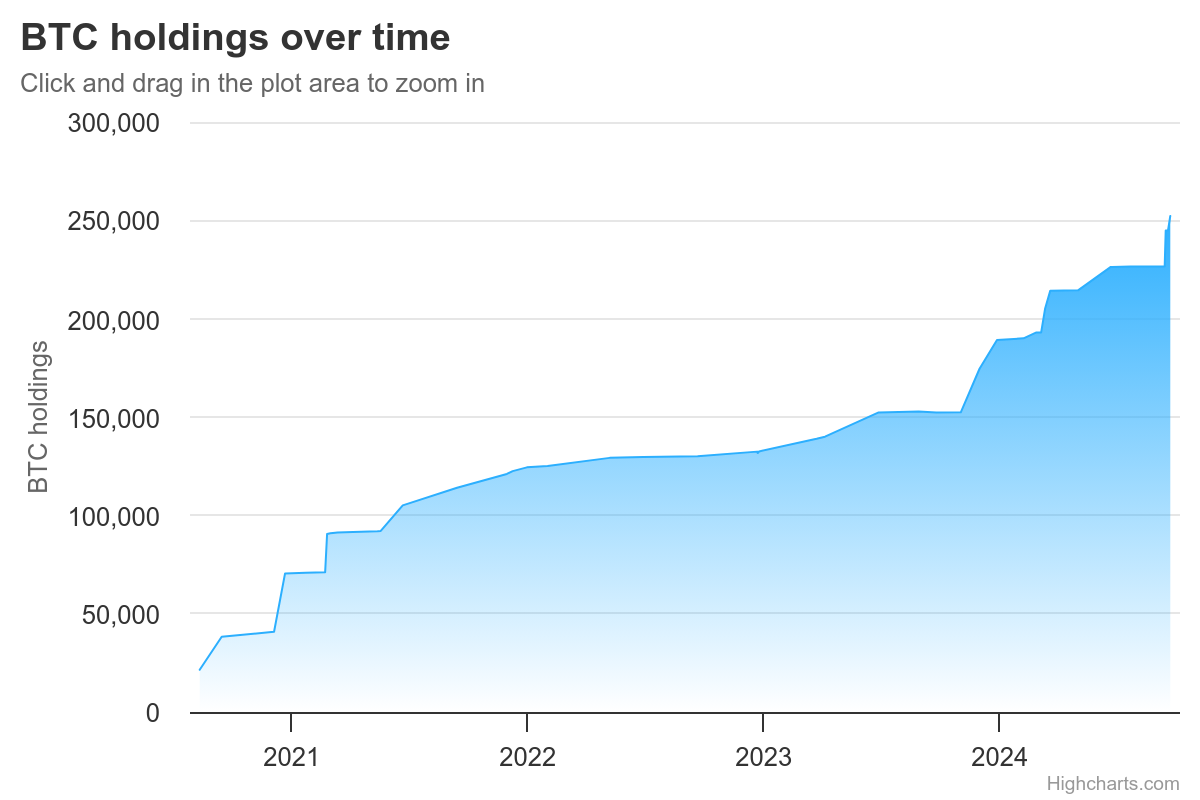

In the last seven days, Bitcoin has experienced a surge of 9.4%. With the price standing at $72,387.46, the BTC market could create a new all-time high at any moment. Interestingly, MicoStrategy, a company with a massive Bitcoin holdings of 252,220 BTC, has grown 58.71% this month, highlighting that the company has benefited greatly from the growth in the Bitcoin market.

A recent report suggests that a company, which has copied MicoStrategy’s strategy, has achieved impressive growth due to the latest BTC boom. Will the success of MicoStrategy co-founder Michael Saylor’s strategy inspire others to follow his investment blueprint? Let’s explore the scenario in depth! Read on!

MicroStrategy Stock Reaches New Highs

At the start of this year, the price of MicroStrategy Incorporated on NASDAQ was $69.06. Over the year, the market has surged by 273.93% – significantly higher than the 71.4% growth achieved by the BTC market.

It was on August 11, 2020, that MicroStrategy made its first Bitcoin investment, purchasing 21,454 BTC. At that time, the stock price of MicroStrategy was only $13.99. Notably, since then, the price has increased by 1745.89%. The MicroStrategy price currently stands at $258.24 – the highest in 24 years.

As per a recent report, the prime driving force behind MicoStrategy’s growth has been institutional support. Notably, BlockRock has recently increased its stake in MicoStrategy to 5.2%.

MetaPlanet Adopts MicoStrategy’s Bitcoin Strategy

MicroStrategy is not the only company that has succeeded using a BTC holding strategy. A Japanese company, MetaPlanet Inc., has achieved 54.26% growth this month by following the investment blueprint of MicroStrategy.

Metaplanet, which now holds 1,015.2 BTC, began its Bitcoin investment journey by purchasing 203.7 BTC on Jul 21, 2024. At that time, the stock price of Metaplanet was around 1,450 JPY. Just a couple of days after the first purchase, the price jumped to a peak of 3,000 JPY. Since the first BTC purchase, the Metaplanet price has risen by 7.24%. Importantly, the market has reported a significant rise of 271.87% this year.

In conclusion, as Bitcoin continues to push for new highs, companies like MicroStrategy and Metaplanet demonstrate how corporate BTC strategies could shape the future of digital finance.

Stay tuned to Coinpedia for more interesting stories related to corporate BTC holdings!