Artificial Intelligence (AI) crypto tokens are riding a wave of interest that began with the release of chatbot ChatGPT, which has captured the imaginations of people across the globe.

The apparent capabilities of ChatGPT showcase the potential of AI to revolutionize multiple aspects of life. As such, some are touting AI crypto tokens as the next big thing.

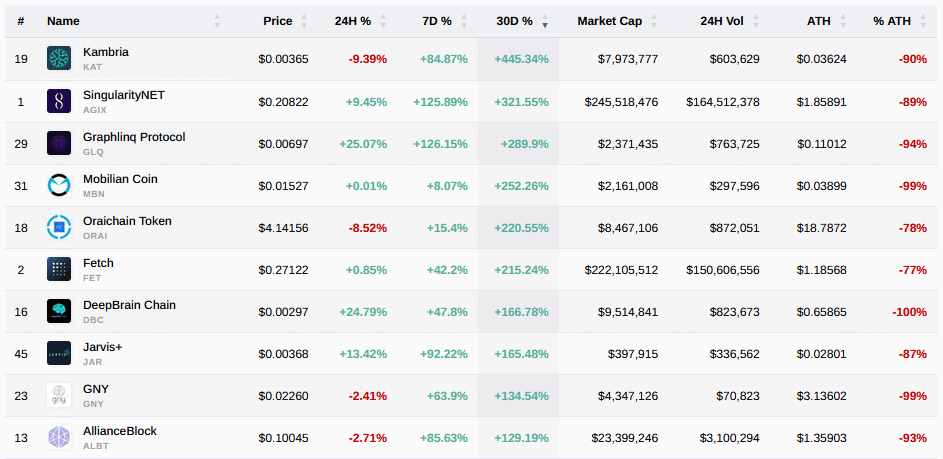

This has been reflected in a strong performance in the AI sector. As at Jan 18, over the previous 30 days, the top three gainers were Kambria, SingularityNET, and Graphling Protocol which grew 445%, 322%, and 290%, respectively.

An analysis of the top 10 performers over the last 30 days showed significant drawdowns from all-time highs, with six of ten losing 90% or more in value from their peak price.

AI tokens are mostly microcaps

In the list above, eight of the ten are micro caps, typically equating to untested proof of concept, a high risk of failure/abandonment, as well as a lack of liquidity. A microcap is a crypto project with less than $50 million in market cap valuation.

However, on the spin side, with high risk comes high reward, as the upside potential is heightened by capital inflows generating more significant percentage gains on low market caps.

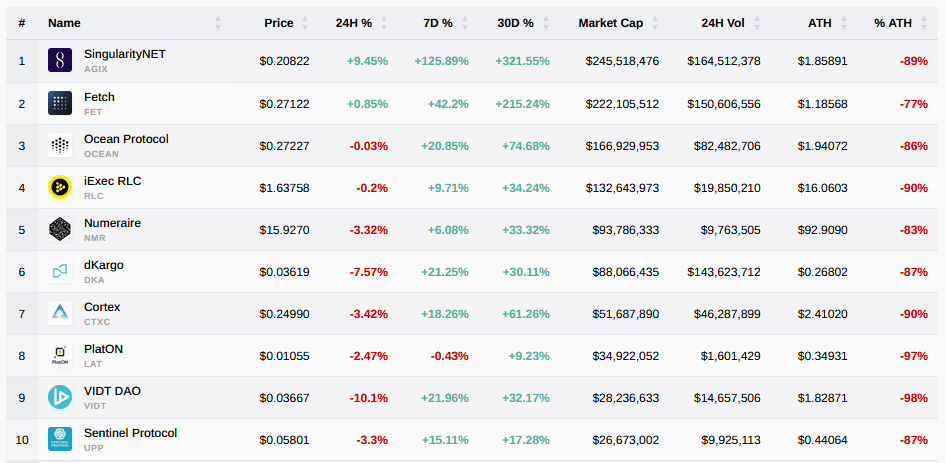

Filtering data by market cap showed that the entire AI sector comprises micro-cap offerings, except for the top seven. The top seven AI projects have market cap valuations of less than $1 billion, making them small caps.

The AI sector is underdeveloped and underinvested, with the leading AI token — SingularityNet — currently ranking 118th largest crypto project by market cap.

As such, recent sky-high percentage gains within the AI sector are exaggerated versus those of large caps in terms of actual inflows.

Top 5 AI tokens by market cap

Nonetheless, many are still eyeing AI as the next sector to boom, leading to speculative fervor from investors looking to get in early.

Out of the top five AI tokens, all lost significant value over the course of last year, as expected. iExec RLC fared best with a 59% drawdown over the period. However, a strong start to 2023 by all has SingularityNet leading the pack, up 360% YTD.

SingularityNet

AGIX opened 2022 at $0.2026, closing the year at $0.0464, equating to a 77% loss in value over the period. The token has since shot up massively in 2023, peaking at $0.2581 on Jan. 14. YTD gains come in at 365%.

Fetch

FET opened 2022 at $0.5029, closing the year at $0.0916, equating to an 82% loss in value over the period. Since the start of the new year, FET has recorded sharp moves higher, peaking at $0.2986 on Jan. 18, coming in with a YTD gain of 203%.

Ocean Protocol

OCEAN opened 2022 at $0.8523, closing the year at $0.1630, equating to an 81% loss in value over the period. 2023 kicked off with strong price action testing resistance at the $0.2995 zone on Jan. 14 and again on Jan. 17. YTD gains at 67%.

iExec RLC

RLC opened 2022 at $2.957, closing the year at $1.221, equating to a 59% loss in value over the period. A solid start to the new year saw RLC record a local top of $1.883 on Jan. 15 before giving up most of those daily gains. Its YTD increase comes in at 32%.

Numeraire

NMR opened 2022 at $31.49, closing the year at $12.29, equating to a 61% loss in value over the period. The token recorded a local of $17.76 on Jan. 14, recording YTD gains of 31%.

The post How the top 5 AI tokens, AGIX, FET, OCEAN, RLC, and NMR fared during 2022 appeared first on CryptoSlate.