In his latest essay, Arthur Hayes, the former CEO of crypto exchange BitMEX, introduced a bold investment philosophy he calls the “Left Curve.” This strategy diverges sharply from traditional investment approaches typically adopted during bull markets in the crypto world. Hayes’ essay serves not only as an investment manifesto but also as a critique of conventional financial wisdom, encouraging investors to maximize their returns by embracing more aggressive tactics.

Crypto Bull Run Just Got Started

Hayes begins by criticizing the common investor mentality that prevails during bull markets, particularly the tendency to revert to conservative strategies after initial gains. He argues that many investors, despite having made profitable decisions, fail to capitalize fully on bull markets by selling their holdings too soon—particularly when they convert high-performing cryptocurrencies into fiat currencies.

“Some of you think you are masters of the universe right now because you bought Solana sub $10 and sold it at $200,” he states, challenging the notion that such actions demonstrate market mastery. Instead, Hayes promotes a strategy of sustained investment and accumulation, particularly in Bitcoin, which he refers to as “the hardest money ever created.”

A central thesis of Hayes’ argument is the critique of fiat currency as a safe haven for profits taken from cryptocurrency investments. “If you sold shitcoins for fiat that you don’t immediately need for living expenses, you are fucking up,” Hayes bluntly asserts.

He discusses the inherent weaknesses of fiat money, primarily its susceptibility to inflation and devaluation through endless cycles of printing by central banks. “Fiat will continue to be printed ad infinitum until the system resets,” he predicts, suggesting that fiat currencies are inherently unstable storage of value compared to cryptocurrencies.

Hayes extends his analysis to the macroeconomic factors influencing cryptocurrency markets. He describes how major economies like the US, China, the European Union, and Japan are debasing their currencies to manage national debt levels.

This macroeconomic maneuvering, according to Hayes, is inadvertently setting the stage for cryptocurrencies to rise. He points out the increasing adoption of Bitcoin ETFs in the US, UK, and Hong Kong markets as a tool for institutional and retail investors to hedge against fiat depreciation.

This part of his analysis underscores a broader acceptance of cryptocurrency as a legitimate asset class in traditional investment circles, powered by the realization that traditional financial systems are struggling under the weight of unsustainable fiscal policies.

Hayes also delves into the strategic aspects of market timing, particularly around events known to influence market dynamics, such as US tax payment deadlines and Bitcoin halving. He notes:

As we exit the window of weakness that I forecasted would occur due to April 15th US tax payments and the Bitcoin halving, I want to remind readers why the bull market will continue and prices will get sillier on the upside.

This observation suggests that understanding these cyclic events can provide strategic entry and exit points for maximizing investment returns. Emphasizing psychological resilience, Hayes encourages investors to adopt a mindset that resists the conventional impulse to cash out during brief market rallies. “At this moment, I will resist the urge to take chips off the table. I will encourage myself to add more to the winners,” he advises, promoting a long-term view of investment in cryptocurrencies.

This approach, according to Hayes, is essential for realizing the full potential of crypto investments, particularly in a market characterized by high volatility and rapid gains. In conclusion, Hayes’ “Left Curve” philosophy is more than just an investment strategy; it is a comprehensive approach that encompasses understanding macroeconomic trends, psychological resilience, and strategic market timing.

His essay serves as a guide for investors looking to navigate the complexities of crypto markets with a bold, assertive strategy that challenges traditional financial doctrines.

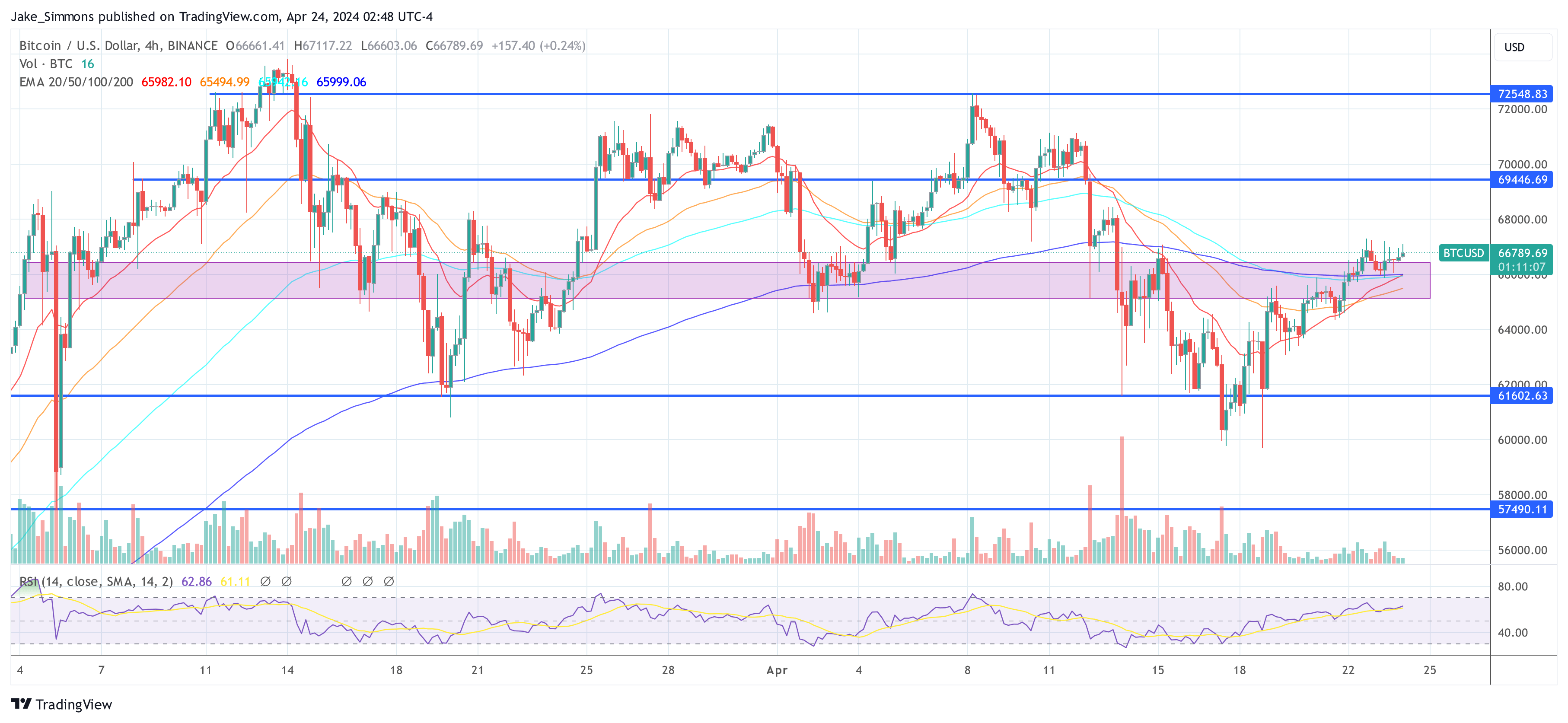

At press time, BTC traded at $66,789.