Data shows that Bitcoin and Ethereum correlate little to traditional markets, implying that cryptocurrency is forging its destiny.

Bitcoin & Ethereum Have Been The Master Of Their Fates Recently

According to data from the market intelligence platform IntoTheBlock, the correlation between BTC and ETH with traditional markets and commodities has been close to zero recently.

The “correlation” here refers to the correlation coefficient (r) from statistics, a metric that tracks how connected two quantities have been over a given period.

When the value of this metric is greater than zero for any two assets, it means that there exists some positive correlation between their prices, implying that the assets are moving in tandem. The closer this value is to 1, the tighter the relationship.

On the other hand, the indicator’s negative value suggests that while there is some correlation between the two, it’s a negative one, as the price of one asset reacts to movements in the other by moving oppositely to it. In this case, the extreme where the correlation is the strongest is -1.

The correlation coefficient standing at or near zero suggests no relationship between the assets. In statistics, the variables are said to be independent in this case.

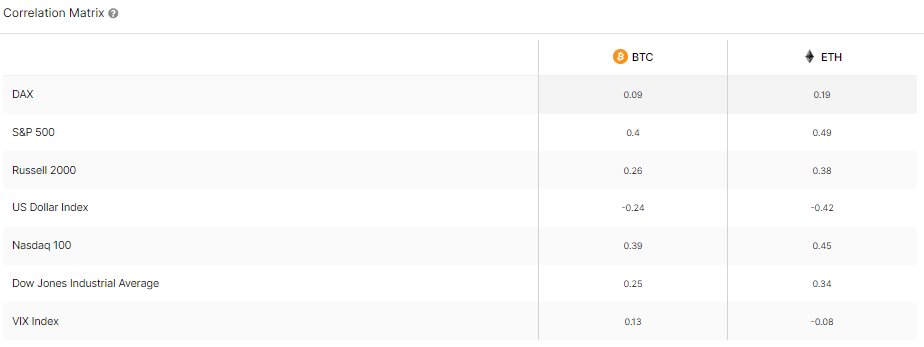

Now, here is a table that shows how the 30-day correlation between the two largest cryptocurrencies by market cap, Bitcoin and Ethereum, looks like against some of the traditional assets:

As is visible above, Bitcoin and Ethereum have appeared to have a low correlation to these assets over the past month. Out of these, the coins are the most correlated to the S&P 500, with the coefficient standing at 0.4 for BTC and 0.49 for ETH.

Thus, this would mean that ETH is slightly more correlated to the S&P 500 than BTC. Like this, ETH also has a more prominent relationship with the others on the list compared to BTC, although it’s still not strongly correlated to any of them.

The low correlation coefficient with the traditional markets suggests that cryptocurrencies have been running more or less independently in the past month.

Generally, correlation can be something to watch when an investor is looking to add an asset to their portfolio. Assets that have a high correlation make up for poor diversifying options, as they would either mimic a similar performance (positive coefficient) or counteract each other (negative coefficient).

Since Bitcoin and Ethereum lack any solid correlation to traditional markets and commodities, the two coins may be viable options for traditional investors to add to their portfolios.

BTC Price

Bitcoin has retraced its earlier recovery over the last few days as it has returned to the $61,100 mark.