Injective is a blockchain designed specifically for finance. It is an interoperable and environmentally-friendly layer 1 blockchain that supports advanced DeFi applications, including crypto trading dApps, like spot and derivative exchanges, and lending protocols.

That being said, in the fast-paced world of cryptocurrency, the Injective Network has emerged as a trailblazing force, revolutionizing the landscape with its innovative approach to scalability and seamless trading experiences. In my opinion, I will say that Injective is trying to follow the Solana path in terms of progressive growth in the ecosystem and price value.

In this in-depth guide, we’ll navigate through the essential features of the Injective (INJ) Network, unravel the intricacies of initiating your trading journey, and explore various methods to acquire and trade the coveted Injective Coin (INJ).

Solving Scalability: The Essence of Injective (INJ) Network

The scalability challenge has long been a hurdle for widespread crypto adoption, and Injective Network steps up to the task as a groundbreaking solution. Scalability is the reason some people don’t trade certain coins. For instance, I avoid making certain Ethereum transactions because of the high gas fees. If I want to make any monetary transaction, I prefer to use a more scalable coin like injective (INJ).

Scalability isn’t just about transaction costs but also about the speed of transactions. Injective Network boasts a remarkable transaction speed of 0.8 seconds, leaving competitors, including Ethereum and its layer 2 counterparts, in the rearview mirror. What more can you ask for with their gas fees as low as $0.01, Injective Network brings unparalleled efficiency to the world of blockchain transactions.

Injective (INJ) gives you a better DeFi experience, this is because you are not scared of exploring the DeFi space due to high gas fees and slow annoying transaction speed. If you have transacted on the Ethereum chain or done any past DeFi activity on the Ethereum chain, you will be conscious of your exploration because each activity will incur a transaction fee whether the contract signed is successful or not and it’s not cheap.

Initiating Your Injective Trading Journey

Embarking on your trading journey within the Injective Network involves meticulous steps to ensure a seamless experience. The choice of a compatible wallet is paramount, and here, we delve deeper into two main types:

- EVM Based Wallets:

EVM compatibility is the bedrock for smooth integration with Injective Network. While Metamask is a popular choice, it’s essential to understand its intricacies, especially when it comes to the EVM chain. Exploring alternative EVM-based wallets can provide tailored solutions for optimal user experience.

It is preferable to use an EVM wallet like Metamask if you are bridging from an EVM chain to an injective chain. As we go further into this post, you will learn how to bridge from EVM to the injective chain. EVM wallet like metamask makes your Defi experience on the injective easier but you can’t compare it to that of the cosmos-based wallet.

- Cosmos Based Wallet:

For a user-friendly experience on your PC, consider Cosmos-based wallets like Leap and Keplr. These Chrome extensions are tailor-made for Injective Networks, ensuring not just compatibility but also enhanced security features. Using a Cosmos-based wallet makes interaction far easier than EVM-based wallets. But you can’t have EVM-based assets on this wallet, this means that you can’t bridge EVM assets to injective using this wallet, you need to use Metamask.

These wallets, the EVM-based wallets, and the Cosmos-based Based Wallets are great for your smooth Defi experience when interacting on the injective chain.

Acquiring Injective Coin (INJ)

Once your wallet is set up, the next crucial step is acquiring the prized Injective Coin. INJ is prominently listed on various centralized exchanges, including Binance, Coinbase, Kucoin, Bybit, OKX, and Gate.io. Each exchange offers its unique advantages, and strategic users may explore multiple platforms for optimal trading conditions.

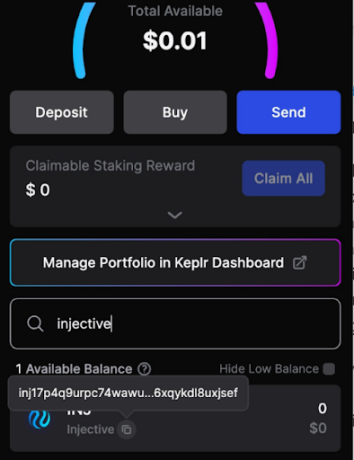

Consider securing your INJ in a Keplr wallet for efficient portfolio management. When you are sending INJ from centralized crypto exchanges to your Keplr wallet, make sure you choose the Injective network and paste your Injective network address from your Keplr wallet.

Setting Up Keplr Wallet for Injective Chain Visibility

Creating a Keplr wallet is a straightforward process through the Chrome extension. Get your Keplr wallet, and create a new wallet, you will be given a seed phrase, save the seed phrase, usually a 12 or 24-word seed phrase. Do not forget to save them, in order not to lose your account permanently.

To make the Injective chain visible in your Keplr wallet, follow these steps:

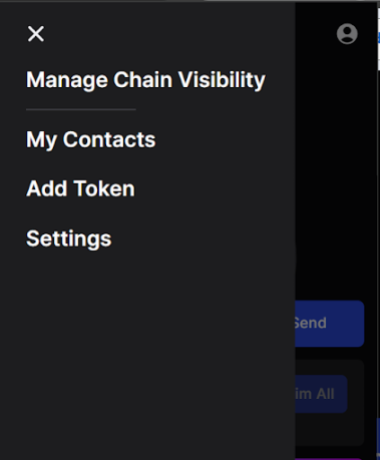

- Click on the hamburger sign in the top left corner.

- Navigate to “Manage Chain Visibility.”

This will take you to where you can view the chain visibility on the Keplr wallet, this is essential as it helps you select other chains on the Keplr wallet.

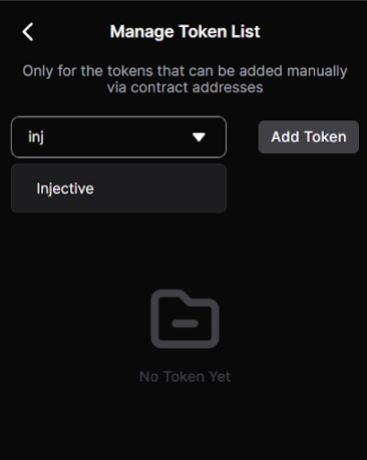

- Search for “Injective” or “Inj” and click on “Add Token.”

By enhancing Injective-related keywords in your wallet setup process, you not only optimize for search engines but also ensure clarity for users seeking to manage their INJ effectively.

It is important to know that every address on the injective chain starts with the “inj” prefix, this helps you identify the injective chain easily. Congratulations you are about to begin your Injective DeFi journey.

Defi means Decentralised Finance, this is a type of transaction that doesn’t require a centralized platform like Binance, Bybit, OKX, or whatever centralized exchange you know. All you need to perform a DeFi transaction is a DEX (Decentralised Exchange) wallets like Keplr and a Dapp (Decentralised Application).

We have a wallet now, we need to fund it with INJ before interacting with a Dapp on the Injective wallet. You can get INJ tokens from an exchange like Binance Binance. You can deposit on your Binance in whatever way you are used to depositing on your Binance, you can deposit USDT with fiat. Trade the USDT for INJ. The next step is to withdraw the INJ to your Keplr wallet. Withdraw the INJ on the Injective wallet.

Withdrawing INJ coin and Bridging Tokens:

The withdrawal process after acquiring INJ involves selecting the coin, choosing the Injective chain, and pasting your Keplr Injective address. Remember the address has to start with “INJ”. This step is crucial for securing your assets, and benefits from additional details regarding security measures, transaction confirmation times, and potential challenges users might encounter. This is just one method to get INJ from a centralized exchange, you can also get INJ by bridging.

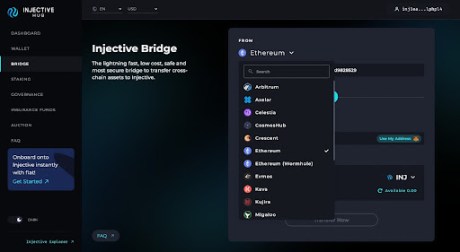

Bridging, an alternative method for bringing tokens to Injective, is an essential strategy, especially for users keen on optimizing their portfolio across multiple chains. Bridging from an EVM-based wallet requires a metamask and INJ on an EVM chain. For instance, if you have INJ on the ETH chain in your metamask, all you need to do is connect your metamask to the Injective Bridge platform. This will help you bridge from the ETH chain to the injective chain.

Bridging Tokens in the Cosmos-Based Wallet Ecosystem:

An intriguing method to diversify your portfolio involves bridging tokens from the Cosmos-based wallet ecosystem to Injective. For example, bridging TIA (Celestia) to Injective and swapping TIA (Injective) to INJ (Injective) using Astroport opens up opportunities within the Cosmos ecosystem.

You will have to go to the Injective Bridge platform, connect to your cosmos-based wallet, select whatever cosmos-based wallet token you have like TIA (Celestia), and bridge from the Celestia chain to the injective chain. Emphasizing this integration showcases the versatility of Injective Network and its compatibility with other blockchain ecosystems. Now you have TIA(Injective) you need to swap it to INJ, trading or swapping can be done Astroport.

Trading INJ on Astroport

Astroport, the decentralized exchange (DEX) on the Injective chain, serves as the epicenter for token swaps. After successfully bridging tokens, users can initiate trades on Astroport, leveraging the platform’s decentralized nature for portfolio diversification. Whatever you are swapping here is expected to be on the injective chain, you can swap INJ for all the available tokens, and now you can trade as easily as you like.

How To Trade on Coinhall

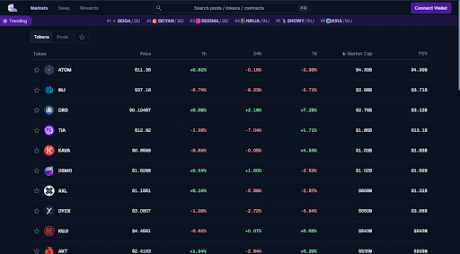

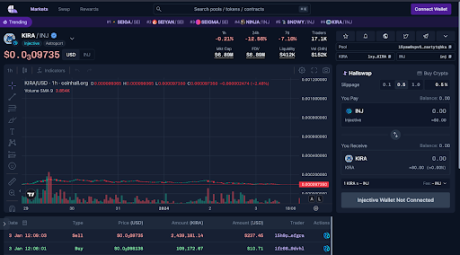

Coinhall is a site where you can bridge directly and swap. It is a multi-token bridge swap DEX that you can use to bridge and swap at the same time but only for Cosmos-based tokens and coins. It serves as a smart chart for all cosmos-based tokens including injective and also for swapping and bridging.

You can see all the available coins and tokens with their respective prices here, it’s a good DEX dApp to use. You can scroll here and search for the token you are looking for. You can also search by using the search bar.

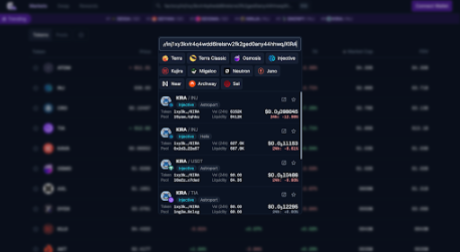

If you want to trade a token and you can find it on the list, all you have to do is go to Coinhall and type the name of the token, as well as search using a contract address.

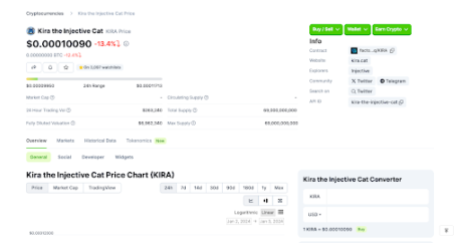

Coingecko is also a good site that has the details of coins. Here, you can search for the name of the coin or token you are looking for, and get the contract address directly.

Go to the info section and search for the contract, copy the smart contract from Coingecko, and paste it into the coinhall market search button.

Like this:

This will take you to where you will be able to trade any token based on the dex.

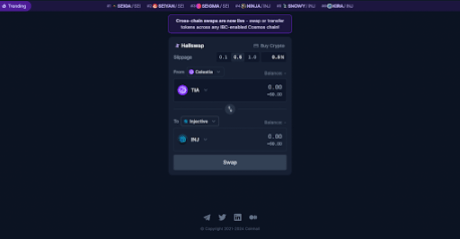

Let’s explore Coinhall as A Bridge Swap DEX

To explore Coinhall this way, you need to navigate to the Swap section. This section will give you the opportunity to bridge and swap at the same time. For instance, if you want to swap TIA (Celestia) to INJ (Injective) you can do this at ease with one click.

Instead of bridging TIA (Celestia) to TIA (Injective) then swapping it to INJ. You can do it as shown below:

Conclusion

With your INJ Coin securely stored in your wallet, you’re now poised to explore the exciting world of trading on the Injective Network. The scalability, low transaction fees, and swift processing times position the blockchain as a promising platform for crypto enthusiasts and traders alike. In the dynamic realm of decentralized finance (DeFi), Injective Network stands tall, offering innovative solutions for seamless and efficient trading experiences.

As you navigate this multifaceted landscape, remember that the Injective Network isn’t just a platform; it’s a gateway to transformative technology shaping the future of cryptocurrency. These steps, when taken with a strategic mindset, offer not only trading opportunities but also a deeper understanding of the evolving crypto ecosystem.

Stay informed, trade wisely, and harness the full potential of the Injective Network, where every transaction is an opportunity to redefine your crypto journey.

In summary, this comprehensive guide provides an extensive roadmap for mastering the Injective Network, ensuring that users, from beginners to seasoned traders, can navigate the intricacies of this innovative blockchain ecosystem with confidence and clarity.