Quick Take

Bitcoin left a significant mark on the ETF industry in 2024, with Bitcoin ETFs drawing in more than $12 billion in net inflows combined. Leading this surge is BlackRock’s iShares Bitcoin ETF (IBIT), which has accumulated over $15 billion in net inflows and stands at the forefront of this success narrative.

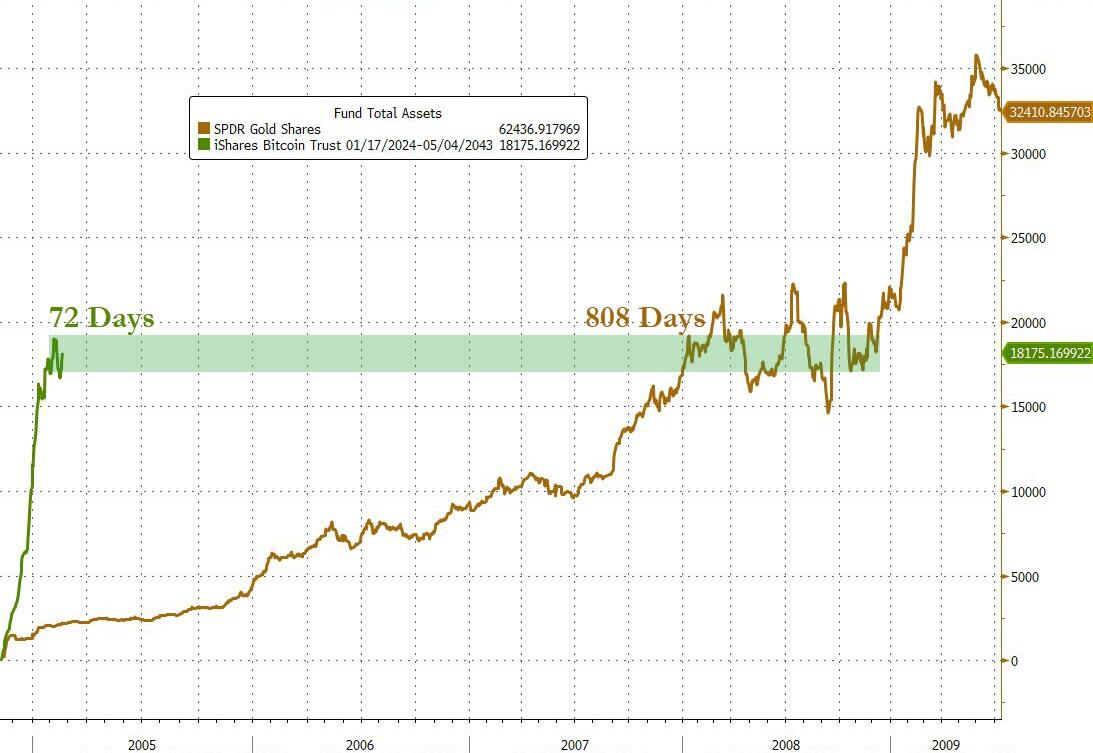

Recently, IBIT completed an impressive streak of 71 consecutive days of inflows, firmly establishing itself among the top 10 US ETFs in terms of successive inflows. However, to fully grasp the significance of IBIT’s achievement, it’s crucial to compare it with the SPDR Gold ETF (GLD), given Bitcoin’s moniker as “digital gold.”

According to Coinglass data, on April 24, IBIT’s trading volume reached $1.19 billion, while GLD’s volume stood at $1.16 billion, despite GLD being more than three times the size of IBIT in terms of market cap.

A particularly notable comparison emerges from Nate Geraci, President of ETF Store, who shared a chart created by Zerohedge. It reveals that the SPDR Gold ETF (GLD) took 808 days since its inception to reach the same assets under management (AUM) that IBIT achieved in 72 days. This striking statistic emphasizes the swift expansion and growing recognition of Bitcoin as an investment avenue.

The post IBIT vs GLD: A compelling tale of Bitcoin’s growing dominance over traditional gold investments appeared first on CryptoSlate.